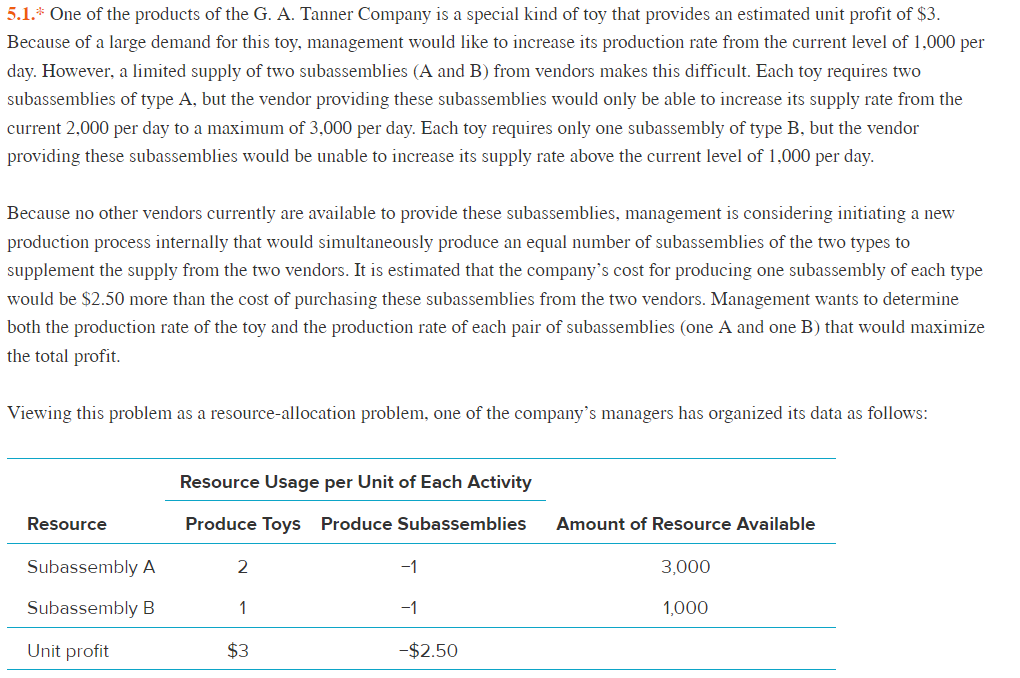

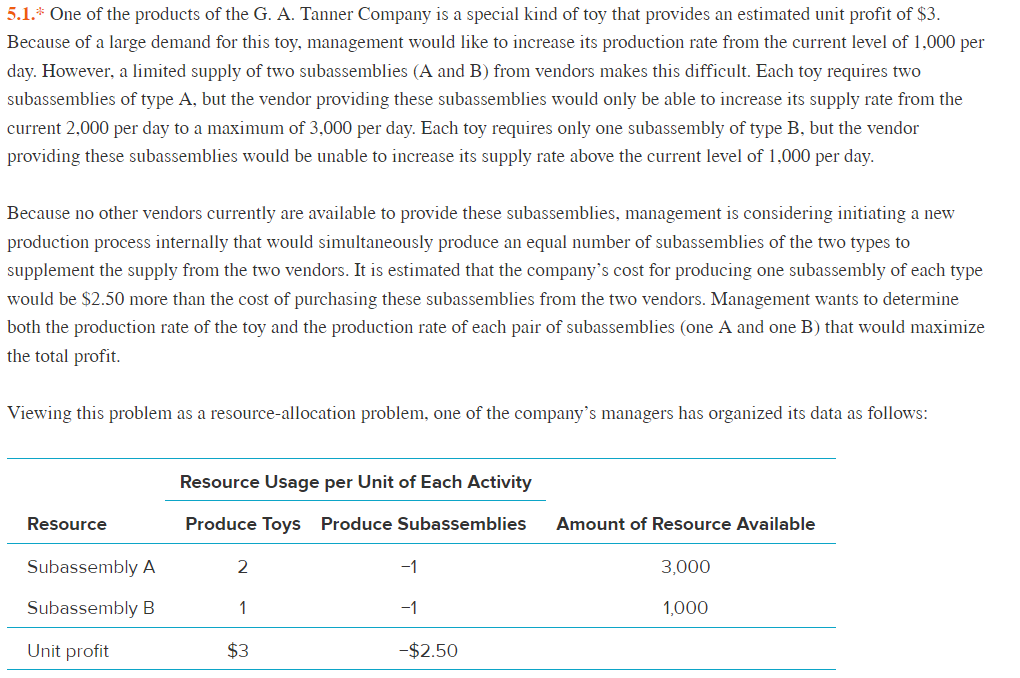

5.10* Reconsider Problem 5.1 . After further negotiations with each vendor, management of the G. A. Tanner Company has earned that either of them would be willing to consider increasing their supply of their respective subassemblies over the oreviously stated maxima (3,000 subassemblies of type A per day and 1,000 of type B per day) if the company would pay a mall premium over the regular price for the extra subassemblies. The size of the premium for each type of subassembly remains o be negotiated. The demand for the toy being produced is sufficiently high that 2,500 per day could be sold if the supply of ubassemblies could be increased enough to support this production rate. Assume that the original estimates of unit profits giver n Problem 5.1 are accurate. a. Formulate and solve a spreadsheet model for this problem with the original maximum supply levels and the additional constraint that no more than 2,500 toys should be produced per day. b. Without considering the premium, use the spreadsheet and Solver to determine the shadow price for the subassembly A constraint by solving the model again after increasing the maximum supply by one. Use this shadow price to determine the maximum premium that the company should be willing to pay for each subassembly of this type. c. Repeat part b for the subassembly B constraint. AS A f. Use Solver's sensitivity report to determine the shadow price for each of the subassembly constraints and the allowable range for the right-hand side of each of these constraints. 5.1.* One of the products of the G. A. Tanner Company is a special kind of toy that provides an estimated unit profit of $3. Because of a large demand for this toy, management would like to increase its production rate from the current level of 1,000 per day. However, a limited supply of two subassemblies (A and B) from vendors makes this difficult. Each toy requires two subassemblies of type A, but the vendor providing these subassemblies would only be able to increase its supply rate from the current 2,000 per day to a maximum of 3,000 per day. Each toy requires only one subassembly of type B, but the vendor providing these subassemblies would be unable to increase its supply rate above the current level of 1,000 per day. Because no other vendors currently are available to provide these subassemblies, management is considering initiating a new production process internally that would simultaneously produce an equal number of subassemblies of the two types to supplement the supply from the two vendors. It is estimated that the company's cost for producing one subassembly of each type would be $2.50 more than the cost of purchasing these subassemblies from the two vendors. Management wants to determine both the production rate of the toy and the production rate of each pair of subassemblies (one A and one B) that would maximize the total profit. Viewing this problem as a resource-allocation problem, one of the company's managers has organized its data as follows