Answered step by step

Verified Expert Solution

Question

1 Approved Answer

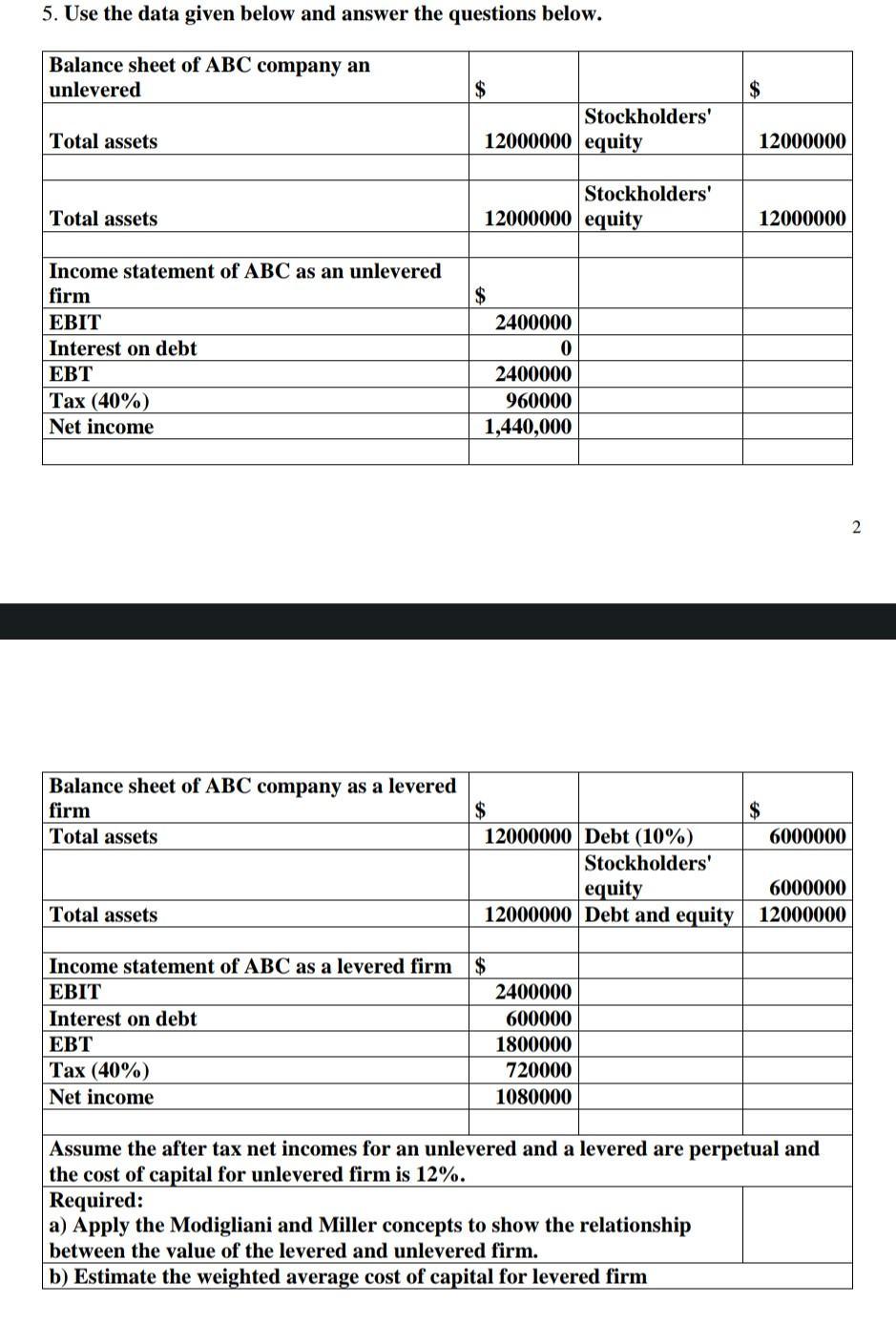

5. Use the data given below and answer the questions below. Balance sheet of ABC company an unlevered Total assets Total assets Income statement

5. Use the data given below and answer the questions below. Balance sheet of ABC company an unlevered Total assets Total assets Income statement of ABC as an unlevered firm EBIT Interest on debt EBT Tax (40%) Net income Balance sheet of ABC company as a levered firm Total assets Total assets $ EBT Tax (40%) Net income 12000000 equity $ 12000000 equity $ 2400000 2400000 960000 1,440,000 0 Income statement of ABC as a levered firm $ EBIT Interest on debt Stockholders' Stockholders' 12000000 Debt (10%) Stockholders' 2400000 600000 1800000 720000 1080000 $ 12000000 12000000 $ equity 6000000 12000000 Debt and equity 12000000 6000000 Assume the after tax net incomes for an unlevered and a levered are perpetual and the cost of capital for unlevered firm is 12%. Required: a) Apply the Modigliani and Miller concepts to show the relationship between the value of the levered and unlevered firm. b) Estimate the weighted average cost of capital for levered firm 2

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Modigliani and Miller Propositions Proposition I with taxes The value of a leveraged firm is equal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started