Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. This question generally focuses on the riskiness of the BBB tranches in the first layer of securitization (see Exhibit 4, the MBS BBB

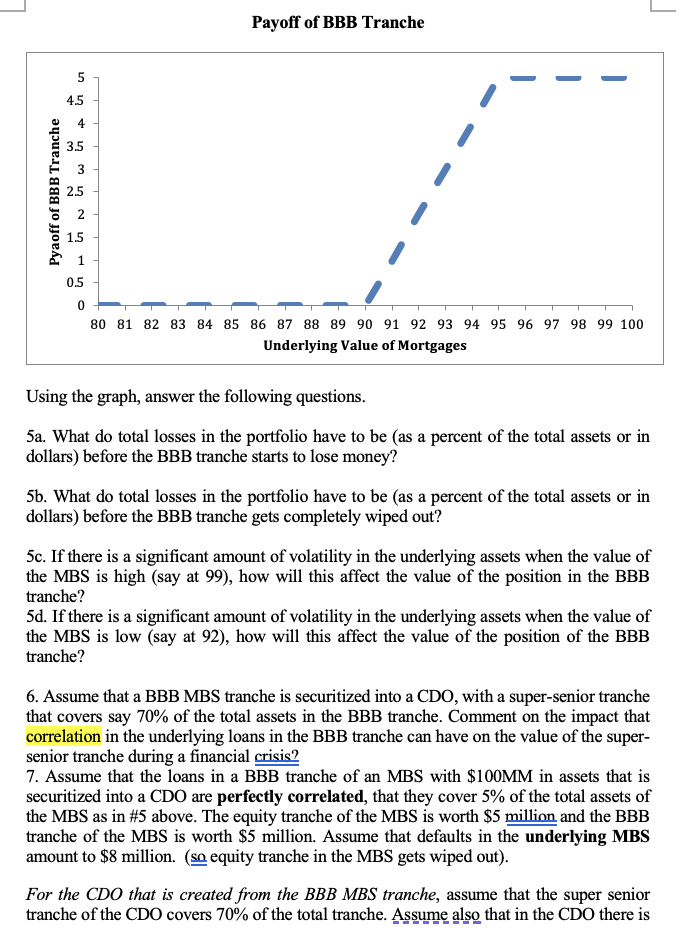

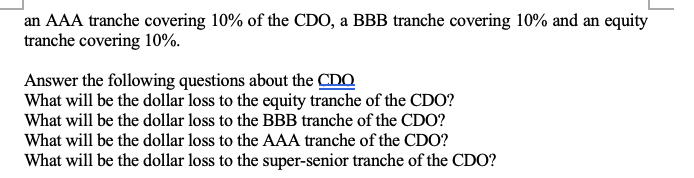

5. This question generally focuses on the riskiness of the BBB tranches in the first layer of securitization (see Exhibit 4, the MBS BBB tranche) See below for a graph of the payoff of the BBB tranche relative to the underlying value of the mortgages in the pool. This graph assumes that the total value of the underlying pool of MBS is $100 million. The equity tranche holds 5%. The BBB tranche holds the next 5% (so their face value is $5 MM). The graph also assumes away periodic interest payments and principal payments and just graphs the final payoff to the security holders as if the entire payoff came at maturity. In other words, the graph assumes that if there are no defaults, the BBB tranche will receive back $5 million at maturity. Pyaoff of BBB Tranche 5 4.5 4 3.5 2.5 ~ w Payoff of BBB Tranche 1.5 1 0.5 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 Underlying Value of Mortgages Using the graph, answer the following questions. 5a. What do total losses in the portfolio have to be (as a percent of the total assets or in dollars) before the BBB tranche starts to lose money? 5b. What do total losses in the portfolio have to be (as a percent of the total assets or in dollars) before the BBB tranche gets completely wiped out? 5c. If there is a significant amount of volatility in the underlying assets when the value of the MBS is high (say at 99), how will this affect the value of the position in the BBB tranche? 5d. If there is a significant amount of volatility in the underlying assets when the value of the MBS is low (say at 92), how will this affect the value of the position of the BBB tranche? 6. Assume that a BBB MBS tranche is securitized into a CDO, with a super-senior tranche that covers say 70% of the total assets in the BBB tranche. Comment on the impact that correlation in the underlying loans in the BBB tranche can have on the value of the super- senior tranche during a financial crisis? 7. Assume that the loans in a BBB tranche of an MBS with $100MM in assets that is securitized into a CDO are perfectly correlated, that they cover 5% of the total assets of the MBS as in #5 above. The equity tranche of the MBS is worth $5 million and the BBB tranche of the MBS is worth $5 million. Assume that defaults in the underlying MBS amount to $8 million. (so equity tranche in the MBS gets wiped out). For the CDO that is created from the BBB MBS tranche, assume that the super senior tranche of the CDO covers 70% of the total tranche. Assume also that in the CDO there is an AAA tranche covering 10% of the CDO, a BBB tranche covering 10% and an equity tranche covering 10%. Answer the following questions about the CDO What will be the dollar loss to the equity tranche of the CDO? What will be the dollar loss to the BBB tranche of the CDO? What will be the dollar loss to the AAA tranche of the CDO? What will be the dollar loss to the super-senior tranche of the CDO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started