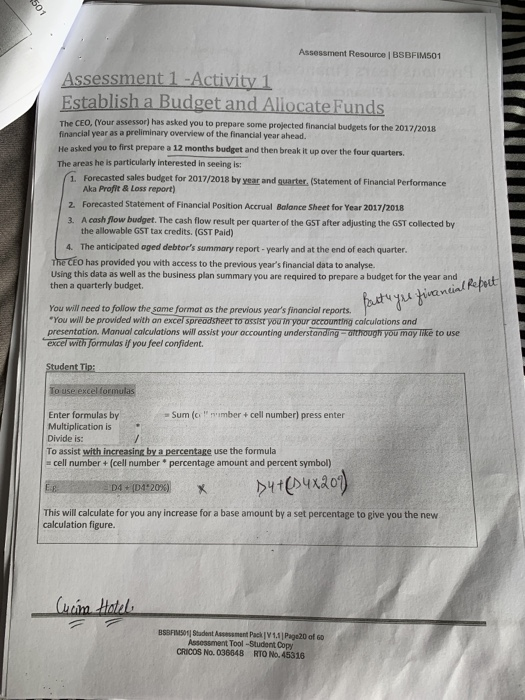

501 Assessment Resource | BSBFIM501 Assessment 1 -Activity 1 Establish a Budget and Allocate Funds The CEO, (Your assessor) has asked you to prepare some projected financial budgets for the 2017/2018 financial year as a preliminary overview of the financial year ahead. He asked you to first prepare a 12 months budget and then break it up over the four quarters. The areas he is particularly interested in seeing is: 1. Forecasted sales budget for 2017/2018 by year and quarter. (Statement of Financial Performance Aka Profit & Loss report) 2. Forecasted Statement of Financial Position Accrual Balance Sheet for Year 2017/2018 3. A cash flow budget. The cash flow result per quarter of the GST after adjusting the GST collected by the allowable GST tax credits. (GST Pald) 4. The anticipated aged debtor's summary report -yearly and at the end of each quarter. The CEO has provided you with access to the previous year's financial data to analyse. Using this data as well as the business plan summary you are required to prepare a budget for the year and then a quarterly budget fast you financial Report You will need to follow the same format as the previous year's financial reports. "You will be provided with an excel spreadsheer to assist you in your accounting calculations and presentation Manual calculations will assist your accounting understanding - although you may like to use excel with formulas if you feel confident Student Tip: To use excel formulas Enter formulas by Sum ( orimber + cell number) press enter Multiplication is Divide is: To assist with increasing by a percentage use the formula cell number + (cell number percentage amount and percent symbol) EE D4+ (4207 X >4+(94x200) This will calculate for you any increase for a base amount by a set percentage to give you the new calculation figure. Cucim Hotel BSSFIMS01 Student met Pack V 1.4 Page 20 of 60 Assessment Tool - Student Copy CRICOS No. 036648 RTO NO. 45316 501 Assessment Resource | BSBFIM501 Assessment 1 -Activity 1 Establish a Budget and Allocate Funds The CEO, (Your assessor) has asked you to prepare some projected financial budgets for the 2017/2018 financial year as a preliminary overview of the financial year ahead. He asked you to first prepare a 12 months budget and then break it up over the four quarters. The areas he is particularly interested in seeing is: 1. Forecasted sales budget for 2017/2018 by year and quarter. (Statement of Financial Performance Aka Profit & Loss report) 2. Forecasted Statement of Financial Position Accrual Balance Sheet for Year 2017/2018 3. A cash flow budget. The cash flow result per quarter of the GST after adjusting the GST collected by the allowable GST tax credits. (GST Pald) 4. The anticipated aged debtor's summary report -yearly and at the end of each quarter. The CEO has provided you with access to the previous year's financial data to analyse. Using this data as well as the business plan summary you are required to prepare a budget for the year and then a quarterly budget fast you financial Report You will need to follow the same format as the previous year's financial reports. "You will be provided with an excel spreadsheer to assist you in your accounting calculations and presentation Manual calculations will assist your accounting understanding - although you may like to use excel with formulas if you feel confident Student Tip: To use excel formulas Enter formulas by Sum ( orimber + cell number) press enter Multiplication is Divide is: To assist with increasing by a percentage use the formula cell number + (cell number percentage amount and percent symbol) EE D4+ (4207 X >4+(94x200) This will calculate for you any increase for a base amount by a set percentage to give you the new calculation figure. Cucim Hotel BSSFIMS01 Student met Pack V 1.4 Page 20 of 60 Assessment Tool - Student Copy CRICOS No. 036648 RTO NO. 45316