Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. You own a shoe store. You are deciding which shoes to stock for the upcoming season. You can either stock designer shoes, midrange shoes

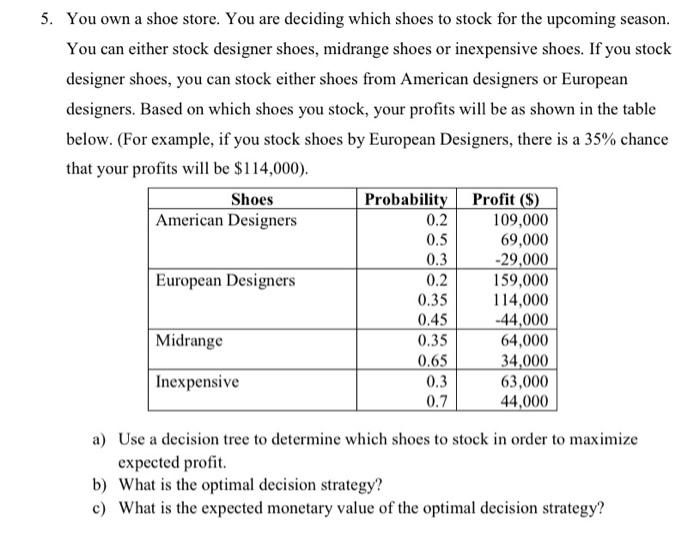

5. You own a shoe store. You are deciding which shoes to stock for the upcoming season. You can either stock designer shoes, midrange shoes or inexpensive shoes. If you stock designer shoes, you can stock either shoes from American designers or European designers. Based on which shoes you stock, your profits will be as shown in the table below. (For example, if you stock shoes by European Designers, there is a 35% chance that your profits will be $114,000). Shoes American Designers European Designers Midrange Inexpensive Probability 0.2 0.5 0.3 0.2 0.35 0.45 0.35 0.65 0.3 0.7 Profit ($) 109,000 69,000 -29,000 159,000 114,000 -44,000 64,000 34,000 63,000 44,000 a) Use a decision tree to determine which shoes to stock in order to maximize expected profit. b) What is the optimal decision strategy? c) What is the expected monetary value of the optimal decision strategy?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started