Answered step by step

Verified Expert Solution

Question

1 Approved Answer

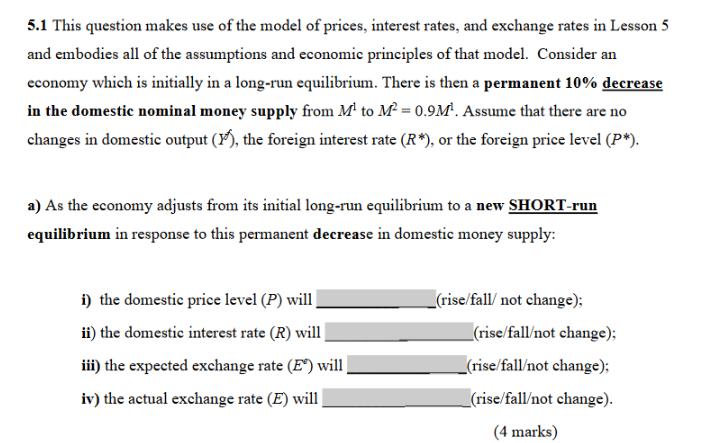

5.1 This question makes use of the model of prices, interest rates, and exchange rates in Lesson 5 and embodies all of the assumptions

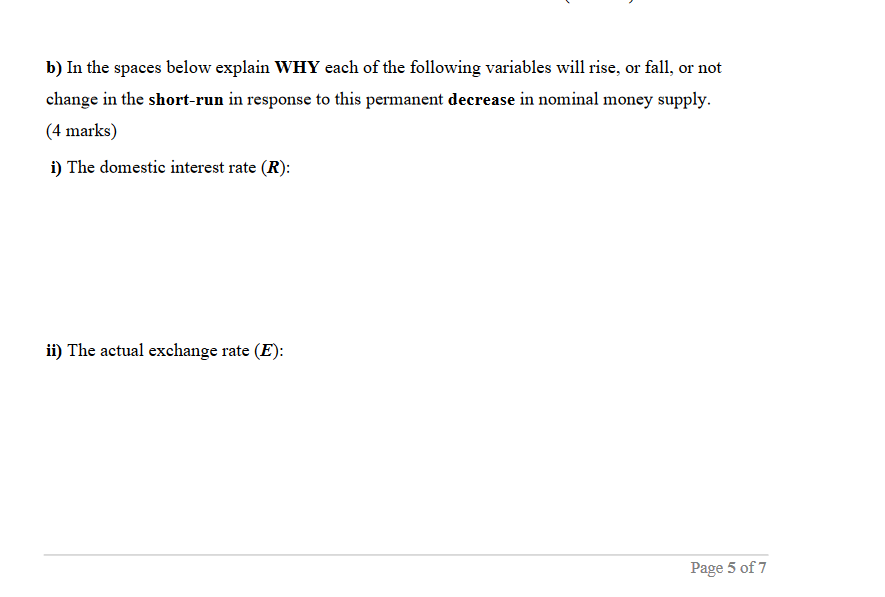

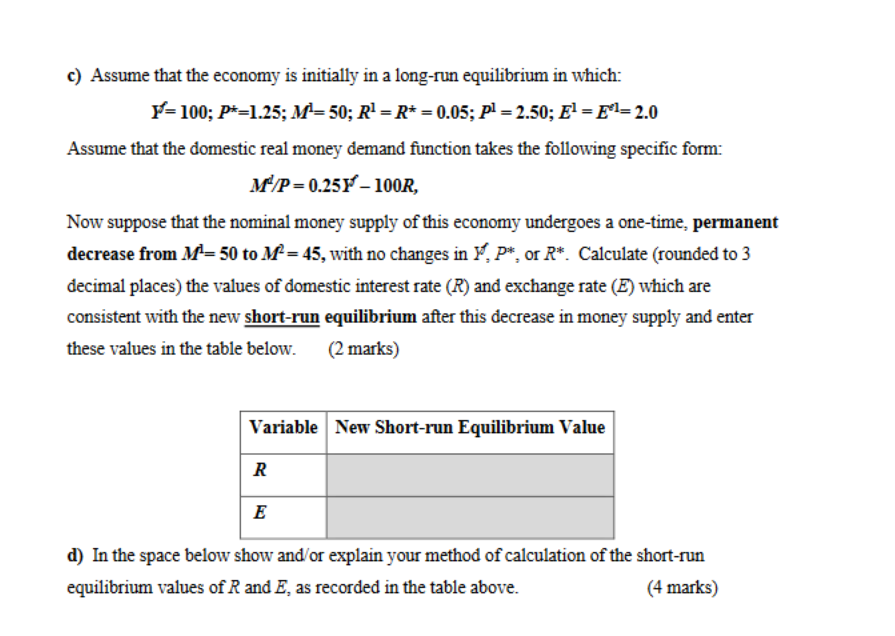

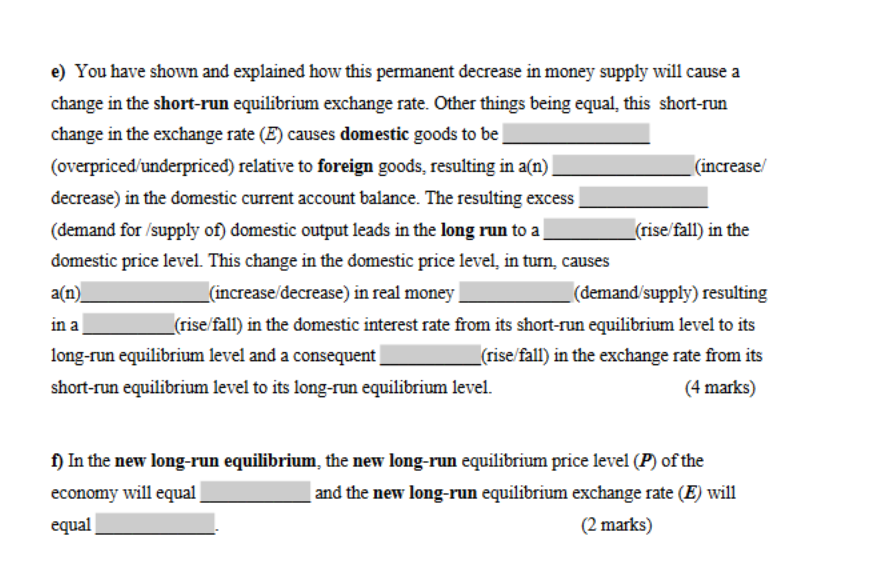

5.1 This question makes use of the model of prices, interest rates, and exchange rates in Lesson 5 and embodies all of the assumptions and economic principles of that model. Consider an economy which is initially in a long-run equilibrium. There is then a permanent 10% decrease in the domestic nominal money supply from M to M = 0.9M. Assume that there are no changes in domestic output (1), the foreign interest rate (R*), or the foreign price level (P*). a) As the economy adjusts from its initial long-run equilibrium to a new SHORT-run equilibrium in response to this permanent decrease in domestic money supply: i) the domestic price level (P) will ii) the domestic interest rate (R) will iii) the expected exchange rate (E) will iv) the actual exchange rate (E) will (rise/fall/ not change); (rise/fall/not change); (rise/fall/not change); (rise/fall/not change). (4 marks) b) In the spaces below explain WHY each of the following variables will rise, or fall, or not change in the short-run in response to this permanent decrease in nominal money supply. (4 marks) i) The domestic interest rate (R): ii) The actual exchange rate (E): Page 5 of 7 c) Assume that the economy is initially in a long-run equilibrium in which: F= 100; P*=1.25; M= 50; R = R* = 0.05; P = 2.50; E = E= 2.0 Assume that the domestic real money demand function takes the following specific form: M/P=0.25-100R, Now suppose that the nominal money supply of this economy undergoes a one-time, permanent decrease from