Answered step by step

Verified Expert Solution

Question

1 Approved Answer

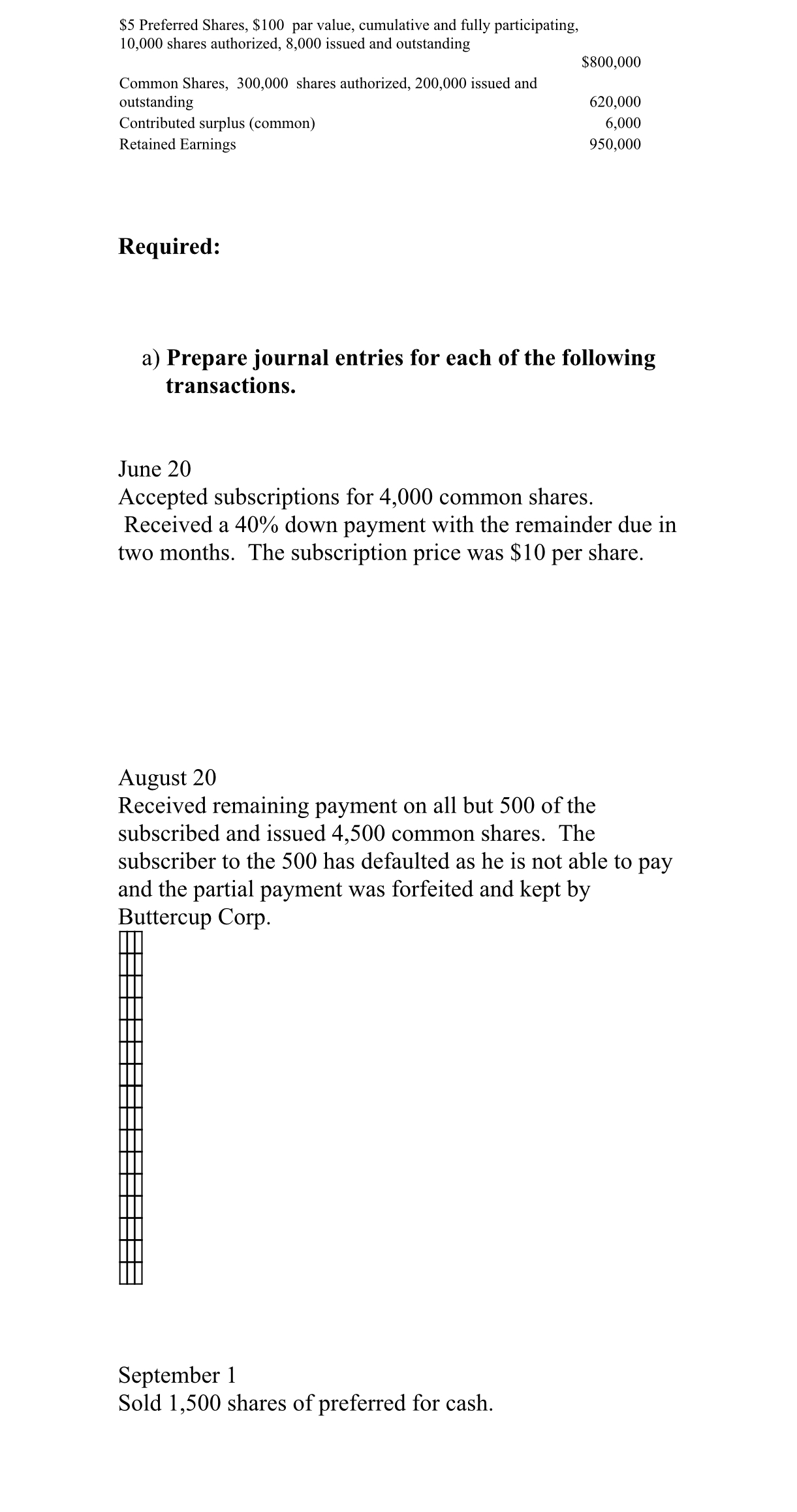

$5 Preferred Shares, $100 par value, cumulative and fully participating, 10,000 shares authorized, 8,000 issued and outstanding $800,000 Common Shares, 300,000 shares authorized, 200,000

