Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Superior Brands Inc. wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return and risk. The

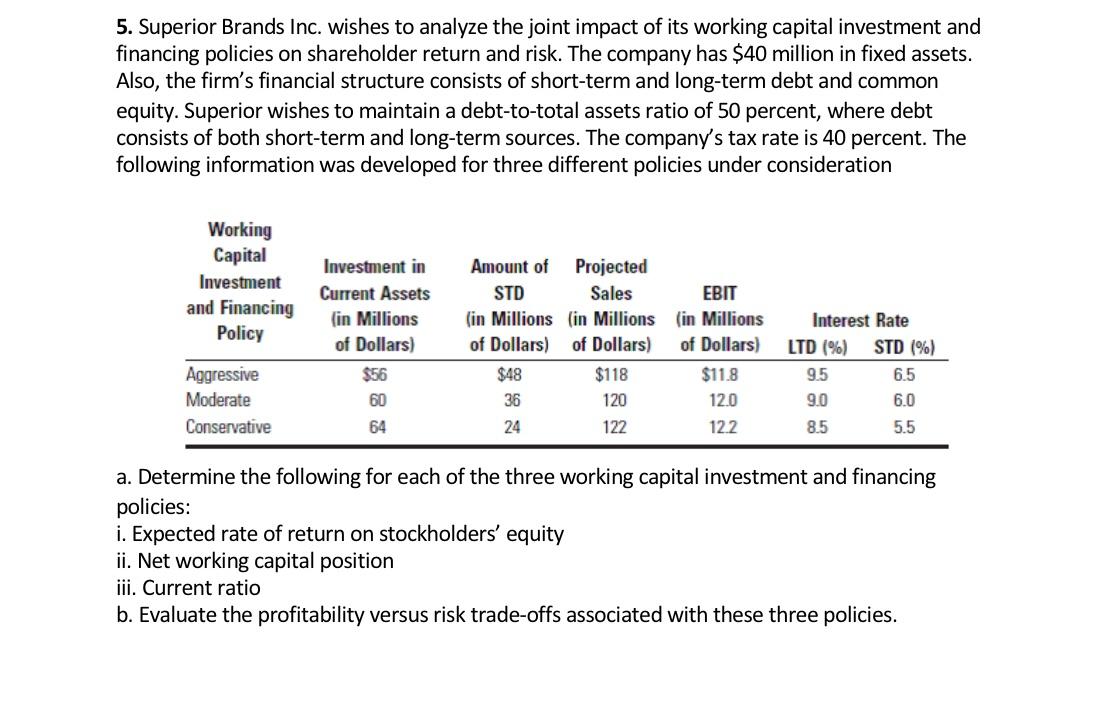

5. Superior Brands Inc. wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return and risk. The company has $40 million in fixed assets. Also, the firm's financial structure consists of short-term and long-term debt and common equity. Superior wishes to maintain a debt-to-total assets ratio of 50 percent, where debt consists of both short-term and long-term sources. The company's tax rate is 40 percent. The following information was developed for three different policies under consideration Working Capital Investment and Financing Policy Aggressive Moderate Conservative Investment in Current Assets (in Millions Amount of STD (in Millions (in Millions Projected Sales EBIT (in Millions Interest Rate of Dollars) of Dollars) of Dollars) of Dollars) LTD (%) STD (%) $56 60 64 $48 $118 $11.8 9.5 6.5 36 120 12.0 9.0 6.0 24 122 12.2 8.5 5.5 a. Determine the following for each of the three working capital investment and financing policies: i. Expected rate of return on stockholders' equity ii. Net working capital position iii. Current ratio b. Evaluate the profitability versus risk trade-offs associated with these three policies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started