Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. There are two projects, according to which it is necessary to take the decision. Determine which project is more preferable by NPV criterion, if

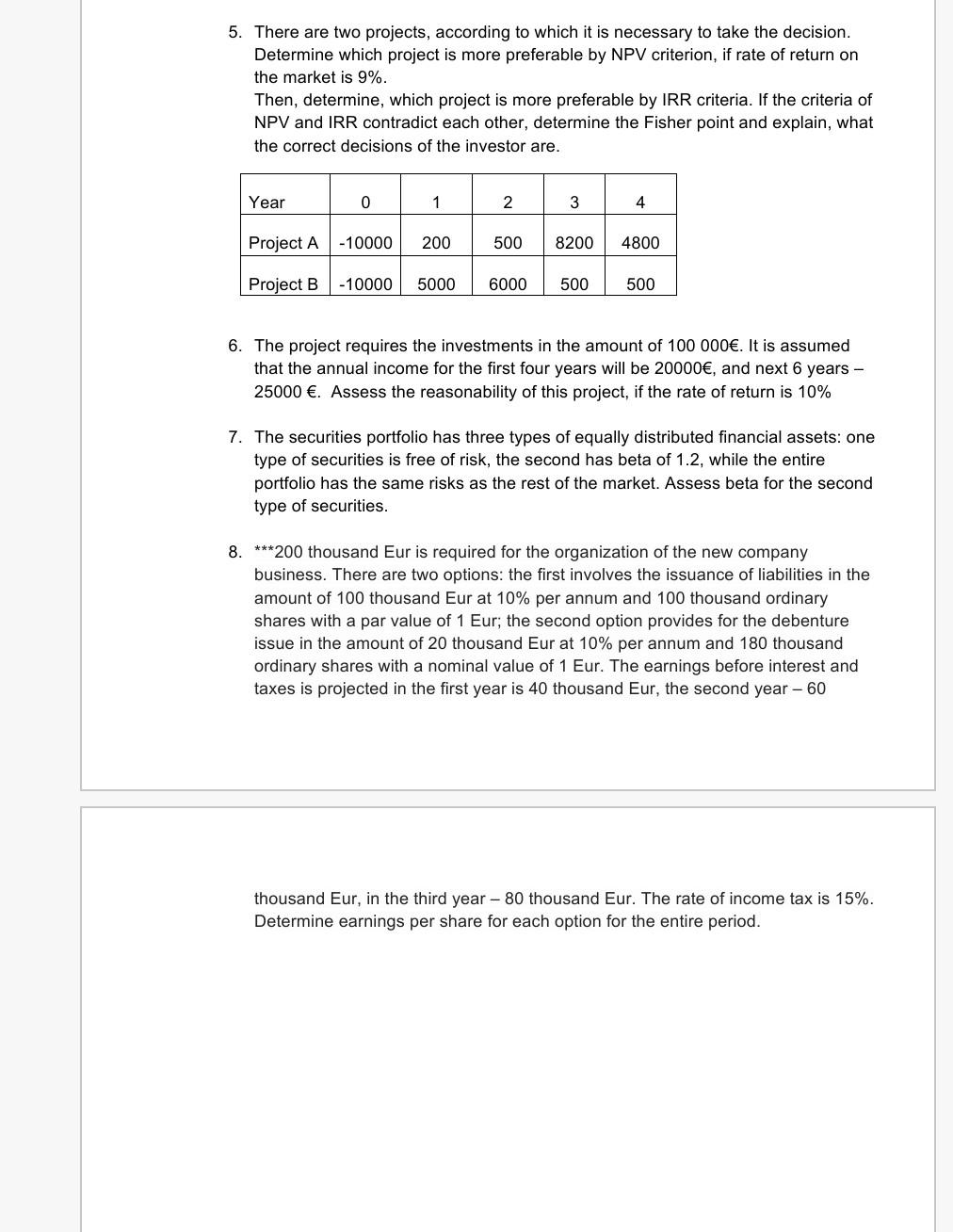

5. There are two projects, according to which it is necessary to take the decision. Determine which project is more preferable by NPV criterion, if rate of return on the market is 9%. Then, determine, which project is more preferable by IRR criteria. If the criteria of NPV and IRR contradict each other, determine the Fisher point and explain, what the correct decisions of the investor are. Year 0 1 2 3 4. Project A -10000 200 500 8200 4800 Project B-10000 5000 6000 500 500 6. The project requires the investments in the amount of 100 000. It is assumed that the annual income for the first four years will be 20000, and next 6 years - 25000 . Assess the reasonability of this project, if the rate of return is 10% 7. The securities portfolio has three types of equally distributed financial assets: one type of securities is free of risk, the second has beta of 1.2, while the entire portfolio has the same risks as the rest of the market. Assess beta for the second type of securities. 8. ***200 thousand Eur is required for the organization of the new company business. There are two options: the first involves the issuance of liabilities in the amount of 100 thousand Eur at 10% per annum and 100 thousand ordinary shares with a par value of 1 Eur; the second option provides for the debenture issue in the amount of 20 thousand Eur at 10% per annum and 180 thousand ordinary shares with a nominal value of 1 Eur. The earnings before interest and taxes is projected in the first year is 40 thousand Eur, the second year - 60 thousand Eur, in the third year - 80 thousand Eur. The rate of income tax is 15%. Determine earnings per share for each option for the entire period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started