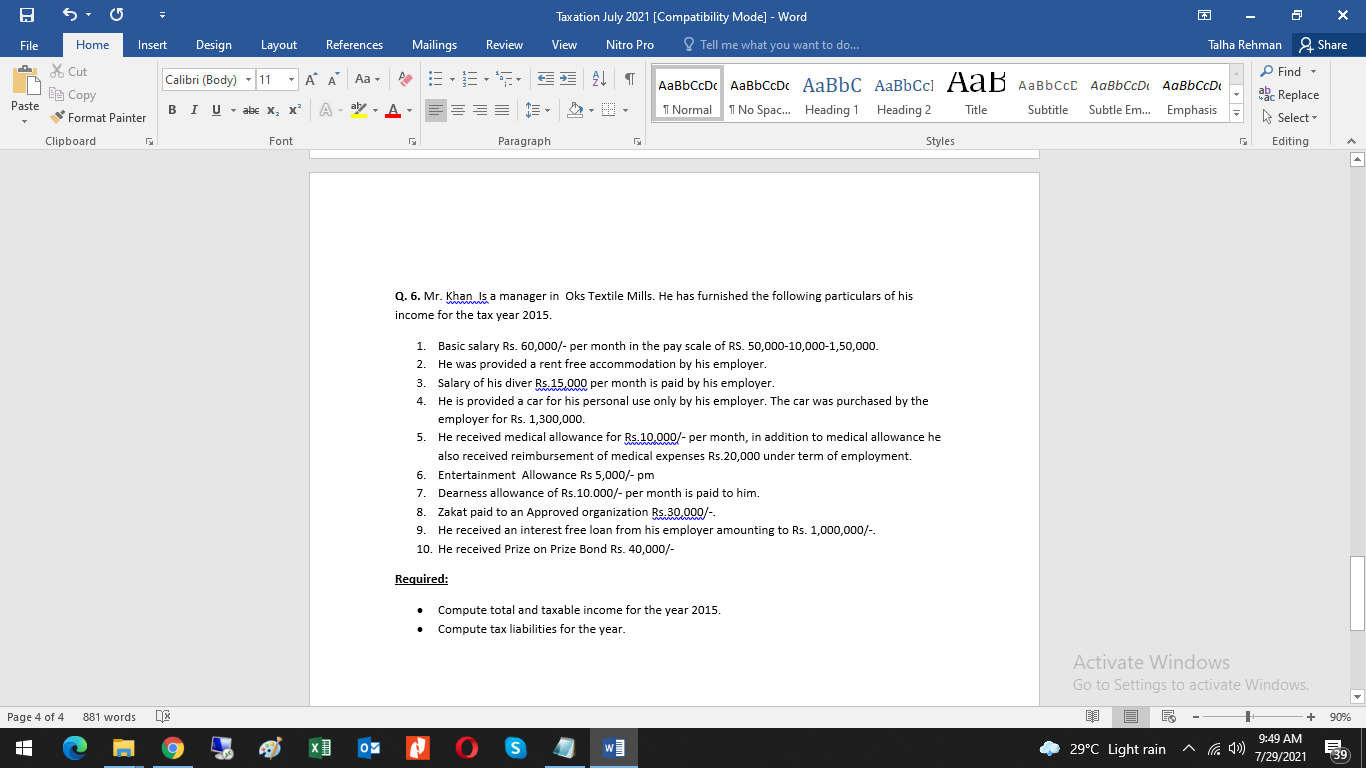

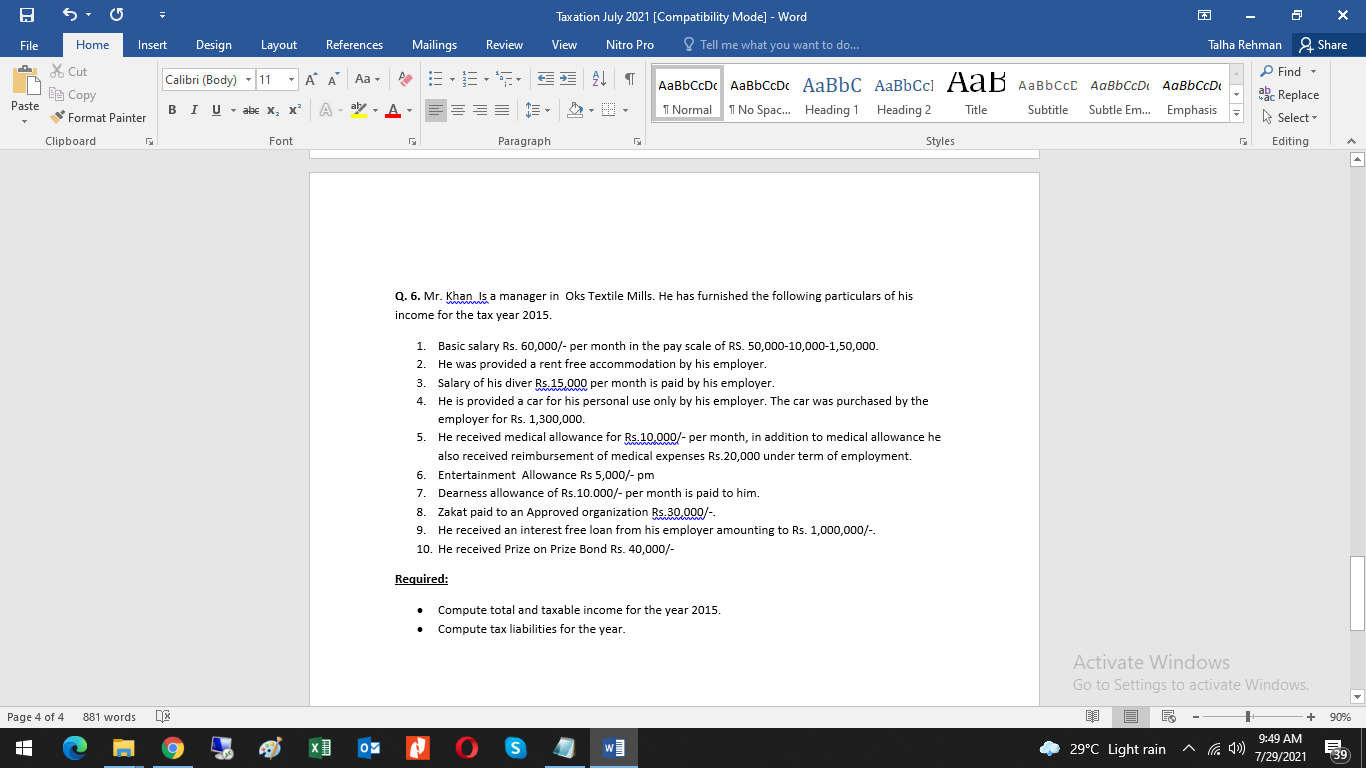

50 5 X File Home Insert Design Layout References Calibri (Body) Taxation July 2021 [Compatibility Mode] - Word Mailings Review View Nitro Pro Tell me what you want to do... Talha Rehman & Share Find - ! T AaBbCcDc AaBbccdc AaBbc AaBbcc AaB Aabbccc AaBBCCDI AaB CCD e, 1 Normal 11 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis 11 - A Aa- % Cut LE Copy Format Painter Clipboard Paste BIU - abe x, x aly.A aac Replace Select Font Paragraph [5 Styles Editing Q. 6. Mr. Khan Is a manager in Oks Textile Mills. He has furnished the following particulars of his income for the tax year 2015. . 1. Basic salary Rs. 60,000/- per month in the pay scale of RS. 50,000-10,000-1,50,000. 2. He was provided a rent free accommodation by his employer. 3. Salary of his diver Rs. 15,000 per month is paid by his employer. 4. He is provided a car for his personal use only by his employer. The car was purchased by the employer for Rs. 1,300,000. 5. He received medical allowance for Rs.10,000/- per month, in addition to medical allowance he also received reimbursement of medical expenses Rs.20,000 under term of employment. 6. Entertainment Allowance Rs 5,000/- pm 7. Dearness allowance of Rs. 10.000/- per month is paid to him. 8. Zakat paid to an Approved organization Rs.30,000/- 9. He received an interest free loan from his employer amounting to Rs. 1,000,000/- 10. He received Prize on Prize Bond Rs. 40,000/- Required: . Compute total and taxable income for the year 2015. Compute tax liabilities for the year. Activate Windows Go to Settings to activate Windows Page 4 of 4 4 4 881 words LA + 90% X] OM 0 S 