Question

5. Which of the following is true? | Bond Concepts A: A zero-coupon bond is worth $0 because ithe coupon rate is 0%. B: A

5. Which of the following is true? | Bond Concepts

A: A zero-coupon bond is worth $0 because ithe coupon rate is 0%.

B: A zero-coupon bond must always sell for less than par value.

C: Use the perpetuity formula to find the value of a zero-coupon bond.

D: A zero coupon bond will always have a higher yield than a coupon-paying bond.

6. A bond matures on todays date in 2025. It has a coupon rate of 9%. The bond pays coupons annually and its yield to maturity is 11%.Is this a par, premium or discount bond? | Bond Concepts

A: Par

B: Premium

C: Discount

7. A 30-year bond was issued 5 years ago. The bond pays interest semi-annually and yields are currently 10%. The price of the bond is $1050. What is the bonds coupon payment? | Coupon Payment

8. A bond has a 6% coupon and pays interest semi-annually. It matures in 10 years. Yields are currently 7%. What is the price of the bond? | Bond Value

9. A bond pays a $45 coupon twice a year. The bond has 8 years to maturity and a yield of 9%. What is the price of the bond? (Enter only numbers and decimals in your response.) | Bond Value

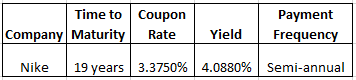

10. Calculate the value of the bond in the table. Enter only numbers in your response. Round to 2 decimal places. | Bond Value

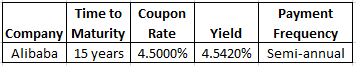

11. What is the value of the bond in the table below. Enter only numbers and decimals in your response. Round to 2 decimal places. | Bond Value

12. A bond that pays a semi-annual coupon of $40 sells at par. What is the yield to maturity? (Answer as a percent. For example, if your answer is 10%, enter 10 in your response. Enter only numbers in decimals in your response.) | Bond Yield

13. Which of the following bonds will sell at a discount? | Discount and Premium Bond

A: A bond that pays an annual coupon of $100 when yields are 10%.

B: A bond that makes $50 semi-annual payments and has a yield to maturity of 11%.

C: A bond that makes $50 annual coupon payments and has a yield of 4%.

14. Based on what you learned about how the relationship between coupon rate and yield to maturity determine the relationship between price and par, rank the following bonds from lowest to highest value: | Bond Value

A: An 8% coupon bond with a yield of 9%

B: A bond with a coupon rate of 3% when yields are 2%

C: A bond that pays a coupon of $60 and has a yield to maturity at 6%

Time to Coupon Company Maturity Rate Payment Yield Frequency Nike | 19 years | 3.3750% | 4.0880% | Semi-annual Time to Coupon Payment Company Maturity RateYield requency Alibaba | 15 years | 4.5000% | 4.5420% | Semi-annualStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started