5. Suppose Amazon.com Inc. is currently an e-commerce company. It is considering acquiring a nation-wide grocery chain GoodFood Company. Assume the acquisition of GoodFood

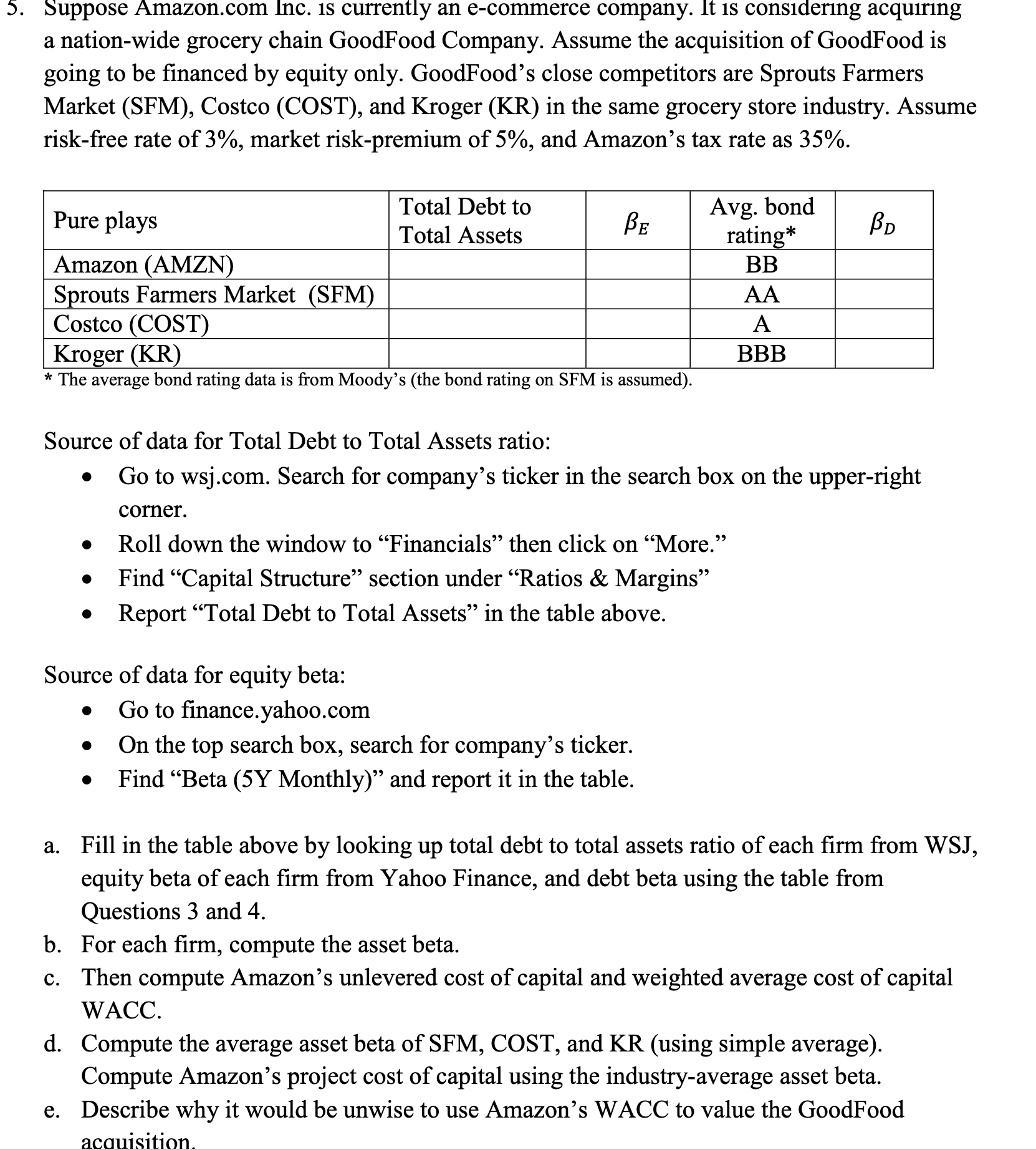

5. Suppose Amazon.com Inc. is currently an e-commerce company. It is considering acquiring a nation-wide grocery chain GoodFood Company. Assume the acquisition of GoodFood is going to be financed by equity only. GoodFood's close competitors are Sprouts Farmers Market (SFM), Costco (COST), and Kroger (KR) in the same grocery store industry. Assume risk-free rate of 3%, market risk-premium of 5%, and Amazon's tax rate as 35%. Pure plays Total Debt to Total Assets BE Avg. bond rating* Amazon (AMZN) BB Sprouts Farmers Market (SFM) AA Costco (COST) A Kroger (KR) BBB * The average bond rating data is from Moody's (the bond rating on SFM is assumed). Source of data for Total Debt to Total Assets ratio: Go to wsj.com. Search for company's ticker in the search box on the upper-right corner. Roll down the window to "Financials then click on More." Find "Capital Structure section under Ratios & Margins" Report "Total Debt to Total Assets" in the table above. Source of data for equity beta: Go to finance.yahoo.com On the top search box, search for company's ticker. Find "Beta (5Y Monthly)" and report it in the table. a. Fill in the table above by looking up total debt to total assets ratio of each firm from WSJ, equity beta of each firm from Yahoo Finance, and debt beta using the table from Questions 3 and 4. b. For each firm, compute the asset beta. c. Then compute Amazon's unlevered cost of capital and weighted average cost of capital WACC. d. Compute the average asset beta of SFM, COST, and KR (using simple average). Compute Amazon's project cost of capital using the industry-average asset beta. e. Describe why it would be unwise to use Amazon's WACC to value the GoodFood acquisition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started