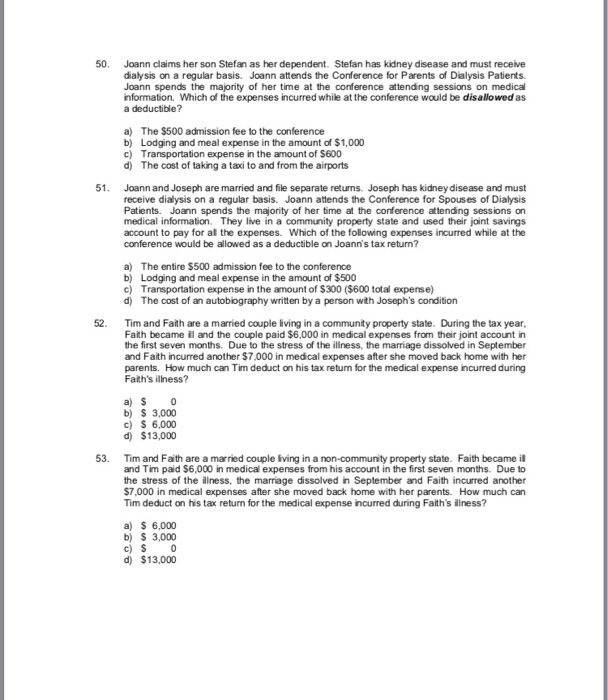

50. Joann claims her son Stefan as her dependent. Stefan has kidney disease and must receive dialysis on a regular basis. Joann attends the Conference for Parents of Dialysis Patients. Joann spends the majority of her time at the conference attending sessions on medical nformation. Which of the expenses incurred while at the conference would be disallowed as a deductible? a) The $500 admission fee to the conference b) Lodging and meal expense in the amount of $1,000 c) Transportation expense in the amount of $600 d) The cost of taking a taxi to and from the airports 51. Joann and Joseph are married and file separate returns. Joseph has kidney disease and must receive dialysis on a regular basis. Joann attends the Conference for Spouses of Dialysis Patients. Joann spends the majority of her time at the conference attending sessions on medical information. They live in a community property state and used their joint savings account to pay for al the expenses. Which of the following expenses incurred while at the conference would be allowed as a deductible on Joann's tax return? a) b) The entire $500 admission fee to the conference Lodging and meal expense in the amount of $500 c) Transportation expense in the amount of $300 ($600 total expense) d) The cost of an autobiography written by a person with Joseph's condition 52. Tim and Faith are a married couple living in a community property state. During the tax year Fath became ill and the couple paid $6,000 in medical expenses from their joint account in the first seven months. Due to the stress of the illness, the marriage dissolved in September and Faith incurred another $7,000 in medical expenses after she moved back home with her parents. How much can Tim deduct on his tax return for the medical expense incurred during Fath's iliness? a) S 0 b) 3,000 c) S 6,000 d) $13,000 53. Tim and Faith are a married couple iving in a property state. Faith became il and Tim paid $6,000 in medical expenses from his account in the first seven months. Due to the stress of the ilness, the marriage dissolved in September and Faith incurred another $7,000 in medical expenses after she moved back home with her parents. How much can Tim deduct on his tax return for the medical expense incurred during Faith's ilness? a) 6,000 b) 3,000 c) S 0 d) $13,000