Answered step by step

Verified Expert Solution

Question

1 Approved Answer

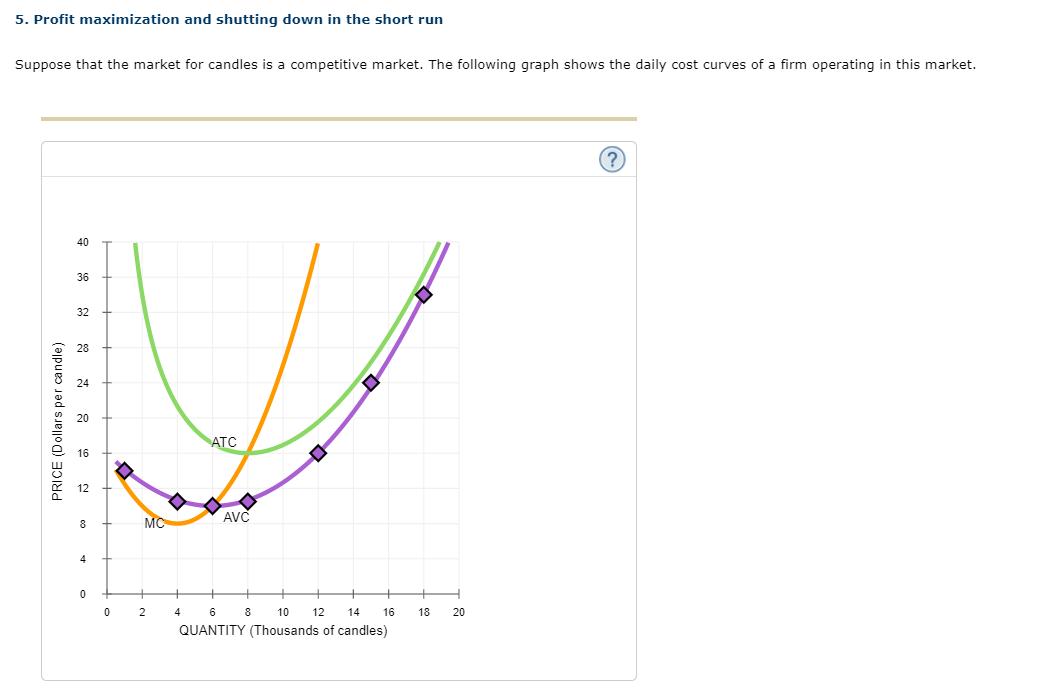

5. Profit maximization and shutting down in the short run Suppose that the market for candles is a competitive market. The following graph shows

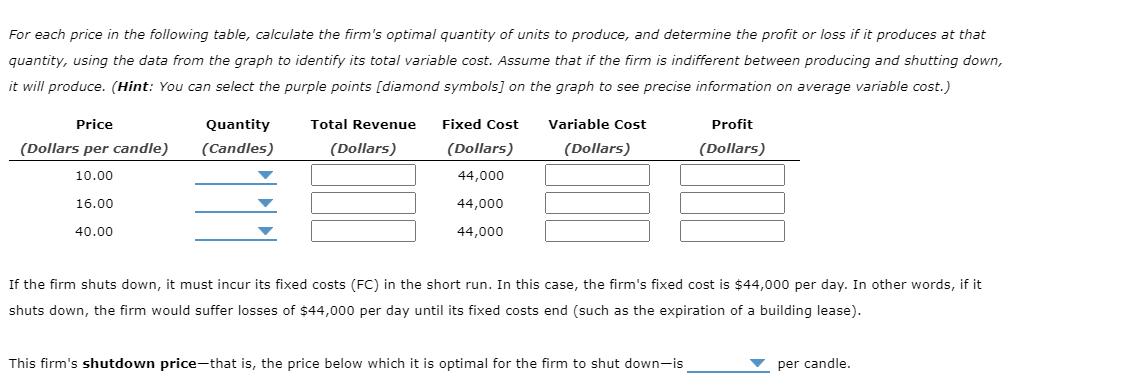

5. Profit maximization and shutting down in the short run Suppose that the market for candles is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. PRICE (Dollars per candle) 40 36 32 28 24 20 ATC 16 12 2 8 4 MC AVC 0 0 2 4 6 8 10 12 14 16 18 20 QUANTITY (Thousands of candles) ?. For each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the graph to identify its total variable cost. Assume that if the firm is indifferent between producing and shutting down, it will produce. (Hint: You can select the purple points [diamond symbols] on the graph to see precise information on average variable cost.) Price (Dollars per candle) Quantity (Candles) 10.00 16.00 Total Revenue Fixed Cost (Dollars) (Dollars) 44,000 44,000 44,000 Variable Cost (Dollars) Profit (Dollars) 40.00 If the firm shuts down, it must incur its fixed costs (FC) in the short run. In this case, the firm's fixed cost is $44,000 per day. In other words, if it shuts down, the firm would suffer losses of $44,000 per day until its fixed costs end (such as the expiration of a building lease). This firm's shutdown price-that is, the price below which it is optimal for the firm to shut down-is per candle.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started