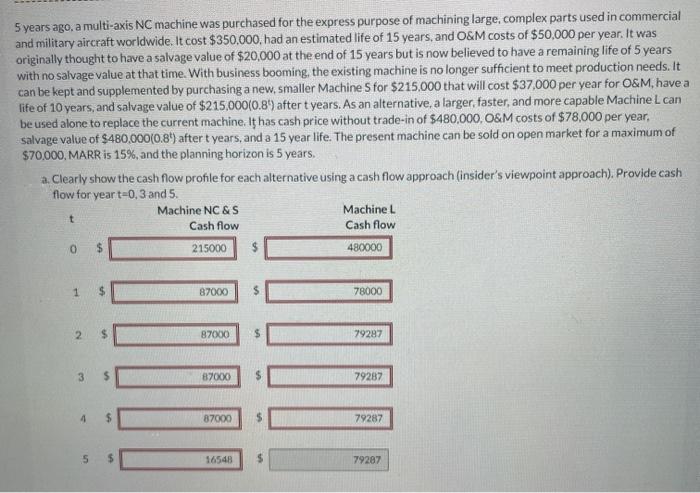

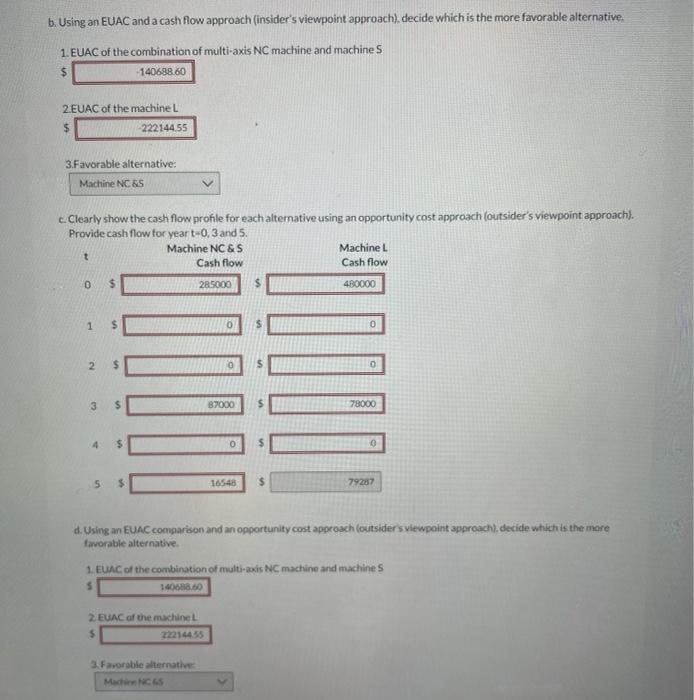

5 years ago, a multi-axis NC machine was purchased for the express purpose of machining large complex parts used in commercial and military aircraft worldwide. It cost $350,000, had an estimated life of 15 years, and O&M costs of $50,000 per year. It was originally thought to have a salvage value of $20,000 at the end of 15 years but is now believed to have a remaining life of 5 years with no salvage value at that time. With business booming, the existing machine is no longer sufficient to meet production needs. It can be kept and supplemented by purchasing a new, smaller Machine S for $215,000 that will cost $37,000 per year for O&M, have a life of 10 years, and salvage value of $215,000(0.8") after t years. As an alternative, a larger, faster, and more capable Machine L can be used alone to replace the current machine. It has cash price without trade-in of $480,000. O&M costs of $78,000 per year, salvage value of $480,000(0.8") after t years, and a 15 year life. The present machine can be sold on open market for a maximum of $70,000, MARR is 15%, and the planning horizon is 5 years. a. Clearly show the cash flow profile for each alternative using a cash flow approach (insider's viewpoint approach). Provide cash flow for yeart=0.3 and 5. Machine NC &S Cash flow Machine L t Cash flow 0 $ 215000 480000 87000 78000 2 87000 79287 3 A 87000 79287 4 87000 5 79287 5 16548 $ 79287 b. Using an EUAC and a cash flow approach (insider's viewpoint approach), decide which is the more favorable alternative. 1. EUAC of the combination of multi-axis NC machine and machines $ -140688.60 2.EUAC of the machine L $ 222144 55 3.Favorable alternative: Machine NC &S c.Clearly show the cash flow profile for each alternative using an opportunity cost approach (outsider's viewpoint approach). Provide cash flow for year t-0,3 and 5. Machine NC &S Machine L Cash flow Cash flow t 0 $ 285000 480000 1 $ 0 0 2 $ $ 0 3 $ 87000 $ 78000 0 0 5 $ 16548 $ 79287 d. Using an EUA comparison and an opportunity cost approach outsider's viewpoint approach), decide which is the more favorable alternative 1. EUAC of the combination of multi-axis NC machine and machines 5 2 EUAC of the machine $ 3. Favorable alternative 5 years ago, a multi-axis NC machine was purchased for the express purpose of machining large complex parts used in commercial and military aircraft worldwide. It cost $350,000, had an estimated life of 15 years, and O&M costs of $50,000 per year. It was originally thought to have a salvage value of $20,000 at the end of 15 years but is now believed to have a remaining life of 5 years with no salvage value at that time. With business booming, the existing machine is no longer sufficient to meet production needs. It can be kept and supplemented by purchasing a new, smaller Machine S for $215,000 that will cost $37,000 per year for O&M, have a life of 10 years, and salvage value of $215,000(0.8") after t years. As an alternative, a larger, faster, and more capable Machine L can be used alone to replace the current machine. It has cash price without trade-in of $480,000. O&M costs of $78,000 per year, salvage value of $480,000(0.8") after t years, and a 15 year life. The present machine can be sold on open market for a maximum of $70,000, MARR is 15%, and the planning horizon is 5 years. a. Clearly show the cash flow profile for each alternative using a cash flow approach (insider's viewpoint approach). Provide cash flow for yeart=0.3 and 5. Machine NC &S Cash flow Machine L t Cash flow 0 $ 215000 480000 87000 78000 2 87000 79287 3 A 87000 79287 4 87000 5 79287 5 16548 $ 79287 b. Using an EUAC and a cash flow approach (insider's viewpoint approach), decide which is the more favorable alternative. 1. EUAC of the combination of multi-axis NC machine and machines $ -140688.60 2.EUAC of the machine L $ 222144 55 3.Favorable alternative: Machine NC &S c.Clearly show the cash flow profile for each alternative using an opportunity cost approach (outsider's viewpoint approach). Provide cash flow for year t-0,3 and 5. Machine NC &S Machine L Cash flow Cash flow t 0 $ 285000 480000 1 $ 0 0 2 $ $ 0 3 $ 87000 $ 78000 0 0 5 $ 16548 $ 79287 d. Using an EUA comparison and an opportunity cost approach outsider's viewpoint approach), decide which is the more favorable alternative 1. EUAC of the combination of multi-axis NC machine and machines 5 2 EUAC of the machine $ 3. Favorable alternative