Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Suppose that the credit rating for Global Outfitter's corporate bond falls from A to BBB because of a major problem of global supplies being

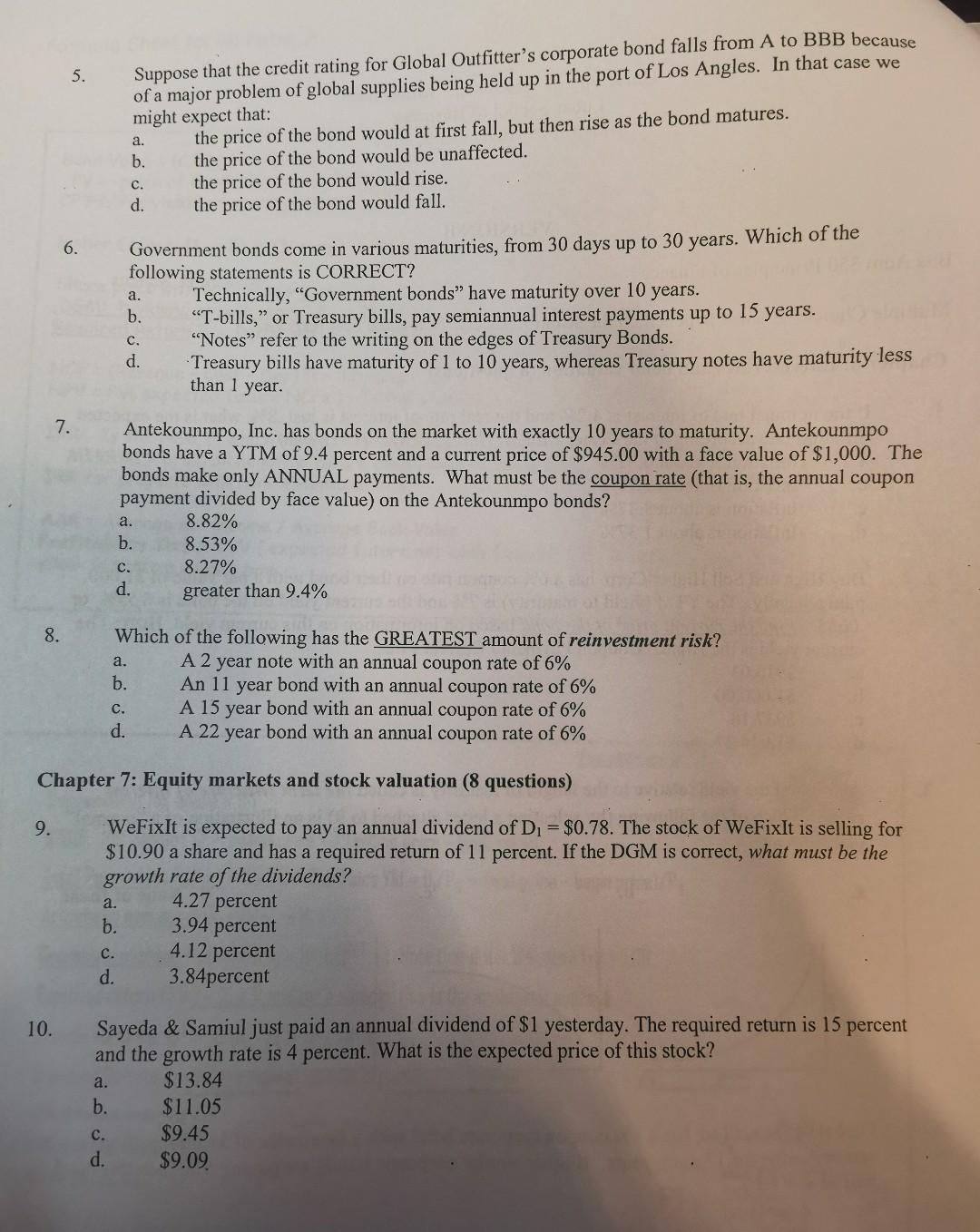

5. Suppose that the credit rating for Global Outfitter's corporate bond falls from A to BBB because of a major problem of global supplies being held up in the port of Los Angles. In that case we might expect that: the price of the bond would at first fall, but then rise as the bond matures. b. the price of the bond would be unaffected. the price of the bond would rise. the price of the bond would fall. a. C. d. 6. Government bonds come in various maturities, from 30 days up to 30 years. Which of the following statements is CORRECT? Technically, Government bonds" have maturity over 10 years. "T-bills," or Treasury bills, pay semiannual interest payments up to 15 years. c. Notes refer to the writing on the edges of Treasury Bonds. d. Treasury bills have maturity of 1 to 10 years, whereas Treasury notes have maturity less a. b. than 1 year. 7. Antekounmpo, Inc. has bonds on the market with exactly 10 years to maturity. Antekounmpo bonds have a YTM of 9.4 percent and a current price of $945.00 with a face value of $1,000. The bonds make only ANNUAL payments. What must be the coupon rate (that is, the annual coupon payment divided by face value) on the Antekounmpo bonds? 8.82% b. 8.53% c. 8.27% d. greater than 9.4% a. 8. a. Which of the following has the GREATEST amount of reinvestment risk? A 2 year note with an annual coupon rate of 6% b. An 11 year bond with an annual coupon rate of 6% A 15 year bond with an annual coupon rate of 6% d. A 22 year bond with an annual coupon rate of 6% c. Chapter 7: Equity markets and stock valuation (8 questions) 9. WeFixIt is expected to pay an annual dividend of D1 = $0.78. The stock of WeFixIt is selling for $10.90 a share and has a required return of 11 percent. If the DGM is correct, what must be the growth rate of the dividends? a. 4.27 percent b. 3.94 percent C. 4.12 percent d. 3.84percent 10. Sayeda & Samiul just paid an annual dividend of $1 yesterday. The required return is 15 percent and the growth rate is 4 percent. What is the expected price of this stock? $13.84 $11.05 $9.45 d. $9.09. a. b. C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started