29C Light rain ^ >) 9:49 AM 7/29/2021 = 139 50 5 X File Home Insert Design Layout References Calibri (Body) Taxation July 2021 [Compatibility Mode] - Word Mailings Review View Nitro Pro Tell me what you want to do... Talha Rehman & Share Find - ! T AaBbCcDc AaBbccdc AaBbc AaBbcc AaB Aabbccc AaBBCCDI AaB CCD e, 1 Normal 11 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis 11 - A Aa- % Cut LE Copy Format Painter Clipboard Paste BIU - abe x, x aly.A aac Replace Select Font Paragraph [5 Styles Editing Q. 6. Mr. Khan Is a manager in Oks Textile Mills. He has furnished the following particulars of his income for the tax year 2015. . 1. Basic salary Rs. 60,000/- per month in the pay scale of RS. 50,000-10,000-1,50,000. 2. He was provided a rent free accommodation by his employer. 3. Salary of his diver Rs. 15,000 per month is paid by his employer. 4. He is provided a car for his personal use only by his employer. The car was purchased by the employer for Rs. 1,300,000. 5. He received medical allowance for Rs.10,000/- per month, in addition to medical allowance he also received reimbursement of medical expenses Rs.20,000 under term of employment. 6. Entertainment Allowance Rs 5,000/- pm 7. Dearness allowance of Rs. 10.000/- per month is paid to him. 8. Zakat paid to an Approved organization Rs.30,000/- 9. He received an interest free loan from his employer amounting to Rs. 1,000,000/- 10. He received Prize on Prize Bond Rs. 40,000/- Required: . Compute total and taxable income for the year 2015. Compute tax liabilities for the year. Activate Windows Go to Settings to activate Windows Page 4 of 4 4 4 881 words LA + 90% X] OM 0 S 29C Light rain ^ >) 9:49 AM 7/29/2021 = 139