Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC fast food corporation plans to open a new branch in the north west region of Calgary. The management is about to evaluate this

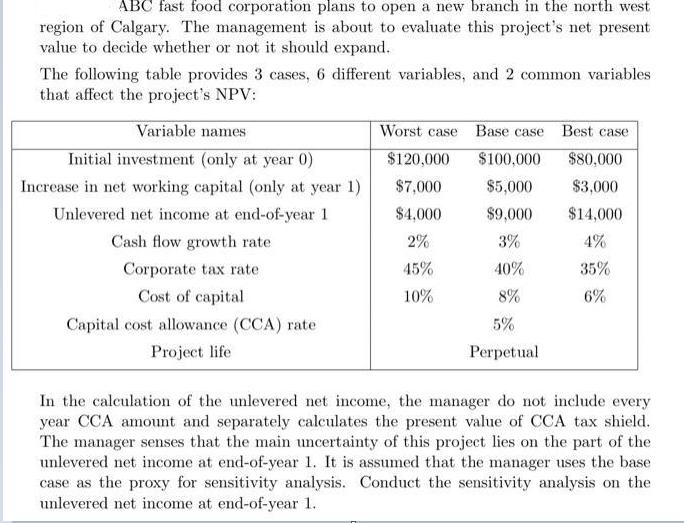

ABC fast food corporation plans to open a new branch in the north west region of Calgary. The management is about to evaluate this project's net present value to decide whether or not it should expand. The following table provides 3 cases, 6 different variables, and 2 common variables that affect the project's NPV: Variable names Worst case Base case Best case Initial investment (only at year 0) $120,000 $100,000 $80,000 Increase in net working capital (only at year 1) $7,000 $5,000 $3,000 Unlevered net income at end-of-year 1 $4,000 $9,000 $14,000 Cash flow growth rate 2% 3% 4% Corporate tax rate 45% 40% 35% Cost of capital 10% 8% 6% Capital cost allowance (CCA) rate 5% Project life Perpetual In the calculation of the unlevered net income, the manager do not include every year CCA amount and separately calculates the present value of CCA tax shield. The manager senses that the main uncertainty of this project lies on the part of the unlevered net income at end-of-year 1. It is assumed that the manager uses the base case as the proxy for sensitivity analysis. Conduct the sensitivity analysis on the unlevered net income at end-of-year 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A D F G 1 2 100000 5000 9000 3 Initial Investment 4 NWC Net income Net Income NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started