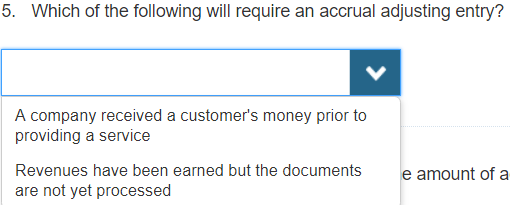

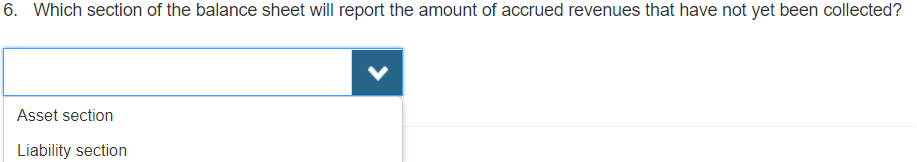

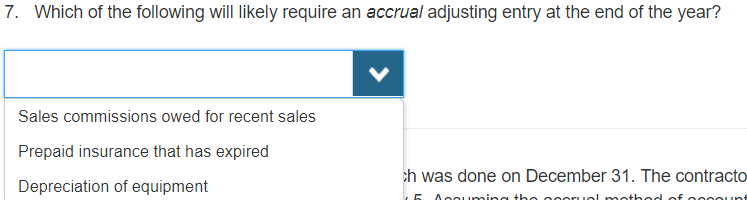

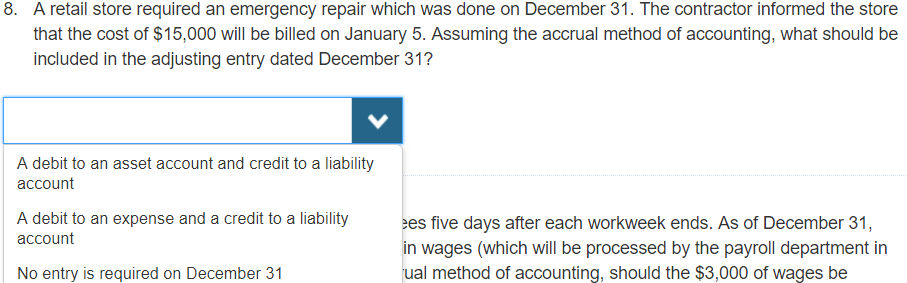

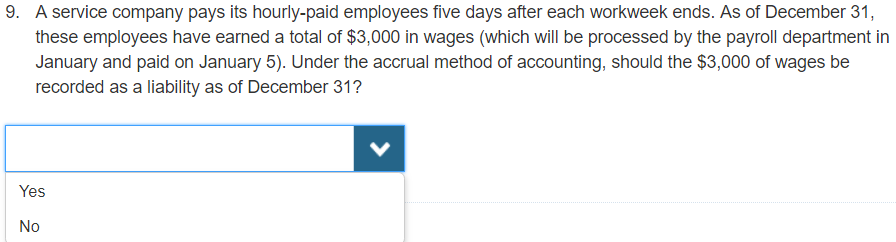

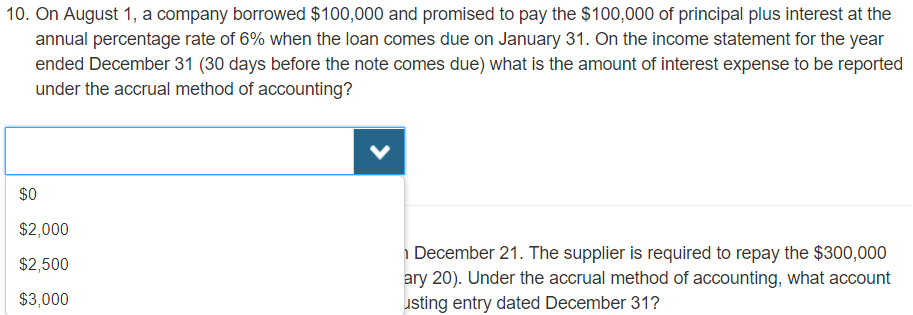

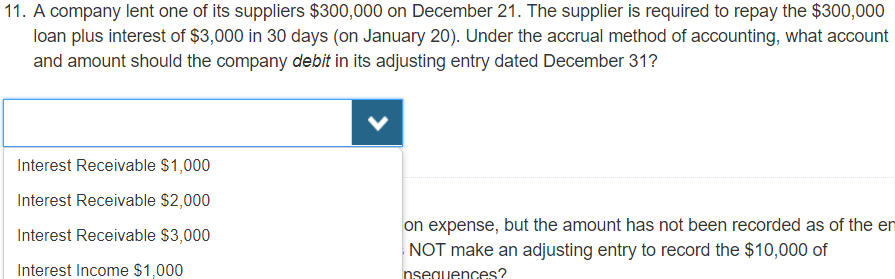

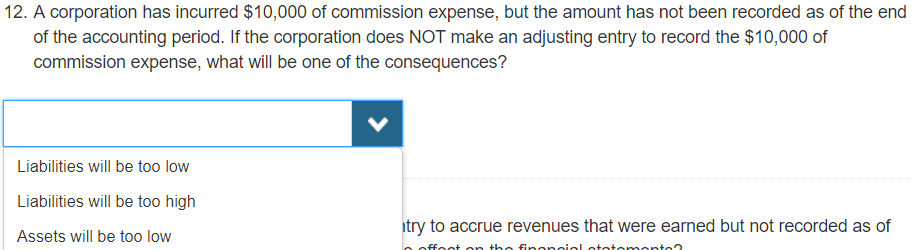

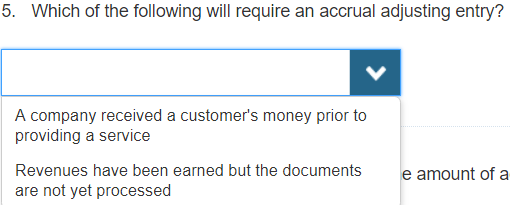

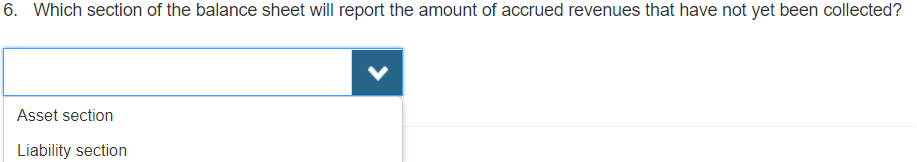

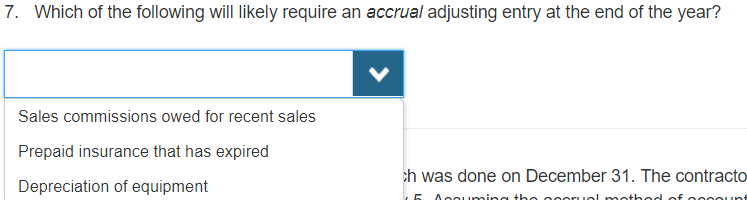

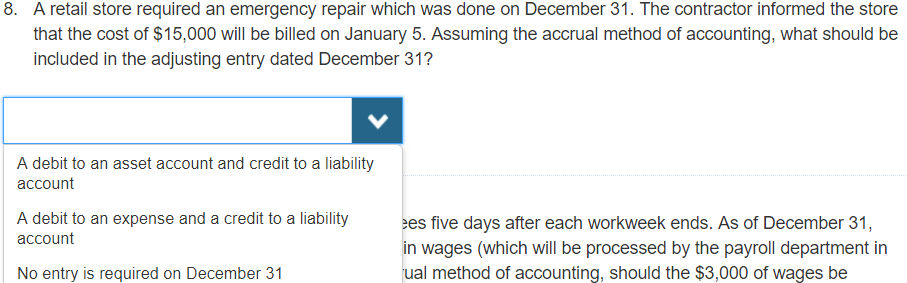

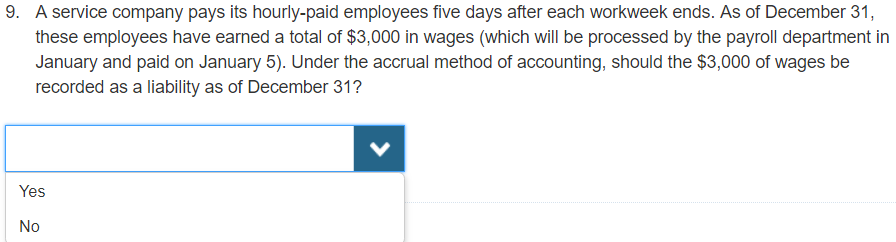

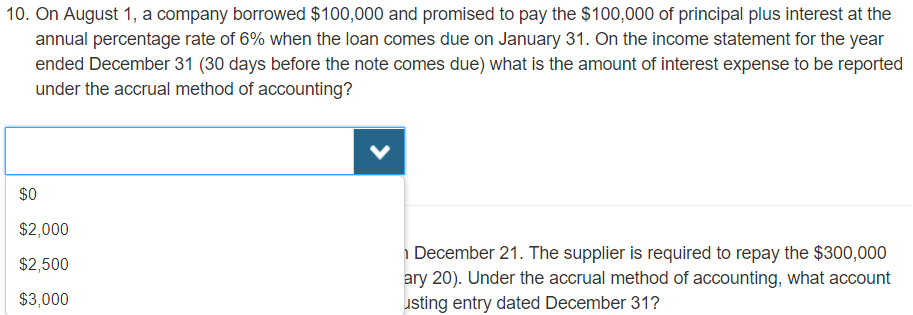

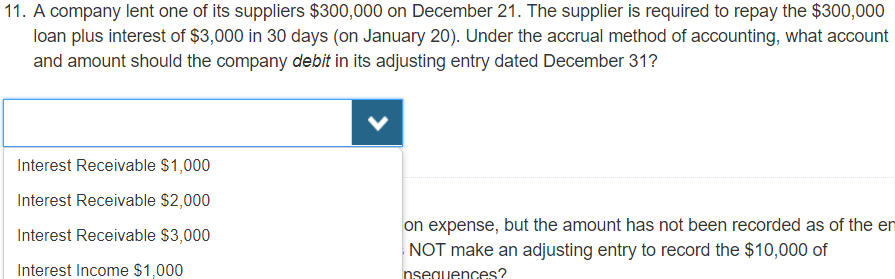

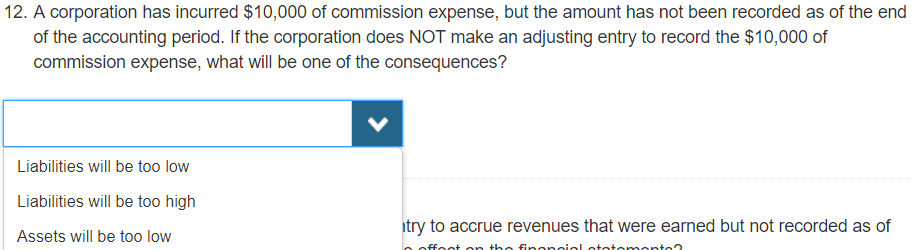

5. Which of the following will require an accrual adjusting entry? A company received a customer's money prior to providing a service Revenues have been earned but the documents e amount of a 6. Which section of the balance sheet will report the amount of accrued revenues that have not yet been collected? Asset section Liability section 7. Which of the following will likely require an accrual adjusting entry at the end of the year? Sales commissions owed for recent sales Prepaid insurance that has expired Depreciation of equipment h was done on December 31. The