Answered step by step

Verified Expert Solution

Question

1 Approved Answer

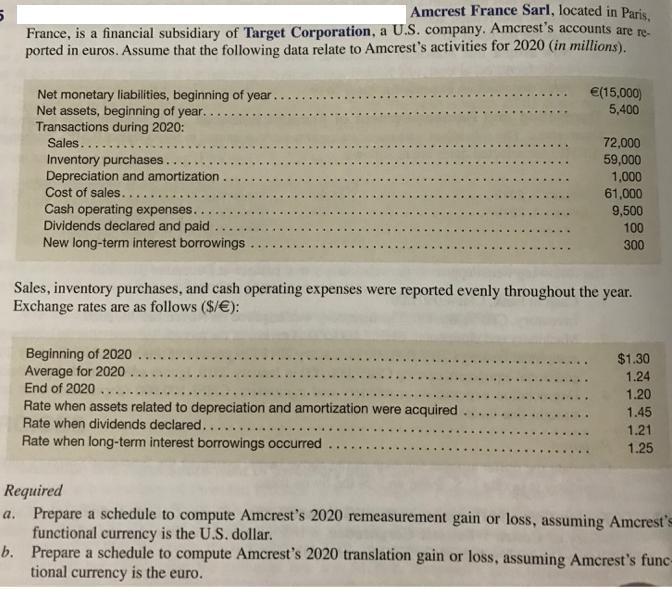

Amcrest France Sarl, located in Paris. France, is a financial subsidiary of Target Corporation, a U.S. company. Amcrest's accounts are re- ported in euros.

Amcrest France Sarl, located in Paris. France, is a financial subsidiary of Target Corporation, a U.S. company. Amcrest's accounts are re- ported in euros. Assume that the following data relate to Amcrest's activities for 2020 (in millions). Net monetary liabilities, beginning of year. Net assets, beginning of year.. Transactions during 2020: (15,000) 5,400 72,000 59,000 Sales.. Inventory purchases.. Depreciation and amortization Cost of sales... Cash operating expenses. Dividends declared and paid New long-term interest borrowings 1,000 61,000 9,500 100 300 Sales, inventory purchases, and cash operating expenses were reported evenly throughout the year. Exchange rates are as follows ($/): Beginning of 2020 Average for 2020 End of 2020 ... Rate when assets related to depreciation and amortization were acquired Rate when dividends declared... Rate when long-term interest borrowings occurred $1.30 1.24 1.20 .. 1.45 1.21 1.25 Required a. Prepare a schedule to compute Amcrest's 2020 remeasurement gain or loss, assuming Amcrest's functional currency is the U.S. dollar. b. Prepare a schedule to compute Amcrest's 2020 translation gain or loss, assuming Amcrest's func- tional currency is the euro.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a conversion of Euro to brings gain on account of foreign exchange translation to 4646 as detailed i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started