Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Please help, I will leave a good review Data table Requirements 1. Which type of costing system is Classic using? What piece of data

5.

Please help, I will leave a good review

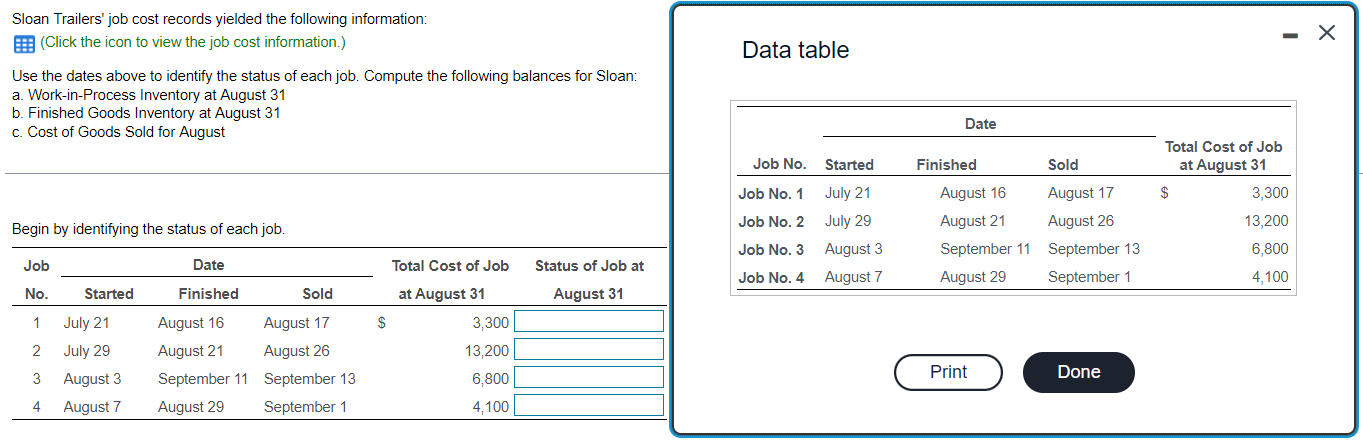

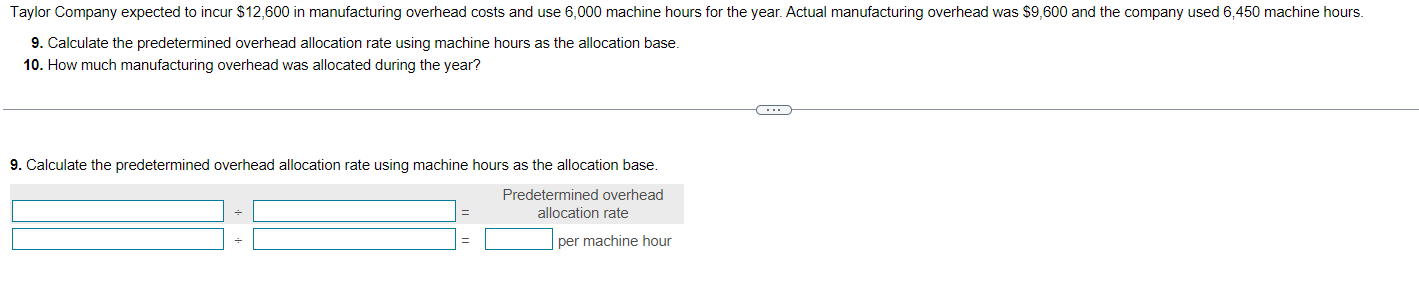

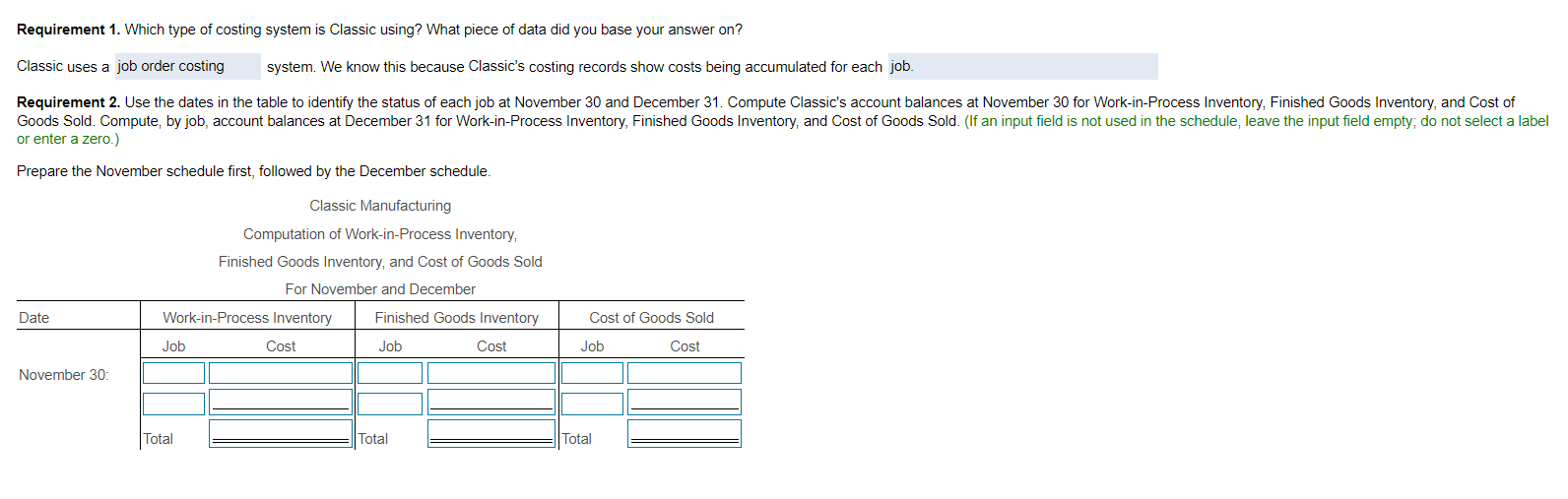

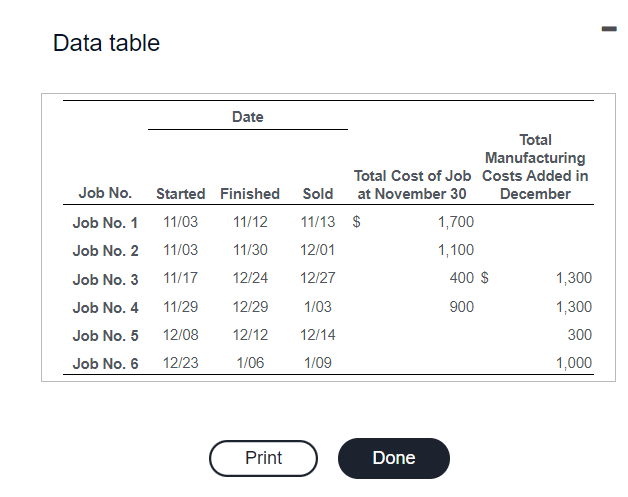

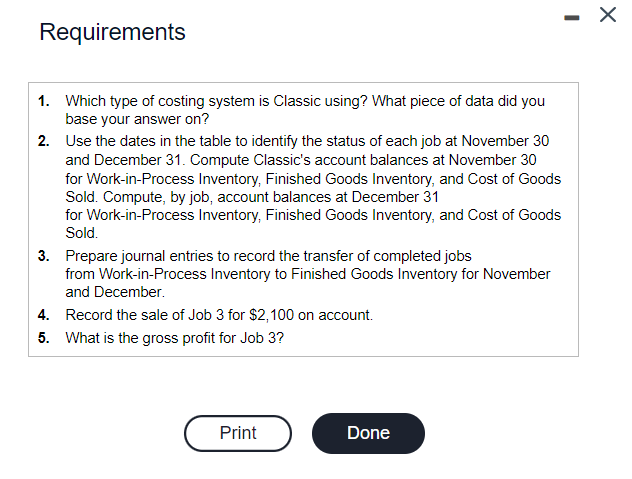

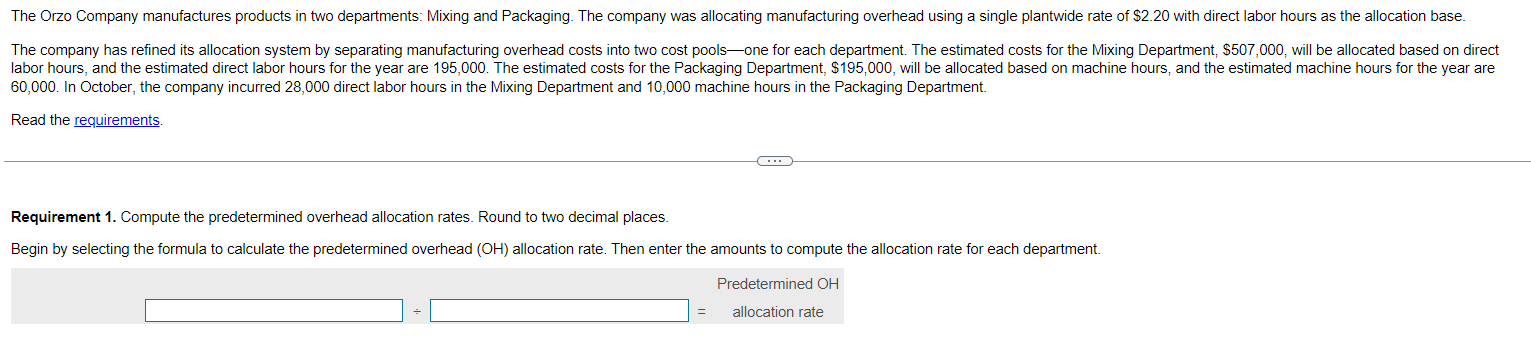

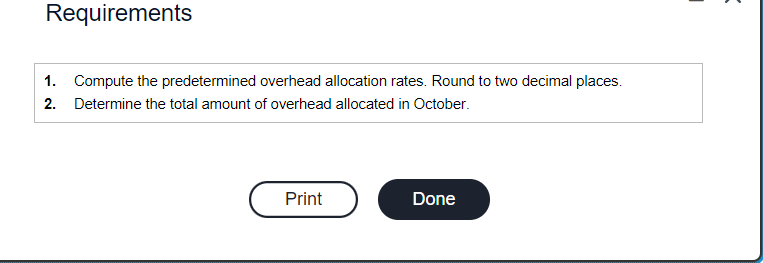

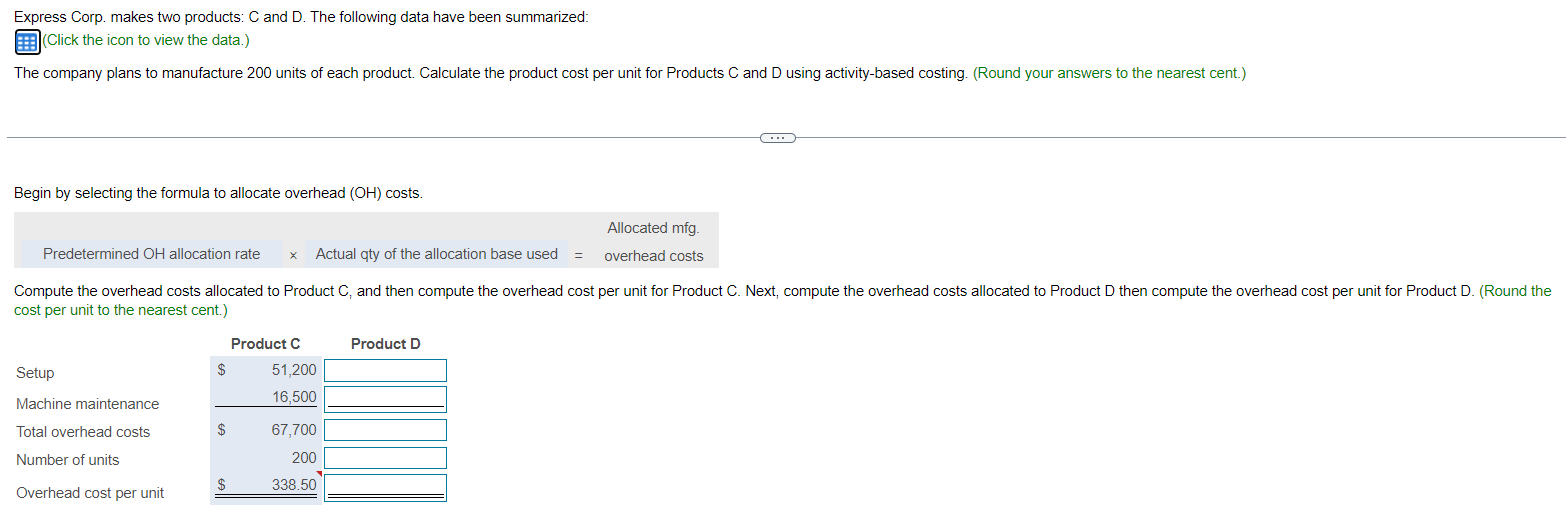

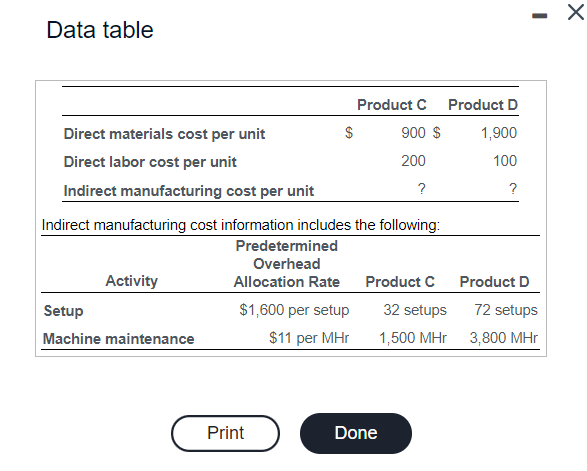

Data table Requirements 1. Which type of costing system is Classic using? What piece of data did you base your answer on? 2. Use the dates in the table to identify the status of each job at November 30 and December 31. Compute Classic's account balances at November 30 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. Compute, by job, account balances at December 31 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. 