Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) The Kamagi Corp. sold thirty year bonds ten years ago (i.e., the market considers these bonds to be 20 year bonds today). The bonds

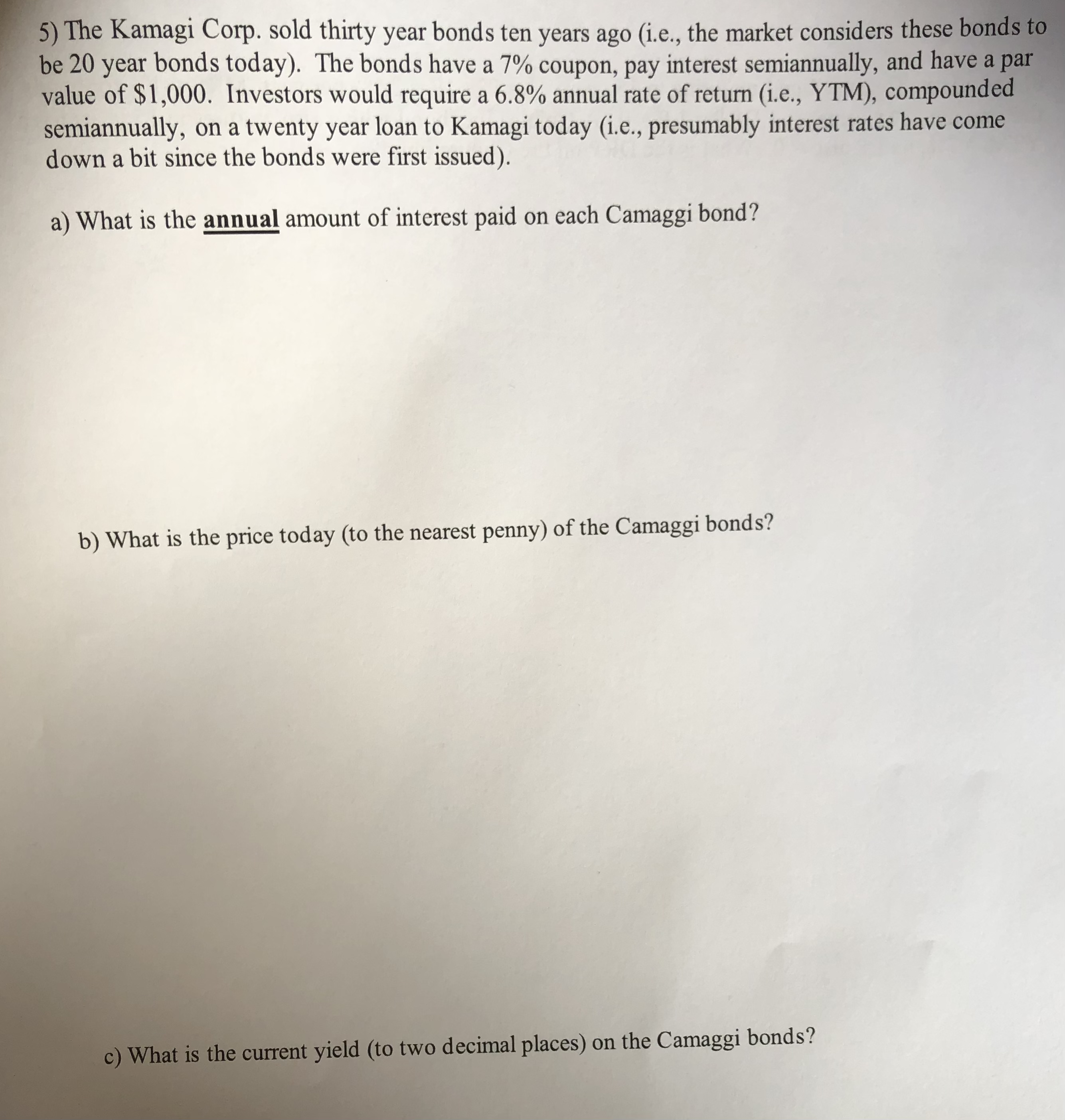

5) The Kamagi Corp. sold thirty year bonds ten years ago (i.e., the market considers these bonds to be 20 year bonds today). The bonds have a 7% coupon, pay interest semiannually, and have a par value of $1,000. Investors would require a 6.8% annual rate of return (i.e., YTM), compounded semiannually, on a twenty year loan to Kamagi today (i.e., presumably interest rates have come down a bit since the bonds were first issued). a) What is the annual amount of interest paid on each Camaggi bond? b) What is the price today (to the nearest penny) of the Camaggi bonds? c) What is the current yield (to two decimal places) on the Camaggi bonds

5) The Kamagi Corp. sold thirty year bonds ten years ago (i.e., the market considers these bonds to be 20 year bonds today). The bonds have a 7% coupon, pay interest semiannually, and have a par value of $1,000. Investors would require a 6.8% annual rate of return (i.e., YTM), compounded semiannually, on a twenty year loan to Kamagi today (i.e., presumably interest rates have come down a bit since the bonds were first issued). a) What is the annual amount of interest paid on each Camaggi bond? b) What is the price today (to the nearest penny) of the Camaggi bonds? c) What is the current yield (to two decimal places) on the Camaggi bonds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started