contracto 8. A retail store required an emergency repair which was done on December 31. The contractor informed the store that the cost of $15,000 will be billed on January 5. Assuming the accrual method of accounting, what should be included in the adjusting entry dated December 31? A debit to an asset account and credit to a liability account A debit to an expense and a credit to a liability account five days after each workweek ends. As of December 31, in wages (which will be processed by the payroll department in ual method of accounting, should the $3,000 of wages be No entry is required on December 31 9. A service company pays its hourly-paid employees five days after each workweek ends. As of December 31, these employees have earned a total of $3,000 in wages (which will be processed by the payroll department in January and paid on January 5). Under the accrual method of accounting, should the $3,000 of wages be recorded as a liability as of December 31? Yes No 10. On August 1, a company borrowed $100,000 and promised to pay the $100,000 of principal plus interest at the annual percentage rate of 6% when the loan comes due on January 31. On the income statement for the year ended December 31 (30 days before the note comes due) what is the amount of interest expense to be reported under the accrual method of accounting? $0 $2,000 $2,500 $3,000 December 21. The supplier is required to repay the $300,000 ary 20). Under the accrual method of accounting, what account sting entry dated December 31? 11. A company lent one of its suppliers $300,000 on December 21. The supplier is required to repay the $300,000 loan plus interest of $3,000 in 30 days (on January 20). Under the accrual method of accounting, what account and amount should the company debit in its adjusting entry dated December 31? Interest Receivable $1,000 Interest Receivable $2,000 Interest Receivable $3,000 Interest Income $1,000 on expense, but the amount has not been recorded as of the er NOT make an adjusting entry to record the $10,000 of seguences? 12. A corporation has incurred $10,000 of commission expense, but the amount has not been recorded as of the end of the accounting period. If the corporation does NOT make an adjusting entry to record the $10,000 of commission expense, what will be one of the consequences? Liabilities will be too low Liabilities will be too high Assets will be too low try to accrue revenues that were earned but not recorded as of