Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. You obtain insider's information that a food company, Kraft, is going to be acquired at $48 per share soon, and you are looking at

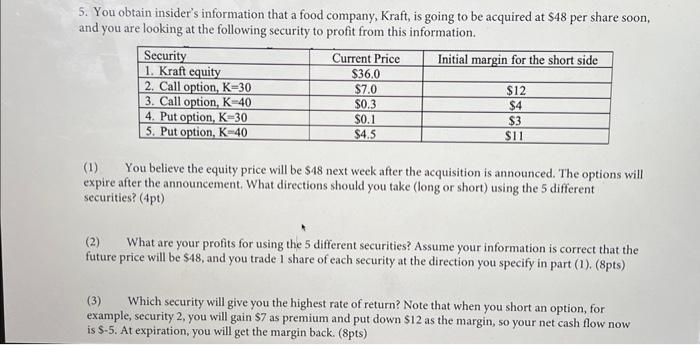

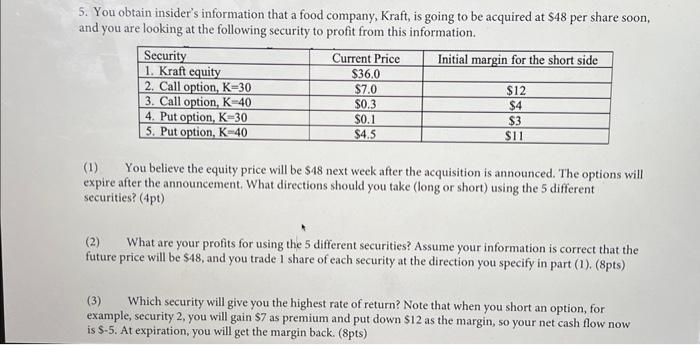

5. You obtain insider's information that a food company, Kraft, is going to be acquired at $48 per share soon, and you are looking at the following security to profit from this information. (1) You believe the equity price will be $48 next week after the acquisition is announced. The options will expire after the announcement. What directions should you take (long or short) using the 5 different securities? (4pt) (2) What are your profits for using the 5 different securities? Assume your information is correct that the future price will be $48, and you trade I share of each security at the direction you specify in part (1). (8pts) (3) Which security will give you the highest rate of return? Note that when you short an option, for example, security 2 , you will gain $7 as premium and put down $12 as the margin, so your net cash flow now is $5. At expiration, you will get the margin back. (8pts)

5. You obtain insider's information that a food company, Kraft, is going to be acquired at $48 per share soon, and you are looking at the following security to profit from this information. (1) You believe the equity price will be $48 next week after the acquisition is announced. The options will expire after the announcement. What directions should you take (long or short) using the 5 different securities? (4pt) (2) What are your profits for using the 5 different securities? Assume your information is correct that the future price will be $48, and you trade I share of each security at the direction you specify in part (1). (8pts) (3) Which security will give you the highest rate of return? Note that when you short an option, for example, security 2 , you will gain $7 as premium and put down $12 as the margin, so your net cash flow now is $5. At expiration, you will get the margin back. (8pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started