3. Prepare journal entries to record the transfer of completed jobs from Work-in-Process Inventory to Finished Goods Inventory for November and December. 4. Record the sale of Job 3 for $2,100 on account. Data table 9. Calculate the predetermined overhead allocation rate using machine hours as the allocation base. 10. How much manufacturing overhead was allocated during the year? 9. Calculate the predetermined overhead allocation rate using machine hours as the allocation base. 1. Compute the predetermined overhead allocation rates. Round to two decimal places. 2. Determine the total amount of overhead allocated in October. Classic Manufacturing makes carrying cases for portable electronic devices. Its costing records yield the following information: (Click the icon to view the costing records.) Read the Requirement 1. Which type of costing system is Classic using? What piece of data did you base your answer on? Classic uses a system. We know this because Classic's costing records show costs being accumulated for each 60,000 . In October, the company incurred 28,000 direct labor hours in the Mixing Department and 10,000 machine hours in the Packaging Department. Read the requirements. Requirement 1. Compute the predetermined overhead allocation rates. Round to two decimal places. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each department. Sloan Trailers' job cost records yielded the following information: (Click the icon to view the job cost information.) Data table Use the dates above to identify the status of each job. Compute the following balances for Sloan: a. Work-in-Process Inventory at August 31 b. Finished Goods Inventory at August 31 c. Cost of Goods Sold for August Begin by identifying the status of each job. Express Corp. makes two products: C and D. The following data have been summarized: (Click the icon to view the data.) The company plans to manufacture 200 units of each product. Calculate the product cost per unit for Products C and D using activity-based costing. (Round your answers to the nearest cent.) Begin by selecting the formula to allocate overhead (OH) costs. Requirement 1. Which type of costing system is Classic using? What piece of data did you base your answer on? Classic uses a system. We know this because Classic's costing records show costs being accumulated for each or enter a zero.) Prepare the November schedule first, followed by the December schedule. Classic Manufacturing Computation of Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods SoldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started