Question

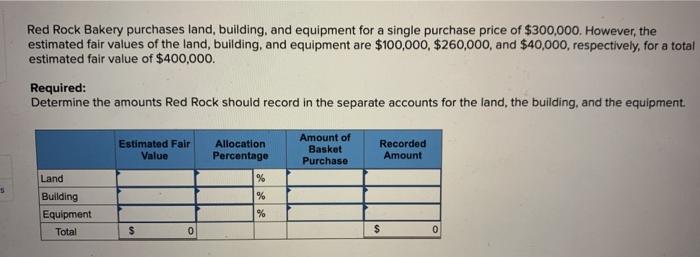

5 Red Rock Bakery purchases land, building, and equipment for a single purchase price of $300,000. However, the estimated fair values of the land,

5 Red Rock Bakery purchases land, building, and equipment for a single purchase price of $300,000. However, the estimated fair values of the land, building, and equipment are $100,000, $260,000, and $40,000, respectively, for a total estimated fair value of $400,000. Required: Determine the amounts Red Rock should record in the separate accounts for the land, the building, and the equipment. Estimated Fair Value Allocation Percentage Amount of Basket Purchase Recorded Amount Land % Building Equipment % Total $ 0 $ 0

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Allocation of Total Cost Land Building Equipme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

2nd Edition

0078110823, 9780078110825

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App