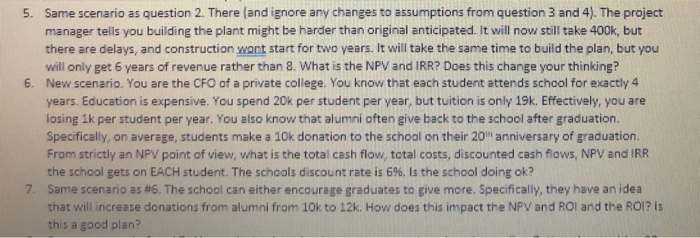

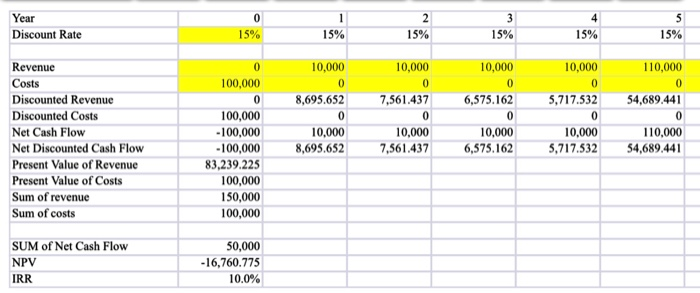

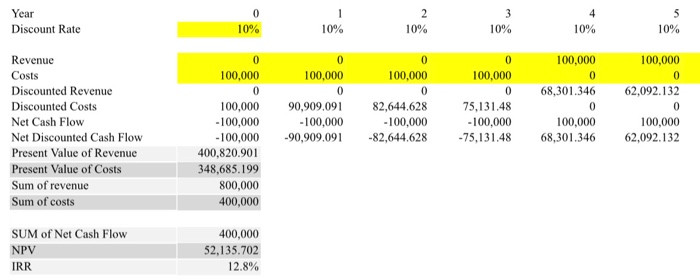

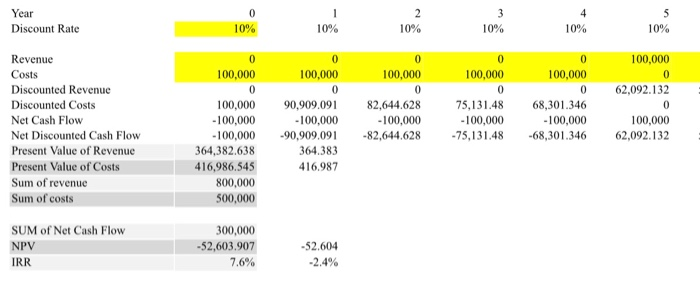

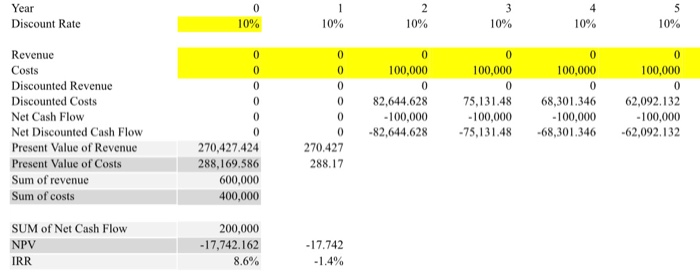

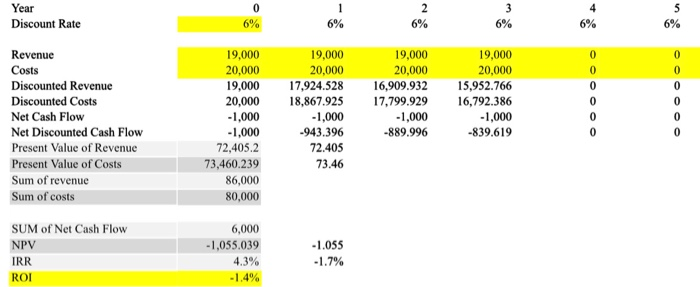

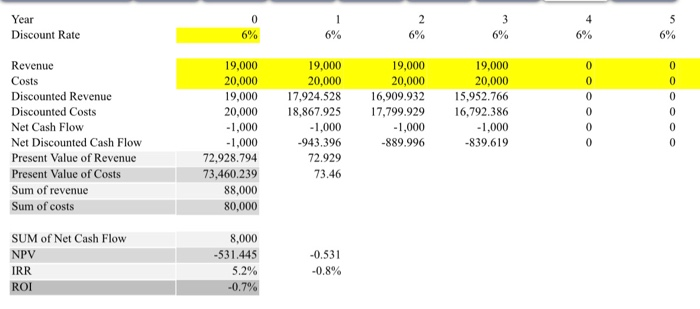

5. Same scenario as question 2. There (and ignore any changes to assumptions from question 3 and 4). The project manager tells you building the plant might be harder than original anticipated. It will now still take 400k, but there are delays, and construction wont start for two years. It will take the same time to build the plan, but you will only get 6 years of revenue rather than 8. What is the NPV and IRR? Does this change your thinking? New scenario. You are the CFO of a private college. You know that each student attends school for exactly 4 years. Education is expensive. You spend 20k per student per year, but tuition is only 19k. Effectively, you are losing ik per student per year. You also know that alumni often give back to the school after graduation. Specifically, on average, students make a 10k donation to the school on their 20 anniversary of graduation From strictly an NPV point of view, what is the total cash flow, total costs, discounted cash flows, NPV and IRR the school gets on EACH student. The schools discount rate is 6%. Is the school doing ok? Same scenario as #6. The school can either encourage graduates to give more. Specifically, they have an idea that will increase donations from alumni from 10K to 12k. How does this impact the NPV and Rol and the ROI? 15 this a good plan? Year Discount Rate 15% 15% 15% 15% 15% 15% 10,000 10,000 10,000 10,000 110,000 100,000 8,695.652 7,561.437 6,575.162 5,717.532 54,689.441 0 0 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 10,000 8,695.652 10,000 7,561.437 10,000 6,575.162 10,000 5.717.532 110,000 54.689.441 100,000 -100,000 -100,000 83,239.225 100,000 150,000 100,000 SUM of Net Cash Flow NPV IRR 50,000 -16,760.775 10.0% Year Discount Rate 10% 10% 10% 10% 10% 10% 100,000 100,000 100,000 100,000 100,000 100,000 68,301.346 62,092.132 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 90,909.091 -100,000 -90,909.091 82,644.628 -100,000 -82,644.628 75,131.48 -100,000 -75,131.48 100,000 68,301.346 100,000 62,092.132 100,000 - 100,000 -100,000 400,820.901 348,685.199 800,000 400,000 SUM of Net Cash Flow NPV IRR 400,000 52,135.702 12.8% Year Discount Rate 10% 10% 10% 10% 10% 10% 100,000 100,000 100,000 100,000 100,000 100,000 62,092.132 0 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 90,909.091 - 100,000 -90,909.091 