Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Ralph and Sandy are equal general partners in a funeral home business. The RS Partnership reports income from sales of caskets on the

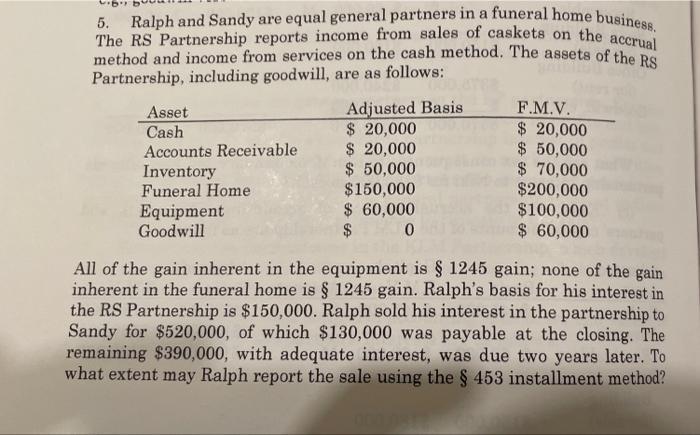

5. Ralph and Sandy are equal general partners in a funeral home business. The RS Partnership reports income from sales of caskets on the accrual method and income from services on the cash method. The assets of the RS Partnership, including goodwill, are as follows: Asset Cash Accounts Receivable Inventory Funeral Home Equipment Goodwill Adjusted Basis $ 20,000 $ 20,000 $ 50,000 $150,000 $ 60,000 $ 0 F.M.V. $ 20,000 $ 50,000 $ 70,000 $200,000 $100,000 $ 60,000 All of the gain inherent in the equipment is 1245 gain; none of the gain inherent in the funeral home is 1245 gain. Ralph's basis for his interest in the RS Partnership is $150,000. Ralph sold his interest in the partnership to Sandy for $520,000, of which $130,000 was payable at the closing. The remaining $390,000, with adequate interest, was due two years later. To what extent may Ralph report the sale using the 453 installment method?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ralphs basis in his interest in the RS Partnership is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started