Answered step by step

Verified Expert Solution

Question

1 Approved Answer

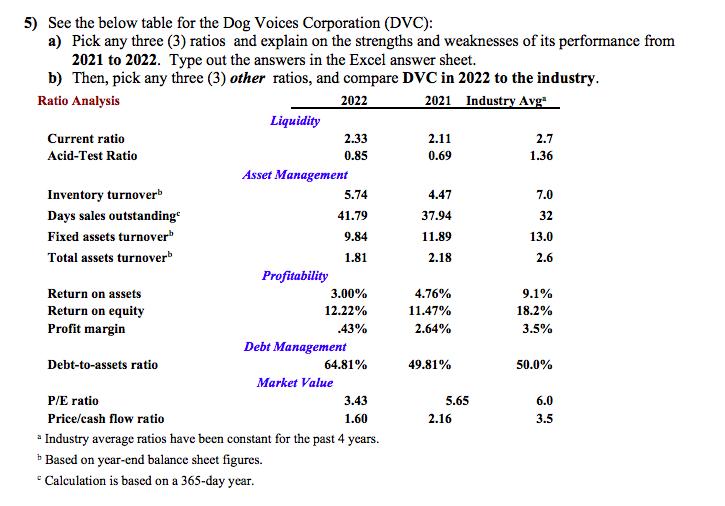

5) See the below table for the Dog Voices Corporation (DVC): a) Pick any three (3) ratios and explain on the strengths and weaknesses

5) See the below table for the Dog Voices Corporation (DVC): a) Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2021 to 2022. Type out the answers in the Excel answer sheet. b) Then, pick any three (3) other ratios, and compare DVC in 2022 to the industry. Ratio Analysis 2022 2021 Industry Avga Current ratio Acid-Test Ratio Inventory turnoverb Days sales outstanding Fixed assets turnoverb Total assets turnoverb Return on assets Return on equity Profit margin Debt-to-assets ratio Liquidity Asset Management Profitability 2.33 0.85 5.74 41.79 9.84 1.81 3.00% 12.22% .43% Debt Management Market Value 64.81% P/E ratio Price/cash flow ratio * Industry average ratios have been constant for the past 4 years. Based on year-end balance sheet figures. C Calculation is based on a 365-day year. 3.43 1.60 2.11 0.69 4.47 37.94 11.89 2.18 4.76% 11.47% 2.64% 49.81% 5.65 2.16 2.7 1.36 7.0 32 13.0 2.6 9.1% 18.2% 3.5% 50.0% 6.0 3.5

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the table lets analyze the strengths and weaknesses of Dog Voices Corporation DVC for the year 2022 compared to 2021 as well as compare DVCs 2022 ratios to the ind...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started