Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Your traditional IRA account has stock of GFH, which cost $2,000 20 years ago when you were 50 years old. You have been very

5. Your traditional IRA account has stock of GFH, which cost $2,000 20 years ago when you were 50 years old. You have been very fortunate, and the stock is now worth $23,000. You are in the 35 percent income tax bracket and pay 15 percent on long-term capital gains.

a) What was the annual rate of growth in the value of the stock?

b) What are the taxes owed if you withdraw the funds?

There are two questions here. 1 (a)(b) and 5 (a)(b).

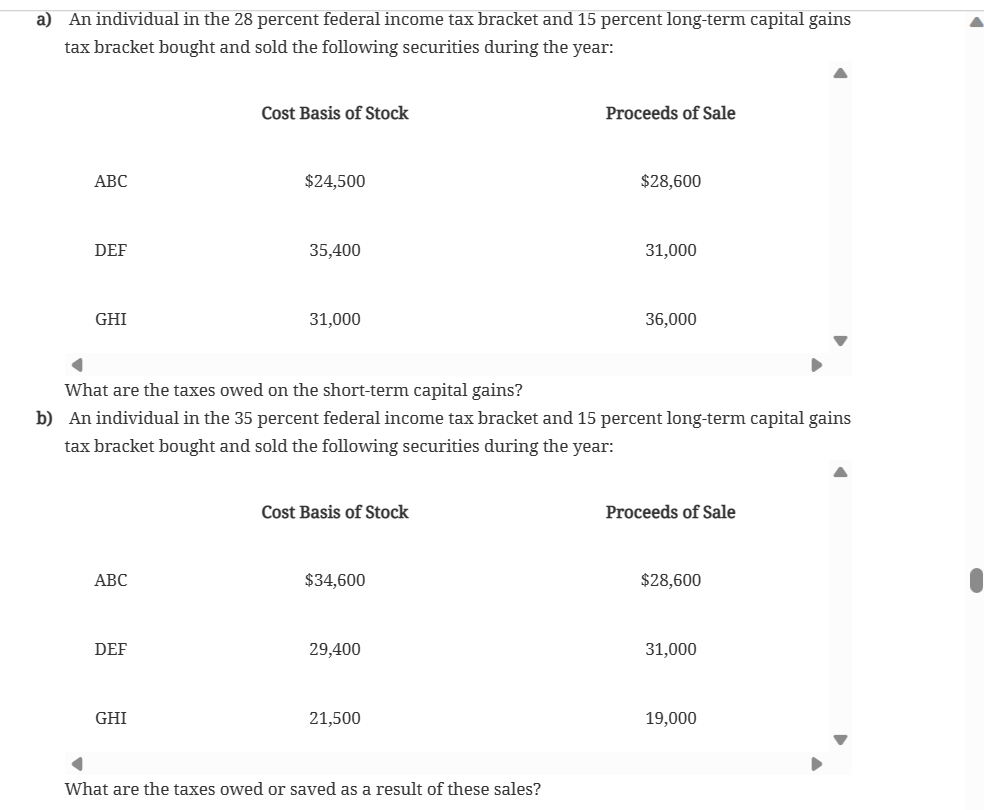

An individual in the 28 percent federal income tax bracket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year: What are the taxes owed on the short-term capital gains? An individual in the 35 percent federal income tax bracket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year: What are the taxes owed or saved as a result of these sales? An individual in the 28 percent federal income tax bracket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year: What are the taxes owed on the short-term capital gains? An individual in the 35 percent federal income tax bracket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year: What are the taxes owed or saved as a result of these salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started