Answered step by step

Verified Expert Solution

Question

1 Approved Answer

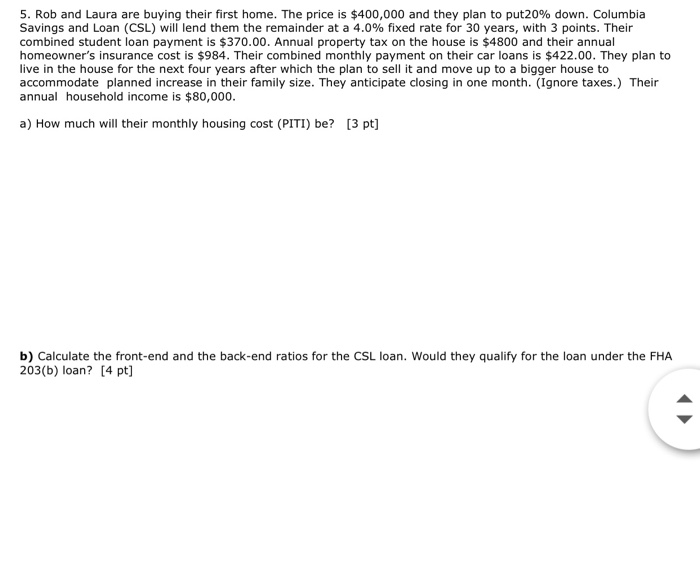

5. Rob and Laura are buying their first home. The price is $400,000 and they plan to put20% down. Columbia Savings and Loan (CSL) will

5. Rob and Laura are buying their first home. The price is $400,000 and they plan to put20% down. Columbia Savings and Loan (CSL) will lend them the remainder at a 4.0% fixed rate for 30 years, with 3 points. Their combined student loan payment is $370.00. Annual property tax on the house is $4800 and their annual homeowners insurance cost is $984. Their combined monthly payment on their car loans is $422.00. They plan to live in the house for the next four years after which the plan to sell it and move up to a bigger house to accommodate planned increase in their family size. They anticipate closing in one month. (Ignore taxes.) Their annual household income is $80,000.

a) How much will their monthly housing cost (PITI) be?

b) Calculate the front-end and the back-end ratios for the CSL loan. Would they qualify for the loan under the FHA 203(b) loan?

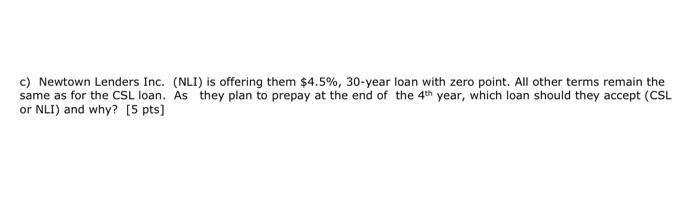

c) Newtown Lenders Inc. (NLI) is offering them $4.5%, 30-year loan with zero point. All other terms remain the same as for the CSL loan. As they plan to prepay at the end of the 4th year, which loan should they accept (CSL or NLI) and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started