Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(5) On the permanent income hypothesis Suppose that you are 20 years old today and expect to live until 90. You consider the future

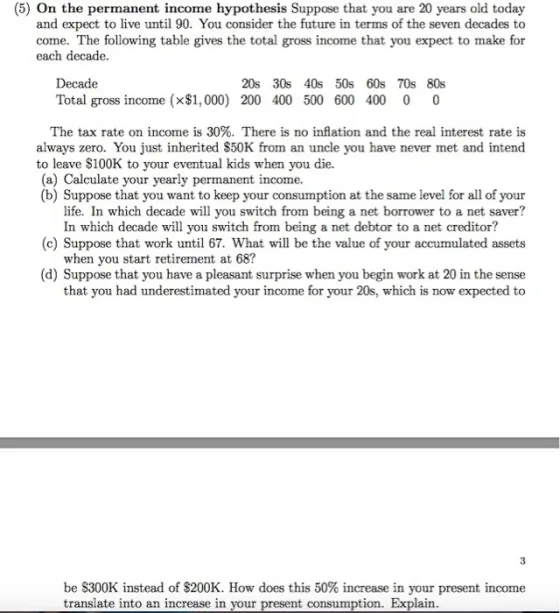

(5) On the permanent income hypothesis Suppose that you are 20 years old today and expect to live until 90. You consider the future in terms of the seven decades to come. The following table gives the total gross income that you expect to make for each decade. Decade 20s 30s 40s 50s 60s 70s 80s Total gross income (x$1,000) 200 400 500 600 400 00 The tax rate on income is 30%. There is no inflation and the real interest rate is always zero. You just inherited $50K from an uncle you have never met and intend to leave $100K to your eventual kids when you die. (a) Calculate your yearly permanent income. (b) Suppose that you want to keep your consumption at the same level for all of your life. In which decade will you switch from being a net borrower to a net saver? In which decade will you switch from being a net debtor to a net creditor? (c) Suppose that work until 67. What will be the value of your accumulated assets when you start retirement at 68? (d) Suppose that you have a pleasant surprise when you begin work at 20 in the sense that you had underestimated your income for your 20s, which is now expected to 3 be $300K instead of $200K. How does this 50% increase in your present income translate into an increase in your present consumption. Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the yearly permanent income we need to divide the total gross income for each decade by the number of years in that decade Since each d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started