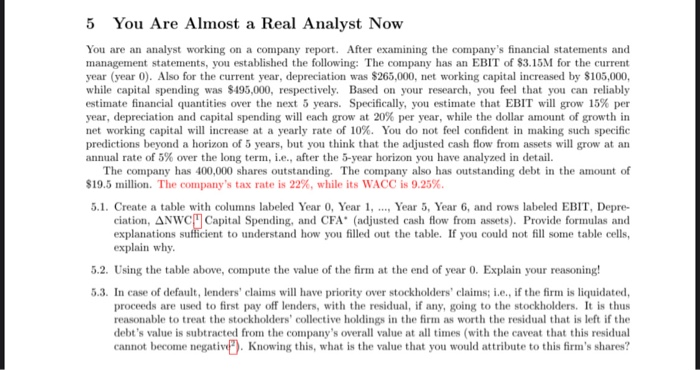

5 You Are Almost a Real Analyst Now You are an analyst working on a company report. After examining the company's financial statements and management statements, you established the following: The company has an EBIT of $3.15M for the current year (year O). Also for the current year, depreciation was $265,000, net working capital increased by $105,000, while capital spending was $495,000, respectively. Based on your research, you feel that you can reliably estimate financial quantities over the next 5 years. Specifically, you estimate that EBIT will grow 15% per year, depreciation and capital spending will each grow at 20% per year, while the dollar amount of growth in net working capital will increase at a yearly rate of 10%. You do not feel confident in making such specific predictions beyond a horizon of 5 years, but you think that the adjusted cash flow from assets will grow at an annual rate of 5% over the long term, i.e., after the 5-year horizon you have analyzed in detail. The company has 400,000 shares outstanding. The company also has outstanding debt in the amount of $19.5 million. The company's tax rate is 22%, while its WACC is 9.25% 5.1. Create a table with columns labeled Year , Year 1, ..., Year 5, Year 6, and rows labeled EBIT, Depre- ciation, ANWCMCapital Spending, and CFA (adjusted cash flow from assets). Provide formulas and explanations sufficient to understand how you filled out the table. If you could not fill some table cells, explain why. 5.2. Using the table above, compute the value of the firm at the end of year 0. Explain your reasoning! 5.3. In case of default, lenders' claims will have priority over stockholders' claims; i.e., if the firm is liquidated, proceeds are used to first pay off lenders, with the residual, if any, going to the stockholders. It is thus reasonable to treat the stockholders' collective holdings in the firm as worth the residual that is left if the debt's value is subtracted from the company's overall value at all times with the caveat that this residual cannot become negative). Knowing this, what is the value that you would attribute to this firm's shares