Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Using one-year of daily returns calculate the volatility and beta of the stock. What does this information tell you about the stock's risk

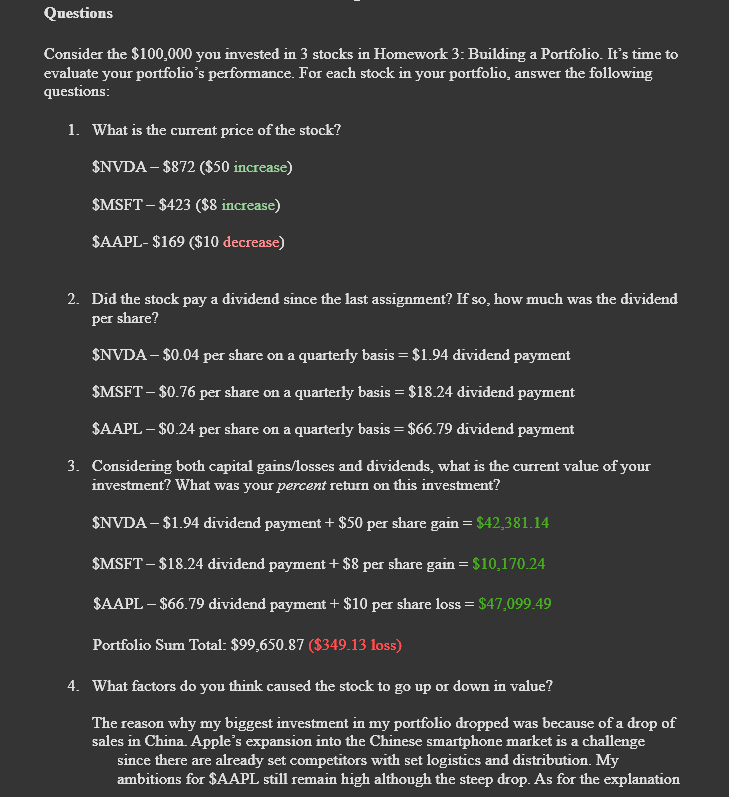

5. Using one-year of daily returns calculate the volatility and beta of the stock. What does this information tell you about the stock's risk profile? (Note: Please submit your calculations. I want to see how you calculated your results, not just the final answer.) 6. If you knew the stock's volatility and beta prior to the previous assignment, would you still have invested in this stock? Why or why not? Questions Consider the $100,000 you invested in 3 stocks in Homework 3: Building a Portfolio. It's time to evaluate your portfolio's performance. For each stock in your portfolio, answer the following questions: 1. What is the current price of the stock? $NVDA $872 ($50 increase) $MSFT - $423 ($8 increase) $AAPL- $169 ($10 decrease) 2. Did the stock pay a dividend since the last assignment? If so, how much was the dividend per share? $NVDA - $0.04 per share on a quarterly basis = $1.94 dividend payment $MSFT - $0.76 per share on a quarterly basis = $18.24 dividend payment $AAPL - $0.24 per share on a quarterly basis = $66.79 dividend payment 3. Considering both capital gains/losses and dividends, what is the current value of your investment? What was your percent return on this investment? $NVDA- $1.94 dividend payment + $50 per share gain = $42,381.14 $MSFT - $18.24 dividend payment + $8 per share gain = $10,170.24 $AAPL - $66.79 dividend payment + $10 per share loss = $47,099.49 Portfolio Sum Total: $99,650.87 ($349.13 loss) 4. What factors do you think caused the stock to go up or down in value? The reason why my biggest investment in my portfolio dropped was because of a drop of sales in China. Apple's expansion into the Chinese smartphone market is a challenge since there are already set competitors with set logistics and distribution. My ambitions for $AAPL still remain high although the steep drop. As for the explanation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started