364.383 416.987 82,644.628 - 100,000 -82,644.628 75,131.48 -100,000 -75,131.48 68,301.346 -100,000 -68,301.346 100,000 - 100,000 - 100,000 364,382.638 416,986.545 800,000 500,000 100,000 62,092.132 SUM of Net Cash Flow NPV IRR 300,000 -52,603.907 7.6% -52.604 -2.4% 5 Year Discount Rate 10% 10% 10% 10% Revenue Costs 0 100,000 100,000 100,000 100,000 82,644.628 -100,000 -82,644.628 75,131.48 -100,000 -75,131.48 68,301,346 -100,000 -68,301.346 62,092.132 -100,000 -62,092.132 Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 270.427 288.17 270,427.424 288,169.586 600,000 400,000 SUM of Net Cash Flow NPV IRR 200,000 -17,742.162 8.6% -17.742 -1.4% Year Discount Rate 0 6% 6% 19,000 20,000 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 19.000 20,000 19,000 20,000 -1,000 -1,000 72,405.2 73,460.239 86,000 80,000 17,924.528 18,867.925 -1,000 -943.396 72.405 73.46 19,000 20,000 16,909.932 17,799.929 -1,000 -889.996 19,000 20,000 15,952.766 16,792.386 -1,000 -839.619 SUM of Net Cash Flow NPV IRR ROI 6,000 -1,055.039 4.3% -1.4% -1.055 -1.7% Year Discount Rate 6% 6% 6% 6% Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 19,000 20,000 19,000 20,000 -1,000 -1,000 72,928.794 73,460.239 88,000 80,000 19,000 20,000 17,924.528 18,867.925 -1,000 -943.396 72.929 73.46 19,000 20,000 16,909.932 17,799.929 -1,000 -889.996 19,000 20,000 15,952.766 16,792.386 -1.000 -839.619 SUM of Net Cash Flow NPV IRR ROI 8,000 -531.445 5.2% -0.7% -0.531 -0.8% 5. Same scenario as question 2. There (and ignore any changes to assumptions from question 3 and 4). The project manager tells you building the plant might be harder than original anticipated. It will now still take 400k, but there are delays, and construction wont start for two years. It will take the same time to build the plan, but you will only get 6 years of revenue rather than 8. What is the NPV and IRR? Does this change your thinking? New scenario. You are the CFO of a private college. You know that each student attends school for exactly 4 years. Education is expensive. You spend 20k per student per year, but tuition is only 19k. Effectively, you are losing ik per student per year. You also know that alumni often give back to the school after graduation. Specifically, on average, students make a 10k donation to the school on their 20 anniversary of graduation From strictly an NPV point of view, what is the total cash flow, total costs, discounted cash flows, NPV and IRR the school gets on EACH student. The schools discount rate is 6%. Is the school doing ok? Same scenario as #6. The school can either encourage graduates to give