Question

5. What additional financial information would be useful in the analysis? 6. Select five financial and five operating KPIs to be presented at future board

5. What additional financial information would be useful in the analysis?

6. Select five financial and five operating KPIs to be presented at future board meetings.

7. Sound financial analysis involves more than just calculating numbers. The American Association of Individual Investors suggests that investors consider qualitative factors (as seen in the following questions) when evaluating a company. Answer the following questions for the hospital. When there is insufficient information in the case to answer a question, briefly speculate about why the question might be relevant to the hospital. Are the companys revenues tied to one key customer? To what extent are the companys revenues tied to one key product? To what extent does the company rely on a single supplier? (Hint: Physicians and nurses are key suppliers of labor to a hospital.) What about the competition? What are the companys future prospects? How does the legal and regulatory environment affect the company?

8. Guided by the limited information provided in the case, what are your top three or four recommendations to the board?

9. In your opinion, what are three key learning points from this case?

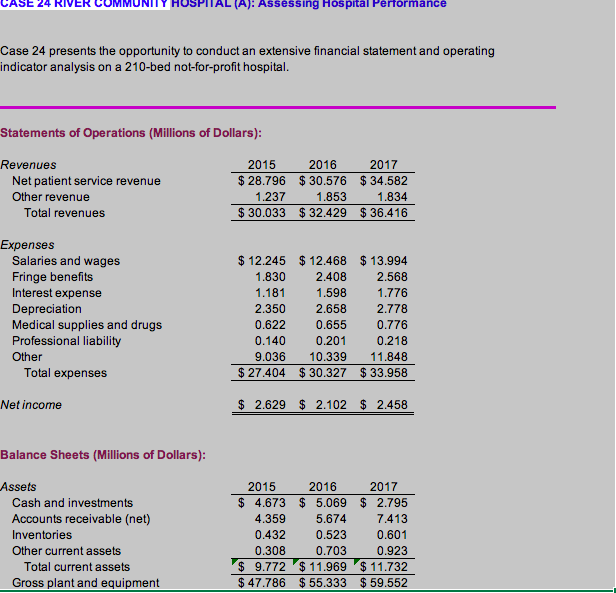

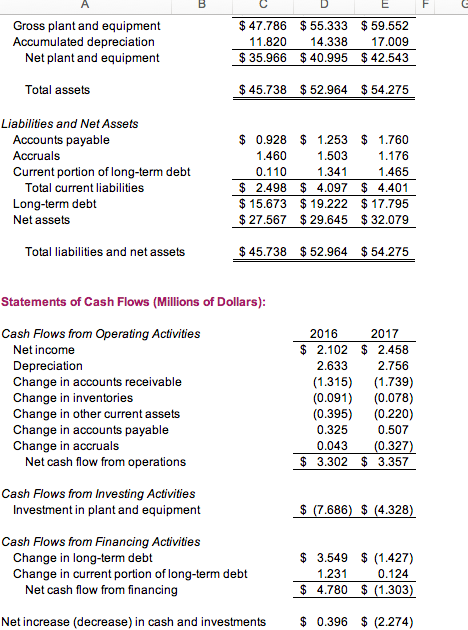

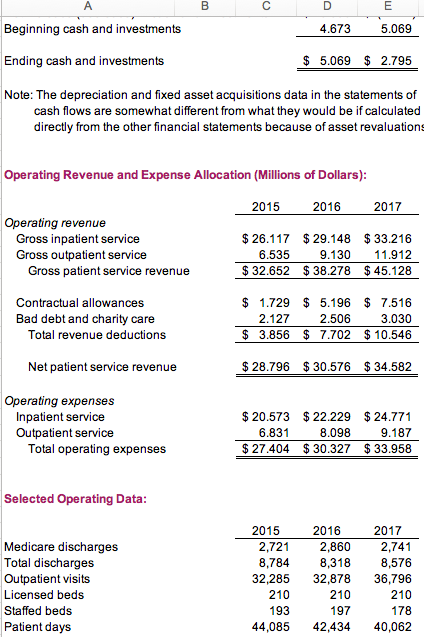

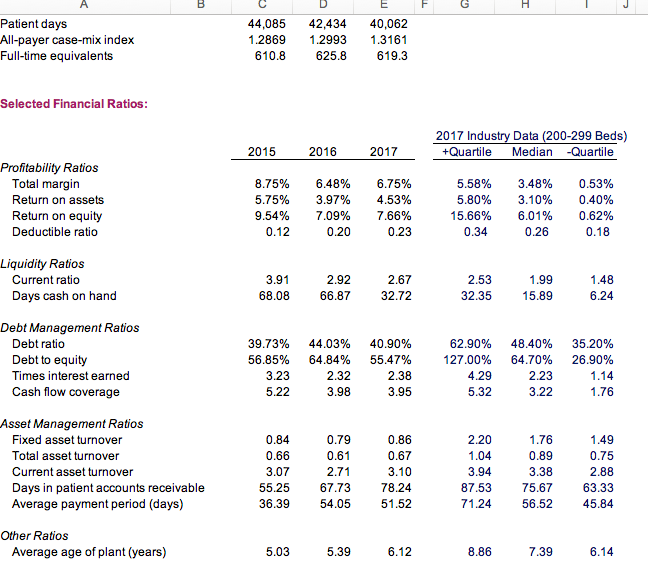

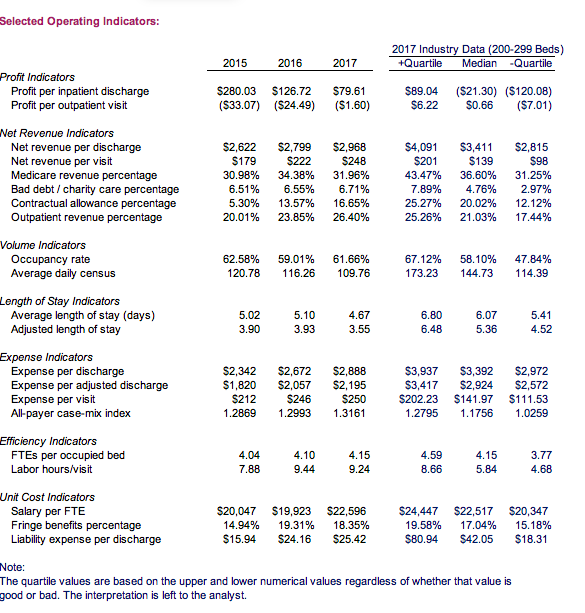

CASE 24 RIVER (A): Assessing Hospital Performance Case 24 presents the opportunity to conduct an extensive financial statement and operating indicator analysis on a 210-bed not-for-profit hospital. Statements of Operations (Millions of Dollars): Revenues Net patient service revenue Other revenue Total revenues 2015 2016 2017 $28.796 $ 30.576 $ 34.582 1.237 1.853 1.834 $ 30.033 $ 32.429 $ 36.416 Expenses Salaries and wages Fringe benefits Interest expense Depreciation Medical supplies and drugs Professional liability Other Total expenses $ 12.245 $ 12.468 $ 13.994 1.830 2.408 2.568 1.181 1.598 1.776 2.350 2.658 2.778 0.622 0.655 0.776 0.140 0.201 0.218 9.036 10.339 11.848 $ 27.404 $30.327 $33.958 Net income $ 2.629 $ 2.102 $ 2.458 Balance Sheets (Millions of Dollars): Assets Cash and investments Accounts receivable (net) Inventories Other current assets Total current assets Gross plant and equipment 2015 2016 2017 $ 4.673 $ 5.069 $ 2.795 4.359 5.674 7.413 0.432 0.523 0.601 0.308 0.703 0.923 $ 9.772 $ 11.969 $ 11.732 $ 47.786 $55.333 $59.552 E Gross plant and equipment Accumulated depreciation Net plant and equipment $ 47.786 $ 55.333 $59.552 11.820 14.338 17.009 $35.966 $40.995 $ 42.543 Total assets $ 45.738 $ 52.964 $ 54.275 Liabilities and Net Assets Accounts payable Accruals Current portion of long-term debt Total