Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5.1 Acai, a company specializing in developing Al technology in food transportation systems, wants to invest in a hardware system for their new office.

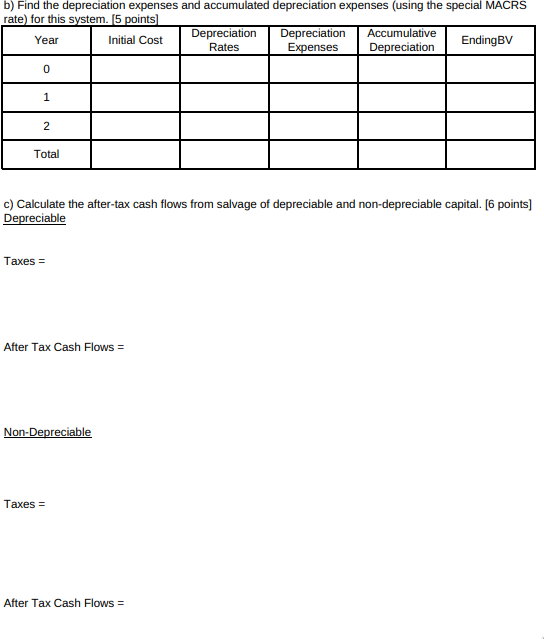

5.1 Acai, a company specializing in developing Al technology in food transportation systems, wants to invest in a hardware system for their new office. Listed below is the economic data for the investment: 1 |Depreciable Capital - year 0 2 500,000 $ |Salvage Value (FMV) (at the end of project life) |Non-depreciable Capital - year 0 |Non-depreciable Capital (at the end of project life) Expected Revenue ($ / yr.) O&M Cost ($ / yr.) Useful life (years) Working Capital - year 0 |Working Capital - (at the end of the project life) Loan Proceeds - year 0 Interest on Loan - per year Loan Period - years Tax rate - per year 2$ 90,000 3 $ 90,000 4 $ 170,000 5 $ 1,800,000 $ 300,000 2 7 250,000 250,000 $ 8 9. 650,000 10% 10 11 12 25% 13 ITC - year 1 15 14 $ 90,000 120,000 ITC - year 2 MARR per year $ 16 20% This system qualifies as a special 2-year MACRS Depreciation (with factors 0.6 and 0.4). Assume that the working capital is returned in year 2. Assume that the company has income from other projects and this system is sold at the end of year 2. Note: Use the following tables to calculate the above values. a) Calculate the interest and principal repayments for the loan. [6 points] Beginning Balance Annual Principal Repayament EndingBalance Year Interest Payment 1 2 Total b) Find the depreciation expenses and accumulated depreciation expenses (using the special MACRS rate) for this system. [5 points] Depreciation Depreciation Expenses Accumulative Year Initial Cost EndingBV Rates Depreciation 1 2 Total c) Calculate the after-tax cash flows from salvage of depreciable and non-depreciable capital. [6 points] Depreciable Taxes = After Tax Cash Flows = Non-Depreciable Taxes = After Tax Cash Flows =

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

answer b calculation of the Depreciation Empentes and Aeeumuloted Depreei Amp in a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started