more. Specifically, they have an idea that will increase donations from alumni from 10K to 12k. How does this impact the NPV and Rol and the ROI? 15 this a good plan? Year Discount Rate 15% 15% 15% 15% 15% 15% 10,000 10,000 10,000 10,000 110,000 100,000 8,695.652 7,561.437 6,575.162 5,717.532 54,689.441 0 0 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 10,000 8,695.652 10,000 7,561.437 10,000 6,575.162 10,000 5.717.532 110,000 54.689.441 100,000 -100,000 -100,000 83,239.225 100,000 150,000 100,000 SUM of Net Cash Flow NPV IRR 50,000 -16,760.775 10.0% Year Discount Rate 10% 10% 10% 10% 10% 10% 100,000 100,000 100,000 100,000 100,000 100,000 68,301.346 62,092.132 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 90,909.091 -100,000 -90,909.091 82,644.628 -100,000 -82,644.628 75,131.48 -100,000 -75,131.48 100,000 68,301.346 100,000 62,092.132 100,000 - 100,000 -100,000 400,820.901 348,685.199 800,000 400,000 SUM of Net Cash Flow NPV IRR 400,000 52,135.702 12.8% Year Discount Rate 10% 10% 10% 10% 10% 10% 100,000 100,000 100,000 100,000 100,000 100,000 62,092.132 0 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 90,909.091 - 100,000 -90,909.091 364.383 416.987 82,644.628 - 100,000 -82,644.628 75,131.48 -100,000 -75,131.48 68,301.346 -100,000 -68,301.346 100,000 - 100,000 - 100,000 364,382.638 416,986.545 800,000 500,000 100,000 62,092.132 SUM of Net Cash Flow NPV IRR 300,000 -52,603.907 7.6% -52.604 -2.4% 5 Year Discount Rate 10% 10% 10% 10% Revenue Costs 0 100,000 100,000 100,000 100,000 82,644.628 -100,000 -82,644.628 75,131.48 -100,000 -75,131.48 68,301,346 -100,000 -68,301.346 62,092.132 -100,000 -62,092.132 Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 270.427 288.17 270,427.424 288,169.586 600,000 400,000 SUM of Net Cash Flow NPV IRR 200,000 -17,742.162 8.6% -17.742 -1.4% Year Discount Rate 0 6% 6% 19,000 20,000 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 19.000 20,000 19,000 20,000 -1,000 -1,000 72,405.2 73,460.239 86,000 80,000 17,924.528 18,867.925 -1,000 -943.396 72.405 73.46 19,000 20,000 16,909.932 17,799.929 -1,000 -889.996 19,000 20,000 15,952.766 16,792.386 -1,000 -839.619 SUM of Net Cash Flow NPV IRR ROI 6,000 -1,055.039 4.3% -1.4% -1.055 -1.7% Year Discount Rate 6% 6% 6% 6% Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 19,000 20,000 19,000 20,000 -1,000 -1,000 72,928.794 73,460.239 88,000 80,000 19,000 20,000 17,924.528 18,867.925 -1,000 -943.396 72.929 73.46 19,000 20,000 16,909.932 17,799.929 -1,000 -889.996 19,000 20,000 15,952.766 16,792.386 -1.000 -839.619 SUM of Net Cash Flow NPV IRR ROI 8,000 -531.445 5.2% -0.7% -0.531 -0.8%