M-50 to M = 45, with no changes in Y, P*, or R*. Calculate (rounded to 3 decimal places) the values of domestic interest rate (R) and exchange rate (E) which are consistent with the new short-run equilibrium after this decrease in money supply and enter these values in the table below. (2 marks) Variable New Short-run Equilibrium Value R E d) In the space below show and/or explain your method of calculation of the short-run equilibrium values of R and E, as recorded in the table above. (4 marks) e) You have shown and explained how this permanent decrease in money supply will cause a change in the short-run equilibrium exchange rate. Other things being equal, this short-run change in the exchange rate (E) causes domestic goods to be (overpriced/underpriced) relative to foreign goods, resulting in a(n). decrease) in the domestic current account balance. The resulting excess (demand for /supply of) domestic output leads in the long run to a domestic price level. This change in the domestic price level, in turn, causes a(n) in a (increase/decrease) in real money | (increase/ (rise/fall) in the (demand/supply) resulting (rise/fall) in the domestic interest rate from its short-run equilibrium level to its (rise/fall) in the exchange rate from its long-run equilibrium level and a consequent short-run equilibrium level to its long-run equilibrium level. (4 marks) f) In the new long-run equilibrium, the new long-run equilibrium price level (P) of the economy will equal equal and the new long-run equilibrium exchange rate (E) will (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a As the economy adjusts from its initial longrun equilibrium to a new shortrun equilibrium in respo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbe200ba8d_962756.pdf

180 KBs PDF File

663dbe200ba8d_962756.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started