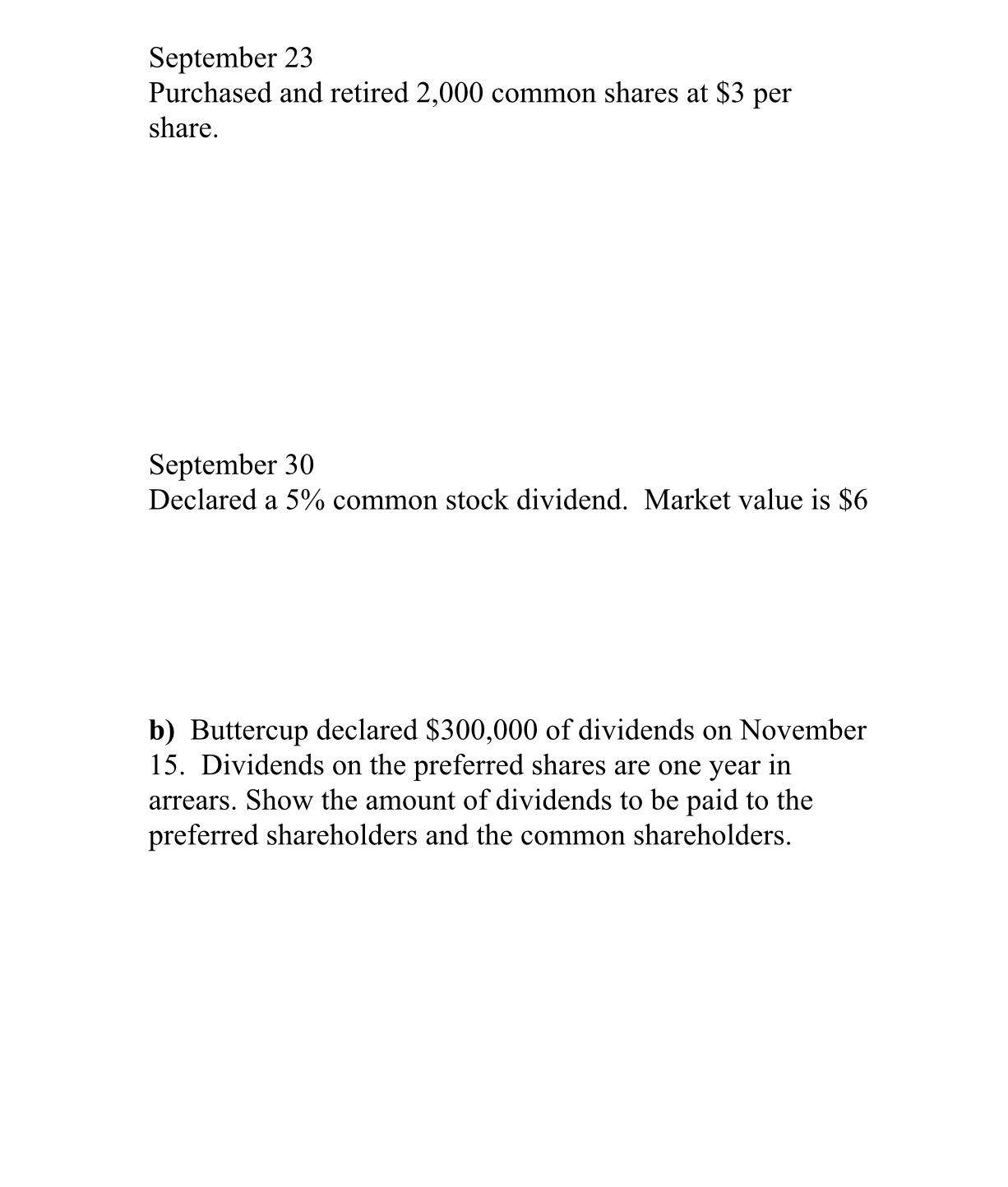

$5 Preferred Shares, $100 par value, cumulative and fully participating, 10,000 shares authorized, 8,000 issued and outstanding $800,000 Common Shares, 300,000 shares authorized, 200,000 issued and outstanding 620,000 Contributed surplus (common) Retained Earnings 6,000 950,000 Required: a) Prepare journal entries for each of the following transactions. June 20 Accepted subscriptions for 4,000 common shares. Received a 40% down payment with the remainder due in two months. The subscription price was $10 per share. August 20 Received remaining payment on all but 500 of the subscribed and issued 4,500 common shares. The subscriber to the 500 has defaulted as he is not able to pay and the partial payment was forfeited and kept by Buttercup Corp. September 1 Sold 1,500 shares of preferred for cash. September 23 Purchased and retired 2,000 common shares at $3 per share. September 30 Declared a 5% common stock dividend. Market value is $6 b) Buttercup declared $300,000 of dividends on November 15. Dividends on the preferred shares are one year in arrears. Show the amount of dividends to be paid to the preferred shareholders and the common shareholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started