Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. The Baillat Corporation is considering the acquisition of a machine that costs $89,000 if bought today. Baillat can buy or lease the machine.

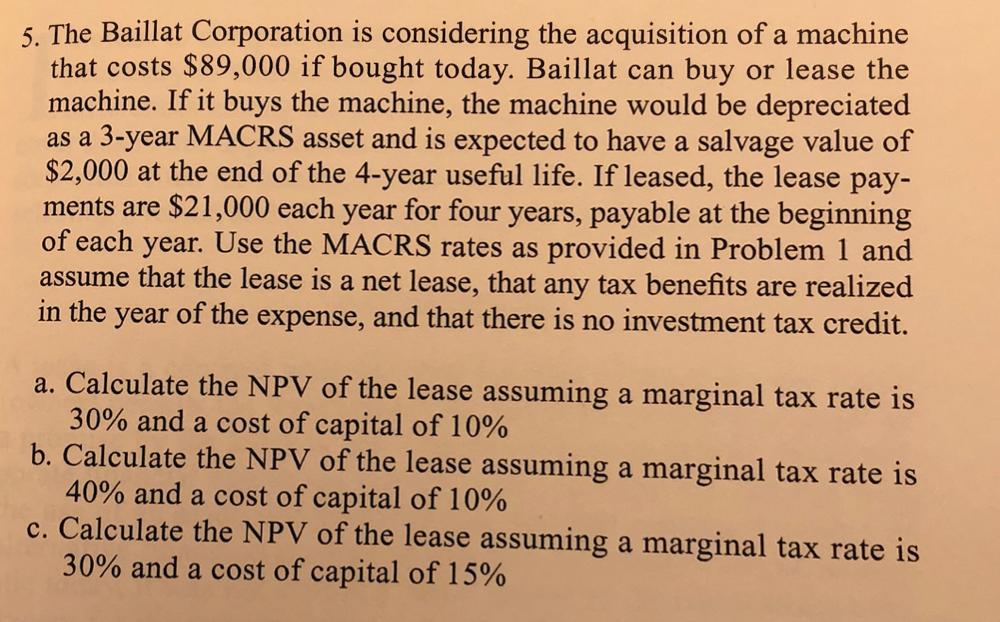

5. The Baillat Corporation is considering the acquisition of a machine that costs $89,000 if bought today. Baillat can buy or lease the machine. If it buys the machine, the machine would be depreciated as a 3-year MACRS asset and is expected to have a salvage value of $2,000 at the end of the 4-year useful life. If leased, the lease pay- ments are $21,000 each year for four years, payable at the beginning of each year. Use the MACRS rates as provided in Problem 1 and assume that the lease is a net lease, that any tax benefits are realized in the year of the expense, and that there is no investment tax credit. a. Calculate the NPV of the lease assuming a marginal tax rate is 30% and a cost of capital of 10% b. Calculate the NPV of the lease assuming a marginal tax rate is 40% and a cost of capital of 10% c. Calculate the NPV of the lease assuming a marginal tax rate is 30% and a cost of capital of 15%

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here are the MACRS depreciation rates Year 1 033 Year 2 045 Year 3 015 Year 4 007 For the buy option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started