Answered step by step

Verified Expert Solution

Question

1 Approved Answer

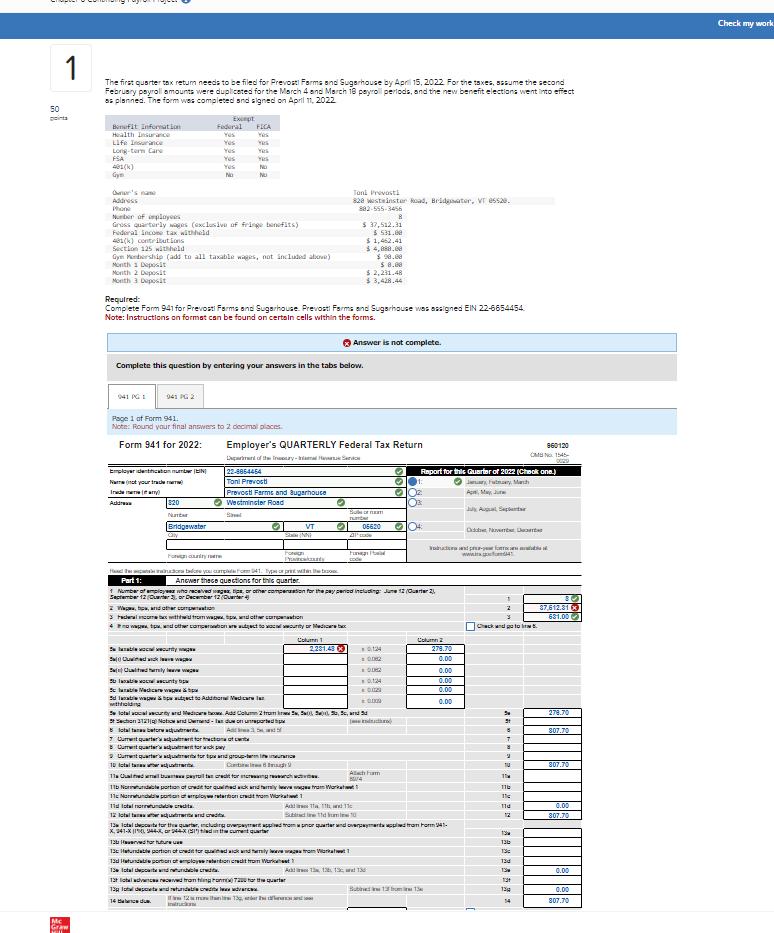

50 points 1 The first quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 15, 2022 For the taxes,

50 points 1 The first quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 15, 2022 For the taxes, assume the second February payroll amounts were duplicated for the March 4 and March 18 payroll periods, and the new benefit elections went into effect as planned. The form was completed and signed on April 11, 2022 Mc Graw Except Benefit Information Health Insurance Federal Yes FICA Yes Life Insurance Yes Yes Long-term Care Yes FSA Yes Yes 401(k) Yes No Gy No Nu Owner's name Address Phone Number of employees Gross quarterly wages (exclusive of fringe benefits) Federal income tax withhold 401(k) contributions Section 125 withheld Gym Membership (add to all taxable wages, not included above) Month 1 Deposit Month 2 Deposit Month 3 Deposit Required: Toni Prevosti 828 Westminster Road, Bridgwater, VT essa. 882-555-3456 $ 37,512.31 $531.00 $1,462.41 $4,080.08 $ 8.88 $2,231.48 $ 3,428.44 Complete Form 941 for Prevosti Farms and Sugarhouse. Prevosti Farms and Sugarhouse was assigned EIN 22-6654454 Note: Instructions on format can be found on certain cells within the forms. Answer is not complete. Complete this question by entering your answers in the tabs below. 041 PG 1 941 PG 2 Page 1 of Form 941. Note: Round your final answers to 2 decimal places. Form 941 for 2022: Employer identification number Name (not your trade Inde men (any) Addre Employer's QUARTERLY Federal Tax Return 860120 CMB 1545- Department of the Insory-amal Haas Send 0029 22-8854454 Toni Prevost Report for this Quarter of 2022 (Check one.) Jary Futury, Mash Prevost Farms and Bugarhouse Westminster Road S VT O 06620 04: Odb S JAS 820 N S Bridgewater a For any ere FON P He you 41. Type or print with Part 1: Ancwer these questions for this quarter. F code Number of employee who received get or other compensation for the pay period including: June 12 (Quarter 2), September 12 (Quarter or December 12 (Quarter 4 Webp, and other compan > Federal income with from wap, and other compensation 4 now tand other compertoaretect to county or Medica Q Cualedrily leave w - www.gfon 37,612.31 681.00 Check and go to lim Colum Column 2.281.433 0124 278.70 0082 0.00 002 0.00 0.124 0.00 0129 0.00 0.00 278.70 807.70 Scale Medicare wa 5 late wa&pect to Additional Medical withholding Se total calcurity and Media Add Column 2 from 5, 50, 50, 5, 5c, and St Section 3121 Notice and Orenda due on unreported lotal tans before Current quarter aquant for conf Current quarter's aunt for wi Cument quarter 10 total tr for and group-term life inuice C 11b portion of credit for qualified wick and army from Workt Alham 807.70 11dlotalarda 11d 0.00 12 lotal 12 307.70 13 lctal departe for the quarter, including overpayment applied from por quarter and overpayment applied from Form 41- X, 341-44-, or 944-X (S1) in the current quarter 13: 13 Herved for future 13c Hatundable portion of credit for quad wick and family leave from 7 13 13d Hatundable portion of employee retention credit from Work 13d 12 13 total departed table credit 13g lt det andrefundaci 14 13 0.00 taldeerved from high 72 the quarter 1213, der 13 0.00 14 807.70 Check my work

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepwise calculations for Form 941 Part 1 Line 2 Gross quarterly wages from information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started