Answered step by step

Verified Expert Solution

Question

1 Approved Answer

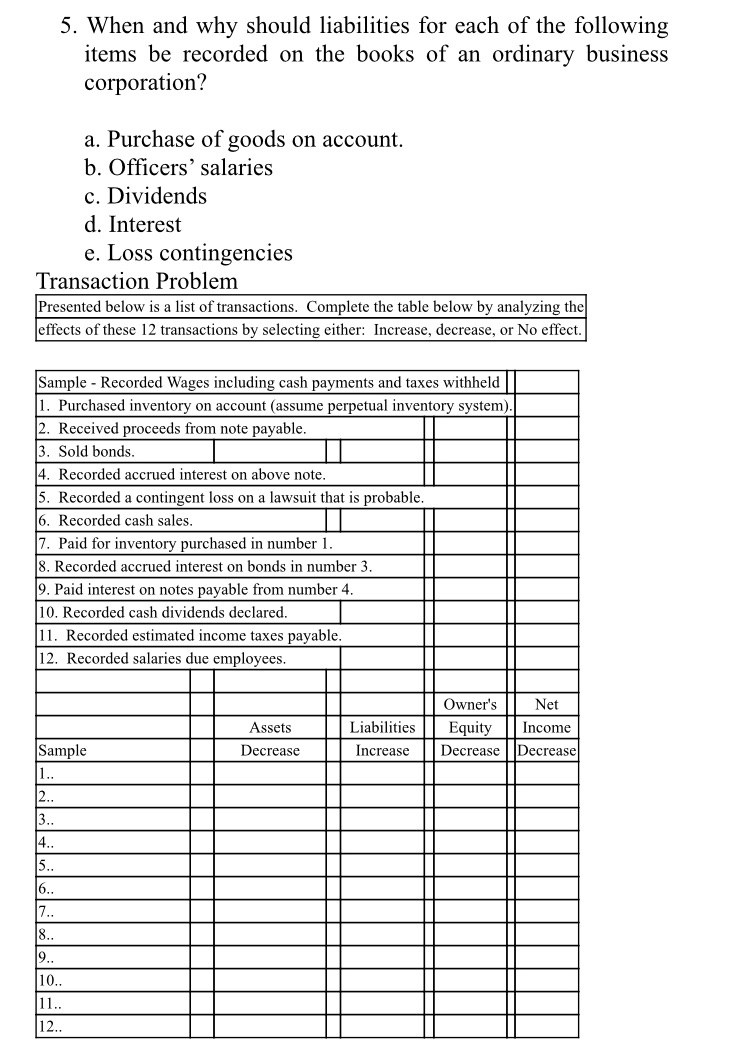

5. When and why should liabilities for each of the following items be recorded on the books of an ordinary business corporation? a. Purchase

5. When and why should liabilities for each of the following items be recorded on the books of an ordinary business corporation? a. Purchase of goods on account. b. Officers' salaries c. Dividends d. Interest e. Loss contingencies Transaction Problem Presented below is a list of transactions. Complete the table below by analyzing the effects of these 12 transactions by selecting either: Increase, decrease, or No effect. Sample - Recorded Wages including cash payments and taxes withheld 1. Purchased inventory on account (assume perpetual inventory system). 2. Received proceeds from note payable. 3. Sold bonds. 4. Recorded accrued interest on above note. 5. Recorded a contingent loss on a lawsuit that is probable. 6. Recorded cash sales. 7. Paid for inventory purchased in number 1. 8. Recorded accrued interest on bonds in number 3. 9. Paid interest on notes payable from number 4. 10. Recorded cash dividends declared. 11. Recorded estimated income taxes payable. 12. Recorded salaries due employees. Sample 1.. 2.. 3.. 4.. 5.. 6.. 7.. 8.. 9.. 10.. 11.. 12.. Owner's Net Assets Decrease Liabilities Increase Equity Income Decrease Decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started