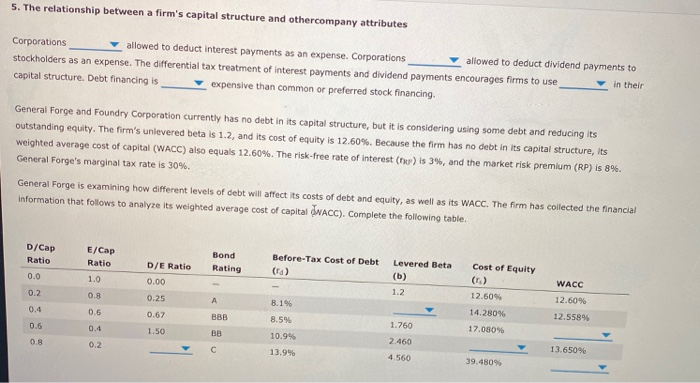

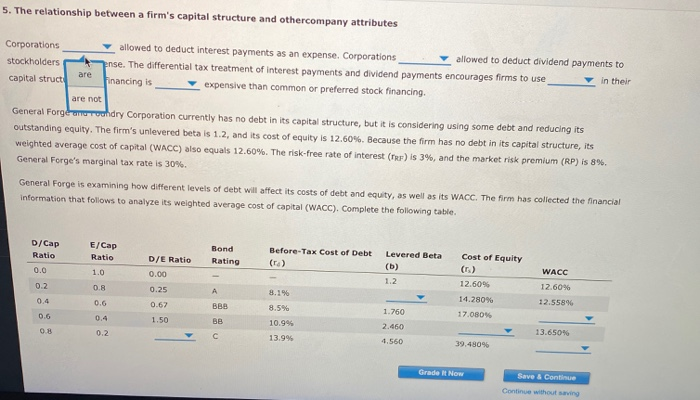

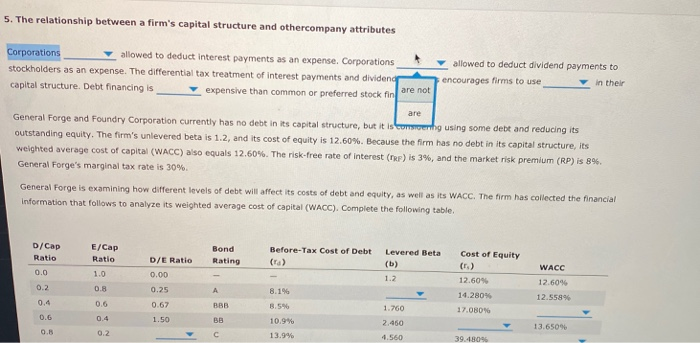

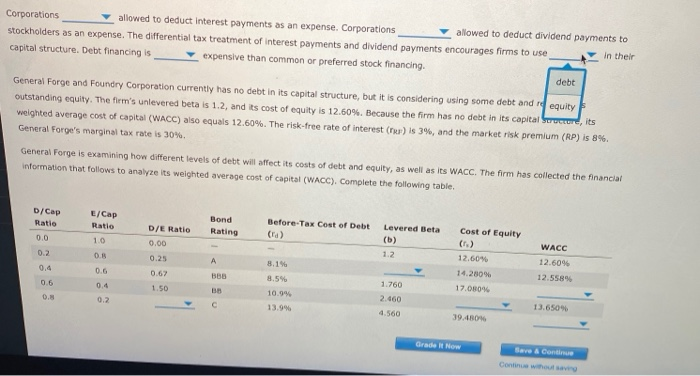

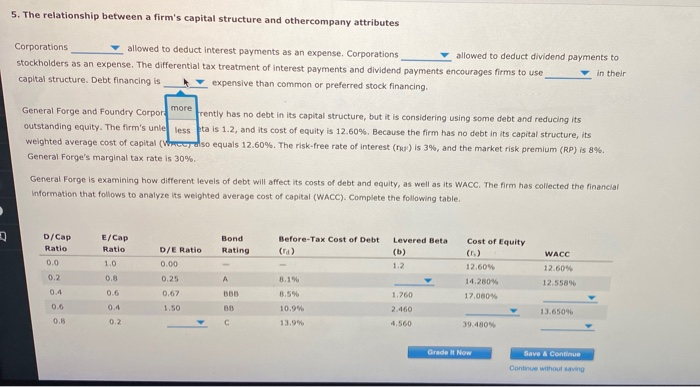

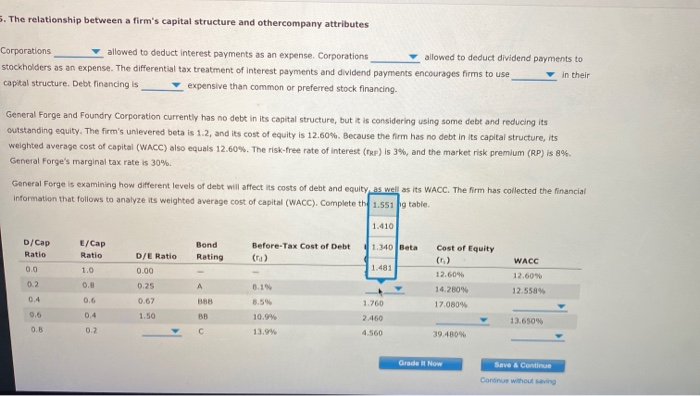

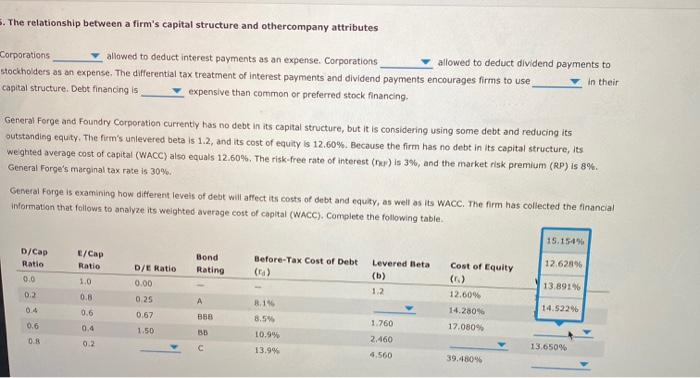

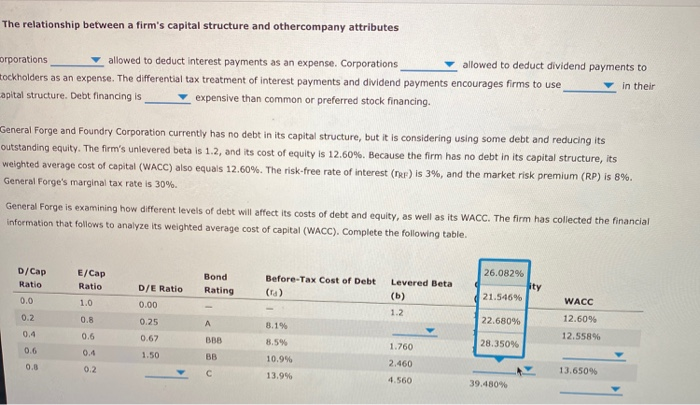

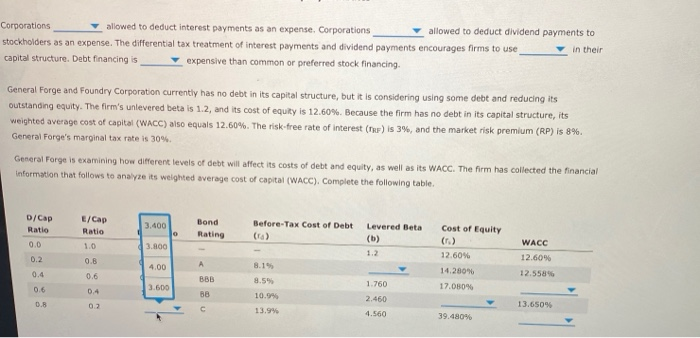

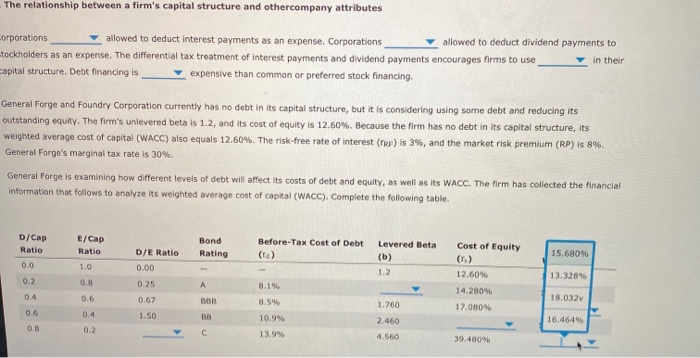

5. The relationship between a firm's capital structure and othercompany attributes Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (r) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30%. General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital NACC). Complete the following table. D/Cap Ratio Before-Tax Cost of Debt Levered Beta E/Cap Ratio 1.0 Bond Rating D/E Ratio (b) Cost of Equity (1) 12.60% WACC 0.0 1.2 12.609 14.28046 12.55 0.2 0.4 0.00 0.25 0.67 1.50 0.5 BBB 8.1% 8.5% 10.9% 1.760 17.080% 0.4 2.460 13.650% 0.5 08 13.9% 4.560 39.480% 5. The relationship between a firm's capital structure and othercompany attributes Corporations allowed to deduct interest payments as an expense. Corporations stockholders as an expense. The differential tax treatment of interest payments and dividend capital structure. Debt financing is expensive than common or preferred stock fin allowed to deduct dividend payments to encourages firms to use in their are not General Forge and Foundry Corporation currently has no debt in its capital structure, but it is tomong using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (ERP) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30%. General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. Cost of Equity D/Cap Ratio E/Cap Ratio Bond Rating Before-Tax Cost of Debt (ra) Levered Beta (b) WACC 0.0 0.8 D/E Ratio 0.00 0.25 0.67 1.50 12.6096 12.559 0.2 0.4 8.1% 12.609 14.280% 17.080 0.6 BBB 1.760 10.94 2.450 4.560 0.5 0.2 13.9% Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing debt General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and equity outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60% Because the firm has no debt in its capital Soccor, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (ru) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30%. General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. /Cap Before-Tax Cost of Debt Levered Beta E/Cap Ratio Cost of Equity Bond Rating Ratio D/E Ratio 0.00 10 12.60% WACC 12.6096 12.5589 OR 0.25 14 0.4 0.6 17.00 1.50 10.99 1.760 2.460 4.560 13.6509 2 13. 