Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) Whats the dollar effect of Company Cs dividends for Carlson Corporation? 6) What account should Carlson credit as a result of Company Cs dividends?

5) What’s the dollar effect of Company C’s dividends for Carlson Corporation?

6) What account should Carlson credit as a result of Company C’s dividends?

a. Cash

b. Dividend revenue

c. Investments

d. No credit

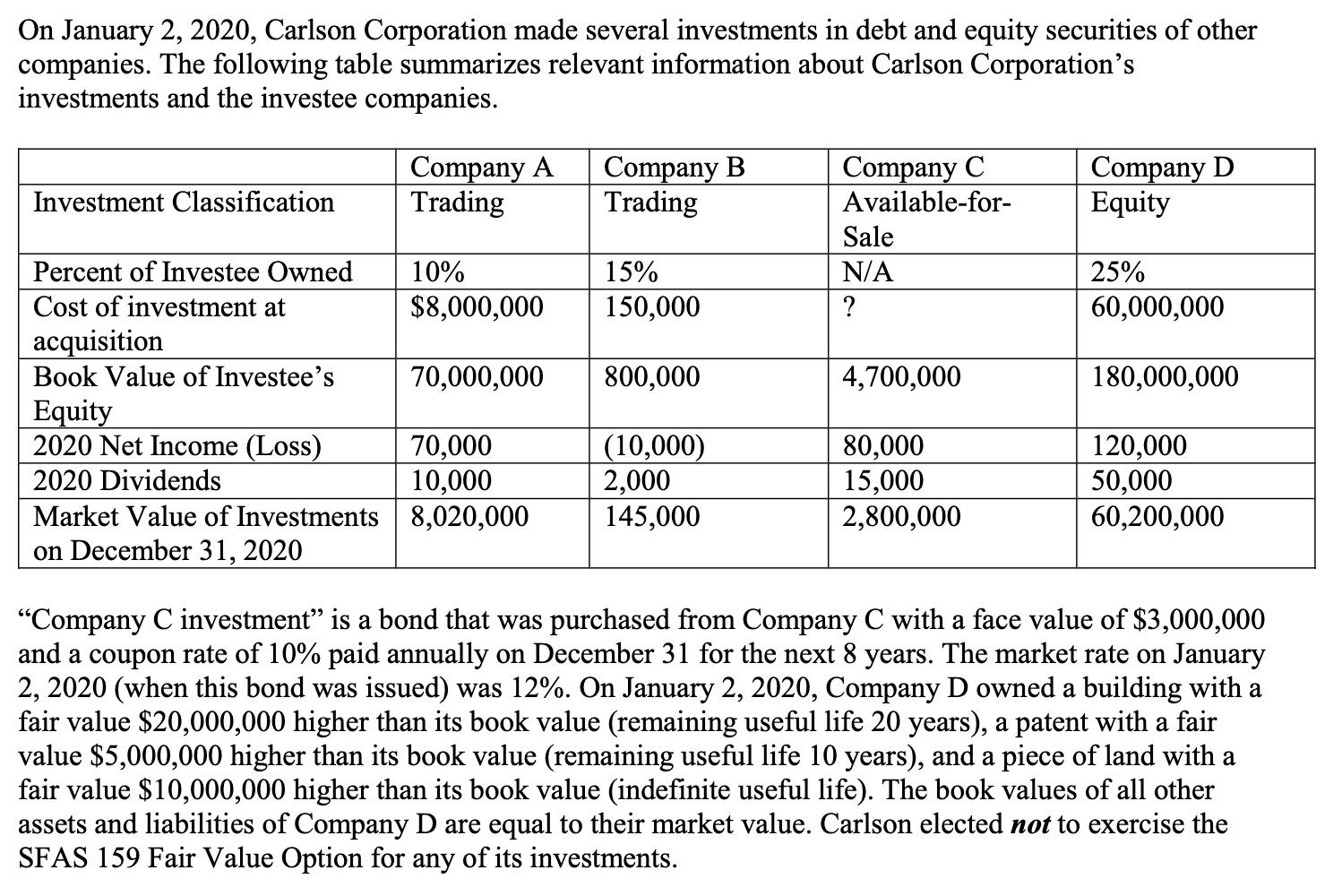

On January 2, 2020, Carlson Corporation made several investments in debt and equity securities of other companies. The following table summarizes relevant information about Carlson Corporation's investments and the investee companies. Investment Classification Percent of Investee Owned Cost of investment at acquisition Book Value of Investee's Equity 2020 Net Income (Loss) 2020 Dividends Market Value of Investments on December 31, 2020 Company A Company B Trading Trading 10% $8,000,000 70,000,000 70,000 10,000 8,020,000 15% 150,000 800,000 (10,000) 2,000 145,000 Company C Available-for- Sale N/A ? 4,700,000 80,000 15,000 2,800,000 Company D Equity 25% 60,000,000 180,000,000 120,000 50,000 60,200,000 "Company C investment" is a bond that was purchased from Company C with a face value of $3,000,000 and a coupon rate of 10% paid annually on December 31 for the next 8 years. The market rate on January 2, 2020 (when this bond was issued) was 12%. On January 2, 2020, Company D owned a building with a fair value $20,000,000 higher than its book value (remaining useful life 20 years), a patent with a fair value $5,000,000 higher than its book value (remaining useful life 10 years), and a piece of land with a fair value $10,000,000 higher than its book value (indefinite useful life). The book values of all other assets and liabilities of Company D are equal to their market value. Carlson elected not to exercise the SFAS 159 Fair Value Option for any of its investments.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 5 The stocks dividend yield stood at 183 as of the close of May 28 Along with this the compan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started