current liabilities Long-term debt Net assets 0.928 $ 1.253 $ 1.760 1.460 1.503 1.176 0.110 1.341 1.465 $ 2.498 $ 4.097 $ 4.401 $ 15.673 $ 19.222 $ 17.795 $ 27.567 $29.645 $ 32.079 Total liabilities and net assets $ 45.738 $ 52.964 $ 54.275 Statements of Cash Flows (Millions of Dollars): Cash Flows from Operating Activities Net income Depreciation Change in accounts receivable Change in inventories Change in other current assets Change in accounts payable Change in accruals Net cash flow from operations 2016 2017 $ 2.102 $ 2.458 2.633 2.756 (1.315) (1.739) (0.091) (0.078) (0.395) (0.220) 0.325 0.507 0.043 (0.327) $ 3.302 $ 3.357 Cash Flows from Investing Activities Investment in plant and equipment $ (7.686) $ (4.328) Cash Flows from Financing Activities Change in long-term debt Change in current portion of long-term debt Net cash flow from financing $ 3.549 $ (1.427) 1.231 0.124 $ 4.780 $ (1.303) Net increase (decrease) in cash and investments $ 0.396 $ (2.274) A B D E Beginning cash and investments 4.673 5.069 Ending cash and investments $ 5.069 $ 2.795 Note: The depreciation and fixed asset acquisitions data in the statements of cash flows are somewhat different from what they would be if calculated directly from the other financial statements because of asset revaluations Operating Revenue and Expense Allocation (Millions of Dollars): 2015 2016 2017 Operating revenue Gross inpatient service Gross outpatient service Gross patient service revenue $26.117 $29.148 $33.216 6.535 9.130 11.912 $ 32,652 $38.278 $ 45.128 Contractual allowances Bad debt and charity care Total revenue deductions $ 1.729 $ 5.196 $ 7.516 2.127 2.506 3.030 $ 3.856 $ 7.702 $ 10.546 Net patient service revenue $28.796 $30.576 $ 34.582 Operating expenses Inpatient service Outpatient service Total operating expenses $ 20.573 $ 22.229 $24.771 6.831 8.098 9.187 $ 27.404 $ 30.327 $33.958 Selected Operating Data: Medicare discharges Total discharges Outpatient visits Licensed beds Staffed beds Patient days 2015 2,721 8,784 32,285 210 193 44,085 2016 2,860 8,318 32,878 210 197 42,434 2017 2,741 8,576 36,796 210 178 40,062 E Patient days All-payer case-mix index Full-time equivalents 44,085 1.2869 610.8 42,434 1.2993 625.8 40,062 1.3161 619.3 Selected Financial Ratios: 2017 Industry Data (200-299 Beds) +Quartile Median -Quartile 2015 2016 2017 Profitability Ratios Total margin Return on assets Return on equity Deductible ratio 8.75% 5.75% 9.54% 0.1 6.48% 3.97% 7.09% 0.20 6.75% 4.53% 7.66% 0.23 5.58% 5.80% 15.66% 0.34 3.48% 3.10% 6.01% 0.53% 0.40% 0.62% 0.18 Liquidity Ratios Current ratio Days cash on hand 3.91 68.08 2.92 66.87 2.67 32.72 2.53 32.35 1.99 15.89 1.48 6.24 Debt Management Ratios Debt ratio Debt to equity Times interest earned Cash flow coverage 39.73% 56.85% 3.23 5.22 44.03% 64.84% 2.32 3.98 40.90% 55.47% 2.38 3.95 62.90% 127.00% 4.29 5.32 48.40% 64.70% 2.23 3.22 