39.400 Orade Sare & Con who 5. The relationship between a firm's capital structure and othercompany attributes Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing General Forge and Foundry Corpor more Frently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unle less ta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (VRCGT dlso equals 12.60%. The risk-free rate of interest (nap) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30%. General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACG. The firm has collected the financial Information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. Cost of Equity D/Cap Ratio E/Cap Ratio Bond Rating Before-Tax Cost of Debt (ra) Levered Beta (b) D/E Ratio WACC 0.0 0.00 12.604 10 03 0.25 12.60 142804 17.000 12.5589 0.6 BBB 1.760 0.67 1.50 06 0.4 3.54 10.9% 13.9% 13.6505 2.460 4.560 C. 39.480 Grad Now Save A Continue Continue without saving . The relationship between a firm's capital structure and othercompany attributes Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (tep) is 3%, and the market risk premium (RP) is 8% General Forge's marginal tax rate is 30% General Forge is examining how different levels of debt will affect its costs of debt and equity as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete th 1.551 g table. 1.410 Before-Tax Cost of Debt 1.340 Beta Cost of Equity D/Cap Ratio E/Cap Ratio Bond Rating DE Ratio WACC 00 1.0 0.00 12.60% 12.5585 0.8 12.604 14.280% 17.00% 0.25 1.760 0.67 1.50 10.99 2.460 13.6509 0.2 13.9 4.560 39.400 Grad Now Save & Continue Continue without ang The relationship between a firm's capital structure and othercompany attributes allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest () is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30% General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. 15.154% 12.628% D/Cap Ratio /Cap Ratio Bond Rating Before-Tax Cost of Debt (ra) D/E Ratio Levered Beta (b) Cost of Equity (.) 