Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Will Wade buys 10 GBP futures contracts? The size of each contract is 62,500 GBP. The futures price is currently 1.30 USD per

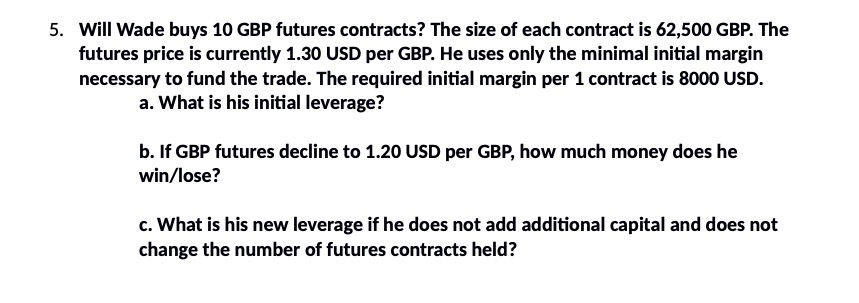

5. Will Wade buys 10 GBP futures contracts? The size of each contract is 62,500 GBP. The futures price is currently 1.30 USD per GBP. He uses only the minimal initial margin necessary to fund the trade. The required initial margin per 1 contract is 8000 USD. a. What is his initial leverage? b. If GBP futures decline to 1.20 USD per GBP, how much money does he win/lose? c. What is his new leverage if he does not add additional capital and does not change the number of futures contracts held?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the initial leverage the profitloss and the new leverage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664228e91f80b_985197.pdf

180 KBs PDF File

664228e91f80b_985197.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started