35.20% 26.90% 1.14 1.76 Asset Management Ratios Fixed asset turnover Total asset turnover Current asset turnover Days in patient accounts receivable Average payment period (days) 0.84 0.66 3.07 55.25 36.39 0.79 0.61 2.71 67.73 54.05 0.86 0.67 3.10 78.24 51.52 2.20 1.04 3.94 87.53 1.76 0.89 3.38 75.67 56.52 1.49 0.75 2.88 63.33 45.84 71.24 Other Ratios Average age of plant (years) 5.03 5.39 6.12 8.86 7.39 6.14 Selected Operating Indicators: 2017 Industry Data (200-299 Beds) +Quartile Median -Quartile 2015 2016 2017 $280.03 $126.72 ($33.07) ($24.49) $79.61 ($1.60) $89.04 $6.22 ($21.30) ($120.08) $0.66 ($7.01) Profit Indicators Profit per inpatient discharge Profit per outpatient visit Net Revenue Indicators Net revenue per discharge Net revenue per visit Medicare revenue percentage Bad debt / charity care percentage Contractual allowance percentage Outpatient revenue percentage $2,622 $179 30.98% 6.51% 5.30% 20.01% $2,799 $222 34.38% 6.55% 13.57% 23.85% $2,968 $248 31.96% 6.71% 16.65% 26.40% $4,091 $201 43.47% 7.89% 25.27% 25.26% $3,411 $139 36.60% 4.76% 20.02% 21.03% $2,815 $98 31.25% 2.97% 12.12% 17.44% Volume Indicators Occupancy rate Average daily census 62.58% 120.78 59.01% 116.26 61.66% 109.76 67.12% 173.23 58.10% 144.73 47.84% 114.39 5.02 3.90 5.10 3.93 4.67 3.55 6.80 6.48 6.07 5.36 5.41 4.52 Length of Stay Indicators Average length of stay (days) Adjusted length of stay Expense Indicators Expense per discharge Expense per adjusted discharge Expense per visit All-payer case-mix index $2,342 $1,820 $212 1.2869 $2,672 $2,057 $246 1.2993 $2,888 $2,195 $250 1.3161 $3,937 $3,417 $202.23 1.2795 $3,392 $2,924 $141.97 1.1756 $2,972 $2,572 $111.53 1.0259 Efficiency Indicators FTES per occupied bed Labor hours/visit 4.04 7.88 4.10 9.44 4.15 9.24 4.59 8.66 4.15 5.84 3.77 4.68 Unit Cost Indicators Salary per FTE Fringe benefits percentage Liability expense per discharge $20,047 14.94% $15.94 $19,923 19.31% $24.16 $22,596 18.35% $25.42 $24,447 19.58% $80.94 $22,517 17.04% $42.05 $20,347 15.18% $18.31 Note: The quartile values are based on the upper and lower numerical values regardless of whether that value is good or bad. The interpretation is left to the analyst. CASE 24 RIVER (A): Assessing Hospital Performance Case 24 presents the opportunity to conduct an extensive financial statement and operating indicator analysis on a 210-bed not-for-profit hospital. Statements of Operations (Millions of Dollars): Revenues Net patient service revenue Other revenue Total revenues 2015 2016 2017 $28.796 $ 30.576 $ 34.582 1.237 1.853 1.834 $ 30.033 $ 32.429 $ 36.416 Expenses Salaries and wages Fringe benefits Interest expense Depreciation Medical supplies and drugs Professional liability Other Total expenses $ 12.245 $ 12.468 $ 13.994 1.830 2.408 2.568 1.181 1.598 1.776 2.350 2.658 2.778 0.622 0.655 0.776 0.140 0.201 0.218 9.036 10.339 11.848 $ 27.404 $30.327 $33.958 Net income $ 2.629 $ 2.102 $ 2.458 Balance Sheets (Millions of Dollars): Assets Cash and investments Accounts receivable (net) Inventories Other current assets Total current assets Gross plant and equipment 2015 2016 2017 $ 4.673 $ 5.069 $ 2.795 4.359 5.674 7.413 0.432 0.523 0.601 0.308 0.703 0.923 $ 9.772 $ 11.969 $ 11.732 $ 47.786 $55.333 $59.552 E Gross plant and equipment Accumulated depreciation Net plant and equipment $ 47.786 $ 55.333 $59.552 11.820 14.338 17.009 $35.966 $40.995 $ 42.543 Total assets $ 45.738 $ 52.964 $ 54.275 Liabilities and Net Assets Accounts payable Accruals Current portion of long-term debt Total current liabilities Long-term debt Net assets 0.928 $ 1.253 $ 1.760 1.460 1.503 1.176 0.110 1.341 1.465 $ 2.498 $ 4.097 $ 4.401 $ 15.673 $ 19.222 $ 17.795 $ 27.567 $29.645 $ 32.079 Total liabilities and net assets $ 45.738 $ 52.964 $ 54.275 Statements of Cash Flows (Millions of Dollars): Cash Flows from Operating Activities Net income Depreciation Change in accounts receivable Change in inventories Change in other current assets Change in accounts payable Change in accruals Net cash flow from operations 2016 2017 $ 2.102 $ 2.458 2.633 2.756 (1.315) (1.739) (0.091) (0.078) (0.395) (0.220) 0.325 0.507 0.043 (0.327) $ 3.302 $ 3.357 Cash Flows from Investing Activities Investment in plant and equipment $ (7.686) $ (4.328) Cash Flows from Financing Activities Change in long-term debt Change in current portion of long-term debt Net cash flow from financing $ 3.549 $ (1.427) 1.231 0.124 $ 4.780 $ (1.303) Net increase (decrease) in cash and investments $ 0.396 $ (2.274) A B D E Beginning cash and investments 4.673 5.069 Ending cash and investments $ 5.069 $ 2.795 Note: The depreciation and fixed asset acquisitions data in the statements of cash flows are somewhat different from what they would be if calculated directly from the other financial statements because of asset revaluations Operating Revenue and Expense Allocation (Millions of Dollars): 2015 2016 2017 Operating revenue Gross inpatient service Gross outpatient service Gross patient service revenue $26.117 $29.148 $33.216 6.535 9.130 11.912 $ 32,652 $38.278 $ 45.128 Contractual allowances Bad debt and charity care Total revenue deductions $ 1.729 $ 5.196 $ 7.516 2.127 2.506 3.030 $ 3.856 $ 7.702 $ 10.546 Net patient service revenue $28.796 $30.576 $ 34.582 Operating expenses Inpatient service Outpatient service Total operating expenses $ 20.573 $ 22.229 $24.771 6.831 8.098 9.187 $ 27.404 $ 30.327 $33.958 Selected Operating Data: Medicare discharges Total discharges Outpatient visits Licensed beds Staffed beds Patient days 2015 2,721 8,784 32,285 210 193 44,085 2016 2,860 8,318 32,878 210 197 42,434 2017 2,741 8,576 36,796 210 178 40,062 E Patient days All-payer case-mix index Full-time equivalents 44,085 1.2869 610.8 42,434 1.2993 625.8 40,062 1.3161 619.3 Selected