13.891% 0.0 1.2 31 0.00 0.25 0.67 1. 500 12.60% 14.280% 17.080% 14.522% 0.6 B6B 10.94 0.4 0.2 1.760 2.460 4.560 13.650% 13.9% 39.480% The relationship between a firm's capital structure and othercompany attributes rporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to Hockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use apital structure. Debt financing is _ expensive than common or preferred stock financing. General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (TRF) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30% General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. 26.082% D/Cap Ratio E/Cap Ratio Bond Rating Before-Tax Cost of Debt D/E Ratio Levered Beta (b) 21.546% 0.0 0.00 22.680% WACC 12.60% 12.558% 0.2 0.25 0.4 0.67 BBB 28.350% 0.4 1.50 8.5% 10.9% 13.9% 1.760 2.460 4.560 13.650% 02 39.480% Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing. General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (n) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 304 General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial Information that follows to analyze its weighted average cost of capital (WACC). Complete the following table D/Cap Ratio E/Cap Ratio Bond Rating Before-Tax Cost of Debt (ra) Levered Beta Cost of Equity WACC 12.6096 12.558% 0.2 12.60% 14.280% 17.080% 81 0.4 BBB 0.6 8.5% 10.99 1.760 2.460 13.65056 02 4.560 39.480% The relationship between a firm's capital structure and othercompany attributes orporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to tockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing. General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.2, and its cost of equity is 12.60%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.60%. The risk-free rate of interest (TKP) is 3%, and the market risk premium (RP) is 8%. General Forge's marginal tax rate is 30% General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. D/Cap Ratio E/Cap Ratio Bond Rating Before-Tax Cost of Debt (ra) Levered Beta 15.680% 13.3289 1.0 1.2 Cost of Equity (r.) 12.60% 14.280% 17.080% 02 D/E Ratio 0.00 0.25 0.67 1.50 0.8 8.11 18.032v 0.4 0.6 BOB 06 1.760 2.460 4.560 16.464% 10.9% 13.9% 0.8 39.480