Answered step by step

Verified Expert Solution

Question

1 Approved Answer

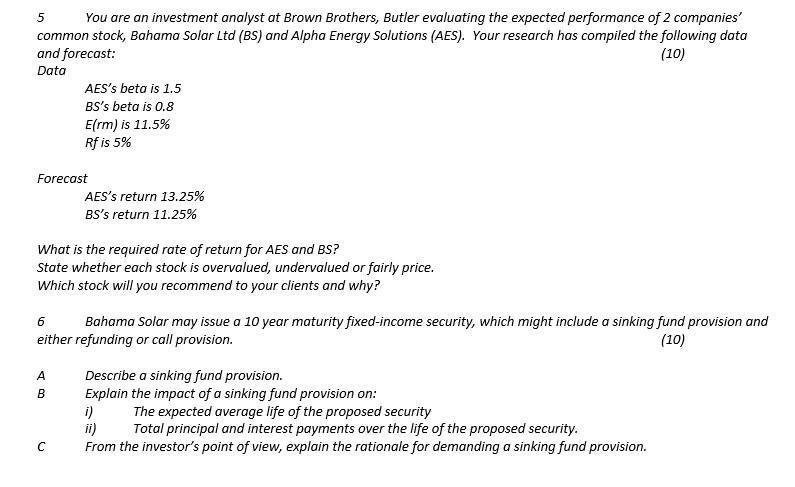

5 You are an investment analyst at Brown Brothers, Butler evaluating the expected performance of 2 companies' common stock, Bahama Solar Ltd ( BS )

You are an investment analyst at Brown Brothers, Butler evaluating the expected performance of companies'

common stock, Bahama Solar Ltd BS and Alpha Energy Solutions AES Your research has compiled the following data

and forecast:

Data

AES's beta is

BSs beta is

is

Rf is

Forecast

AES's return

BSs return

What is the required rate of return for AES and BS

State whether each stock is overvalued, undervalued or fairly price.

Which stock will you recommend to your clients and why?

Bahama Solar may issue a year maturity fixedincome security, which might include a sinking fund provision and

either refunding or call provision.

A Describe a sinking fund provision.

Explain the impact of a sinking fund provision on:

i The expected average life of the proposed security

ii Total principal and interest payments over the life of the proposed security.

From the investor's point of view, explain the rationale for demanding a sinking fund provision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started