Financial Ratios: 2017 Industry Data (200-299 Beds) +Quartile Median -Quartile 2015 2016 2017 Profitability Ratios Total margin Return on assets Return on equity Deductible ratio 8.75% 5.75% 9.54% 0.1 6.48% 3.97% 7.09% 0.20 6.75% 4.53% 7.66% 0.23 5.58% 5.80% 15.66% 0.34 3.48% 3.10% 6.01% 0.53% 0.40% 0.62% 0.18 Liquidity Ratios Current ratio Days cash on hand 3.91 68.08 2.92 66.87 2.67 32.72 2.53 32.35 1.99 15.89 1.48 6.24 Debt Management Ratios Debt ratio Debt to equity Times interest earned Cash flow coverage 39.73% 56.85% 3.23 5.22 44.03% 64.84% 2.32 3.98 40.90% 55.47% 2.38 3.95 62.90% 127.00% 4.29 5.32 48.40% 64.70% 2.23 3.22 35.20% 26.90% 1.14 1.76 Asset Management Ratios Fixed asset turnover Total asset turnover Current asset turnover Days in patient accounts receivable Average payment period (days) 0.84 0.66 3.07 55.25 36.39 0.79 0.61 2.71 67.73 54.05 0.86 0.67 3.10 78.24 51.52 2.20 1.04 3.94 87.53 1.76 0.89 3.38 75.67 56.52 1.49 0.75 2.88 63.33 45.84 71.24 Other Ratios Average age of plant (years) 5.03 5.39 6.12 8.86 7.39 6.14 Selected Operating Indicators: 2017 Industry Data (200-299 Beds) +Quartile Median -Quartile 2015 2016 2017 $280.03 $126.72 ($33.07) ($24.49) $79.61 ($1.60) $89.04 $6.22 ($21.30) ($120.08) $0.66 ($7.01) Profit Indicators Profit per inpatient discharge Profit per outpatient visit Net Revenue Indicators Net revenue per discharge Net revenue per visit Medicare revenue percentage Bad debt / charity care percentage Contractual allowance percentage Outpatient revenue percentage $2,622 $179 30.98% 6.51% 5.30% 20.01% $2,799 $222 34.38% 6.55% 13.57% 23.85% $2,968 $248 31.96% 6.71% 16.65% 26.40% $4,091 $201 43.47% 7.89% 25.27% 25.26% $3,411 $139 36.60% 4.76% 20.02% 21.03% $2,815 $98 31.25% 2.97% 12.12% 17.44% Volume Indicators Occupancy rate Average daily census 62.58% 120.78 59.01% 116.26 61.66% 109.76 67.12% 173.23 58.10% 144.73 47.84% 114.39 5.02 3.90 5.10 3.93 4.67 3.55 6.80 6.48 6.07 5.36 5.41 4.52 Length of Stay Indicators Average length of stay (days) Adjusted length of stay Expense Indicators Expense per discharge Expense per adjusted discharge Expense per visit All-payer case-mix index $2,342 $1,820 $212 1.2869 $2,672 $2,057 $246 1.2993 $2,888 $2,195 $250 1.3161 $3,937 $3,417 $202.23 1.2795 $3,392 $2,924 $141.97 1.1756 $2,972 $2,572 $111.53 1.0259 Efficiency Indicators FTES per occupied bed Labor hours/visit 4.04 7.88 4.10 9.44 4.15 9.24 4.59 8.66 4.15 5.84 3.77 4.68 Unit Cost Indicators Salary per FTE Fringe benefits percentage Liability expense per discharge $20,047 14.94% $15.94 $19,923 19.31% $24.16 $22,596 18.35% $25.42 $24,447 19.58% $80.94 $22,517 17.04% $42.05 $20,347 15.18% $18.31 Note: The quartile values are based on the upper and lower numerical values regardless of whether that value is good or bad. The interpretation is left to the analystStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started