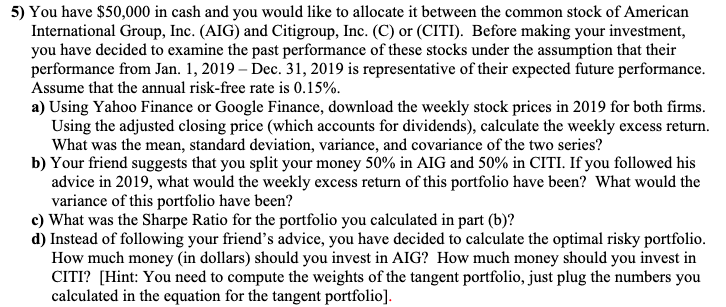

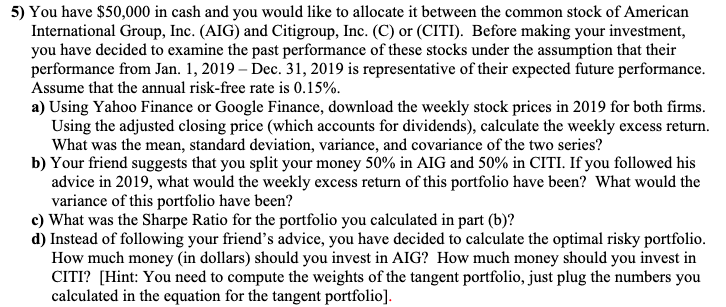

5) You have $50,000 in cash and you would like to allocate it between the common stock of American International Group, Inc. (AIG) and Citigroup, Inc. (C) or (CITI). Before making your investment, you have decided to examine the past performance of these stocks under the assumption that their performance from Jan. 1, 2019 - Dec. 31, 2019 is representative of their expected future performance. Assume that the annual risk-free rate is 0.15%. a) Using Yahoo Finance or Google Finance, download the weekly stock prices in 2019 for both firms. Using the adjusted closing price (which accounts for dividends), calculate the weekly excess return. What was the mean, standard deviation, variance, and covariance of the two series? b) Your friend suggests that you split your money 50% in AIG and 50% in CITI. If you followed his advice in 2019, what would the weekly excess return of this portfolio have been? What would the variance of this portfolio have been? c) What was the Sharpe Ratio for the portfolio you calculated in part (b)? d) Instead of following your friend's advice, you have decided to calculate the optimal risky portfolio. How much money (in dollars) should you invest in AIG? How much money should you invest in CITI? [Hint: You need to compute the weights of the tangent portfolio, just plug the numbers you calculated in the equation for the tangent portfolio). 5) You have $50,000 in cash and you would like to allocate it between the common stock of American International Group, Inc. (AIG) and Citigroup, Inc. (C) or (CITI). Before making your investment, you have decided to examine the past performance of these stocks under the assumption that their performance from Jan. 1, 2019 - Dec. 31, 2019 is representative of their expected future performance. Assume that the annual risk-free rate is 0.15%. a) Using Yahoo Finance or Google Finance, download the weekly stock prices in 2019 for both firms. Using the adjusted closing price (which accounts for dividends), calculate the weekly excess return. What was the mean, standard deviation, variance, and covariance of the two series? b) Your friend suggests that you split your money 50% in AIG and 50% in CITI. If you followed his advice in 2019, what would the weekly excess return of this portfolio have been? What would the variance of this portfolio have been? c) What was the Sharpe Ratio for the portfolio you calculated in part (b)? d) Instead of following your friend's advice, you have decided to calculate the optimal risky portfolio. How much money (in dollars) should you invest in AIG? How much money should you invest in CITI? [Hint: You need to compute the weights of the tangent portfolio, just plug the numbers you calculated in the equation for the tangent portfolio)