Question

5. Pathao, a ride sharing company, is interested in estimating its weighted average cost of capital (WACC). The firm is currently in its rapid

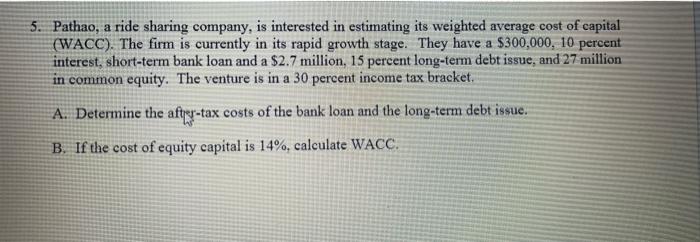

5. Pathao, a ride sharing company, is interested in estimating its weighted average cost of capital (WACC). The firm is currently in its rapid growth stage. They have a $300,000, 10 percent interest, short-term bank loan and a $2.7 million, 15 percent long-term debt issue, and 27 million in common equity. The venture is in a 30 percent income tax bracket. A. Determine the after-tax costs of the bank loan and the long-term debt issue. B. If the cost of equity capital is 14%, calculate WACC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To determine the aftertax costs of the bank loan and longterm debt issue we need to consider the interest rates and the income tax bracket 1 Afterta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan Wolcott, Liang Hsuan Chen, Gail Cook

2nd Canadian Edition

1118168879, 9781118168875

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App