Answered step by step

Verified Expert Solution

Question

1 Approved Answer

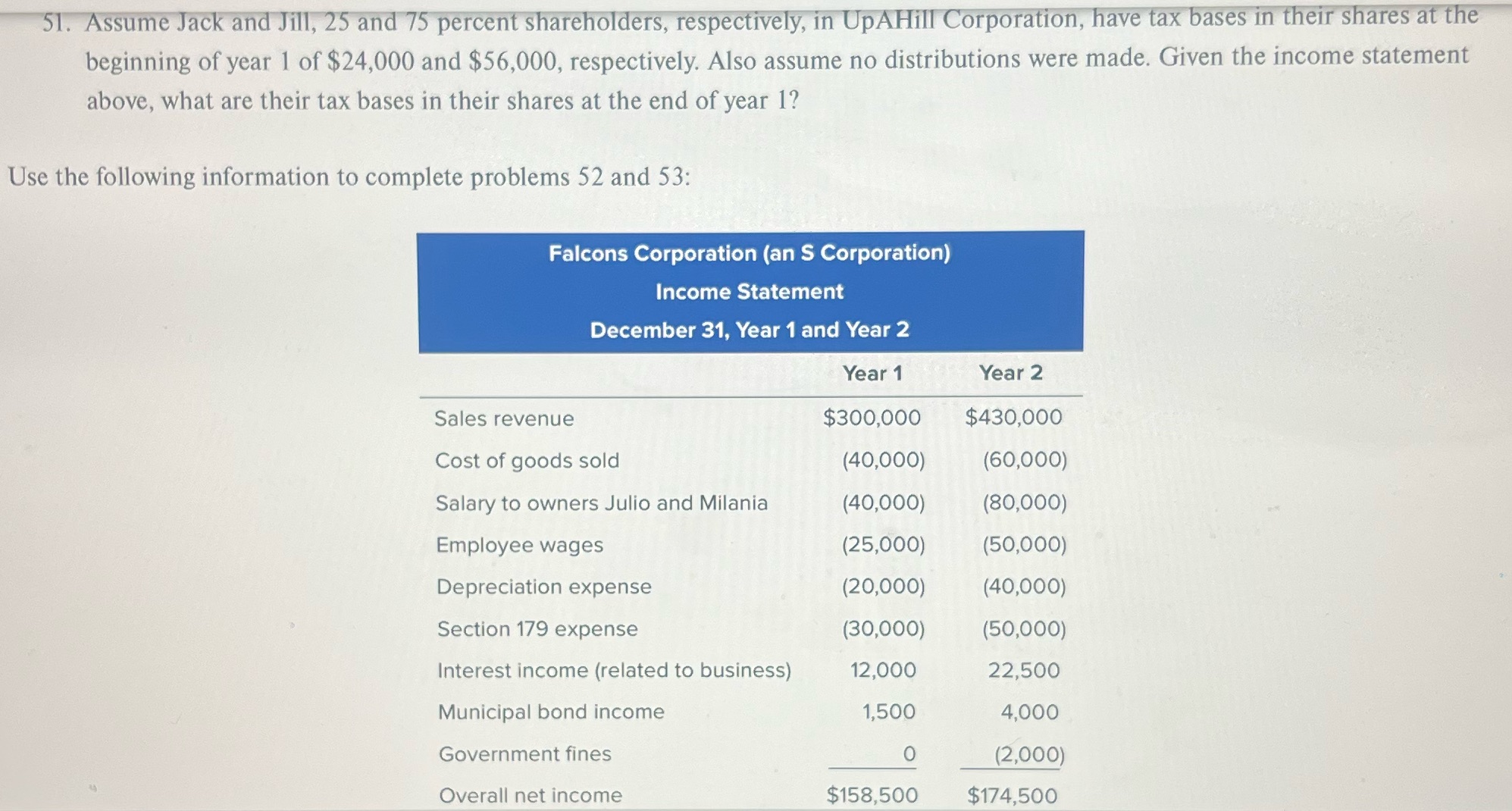

51. Assume Jack and Jill, 25 and 75 percent shareholders, respectively, in UpAHill Corporation, have tax bases in their shares at the beginning of

51. Assume Jack and Jill, 25 and 75 percent shareholders, respectively, in UpAHill Corporation, have tax bases in their shares at the beginning of year 1 of $24,000 and $56,000, respectively. Also assume no distributions were made. Given the income statement above, what are their tax bases in their shares at the end of year 1? Use the following information to complete problems 52 and 53: Falcons Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Year 1 Year 2 Sales revenue $300,000 $430,000 Cost of goods sold (40,000) (60,000) Salary to owners Julio and Milania (40,000) (80,000) Employee wages (25,000) (50,000) Depreciation expense (20,000) (40,000) Section 179 expense (30,000) (50,000) Interest income (related to business) 12,000 22,500 Municipal bond income 1,500 4,000 Government fines (2,000) Overall net income $158,500 $174,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the tax bases in their shares at the end of year 1 for Jack and Jil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started