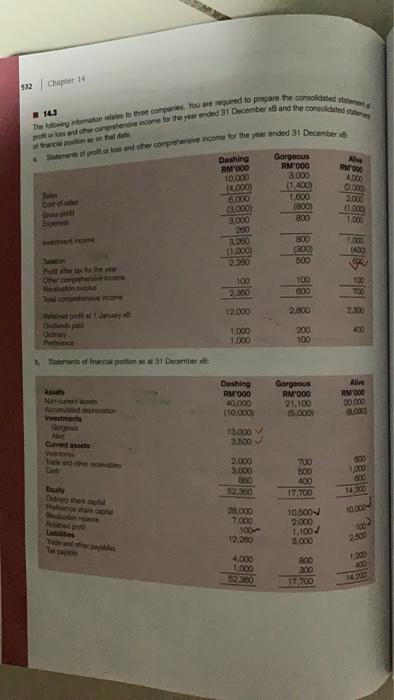

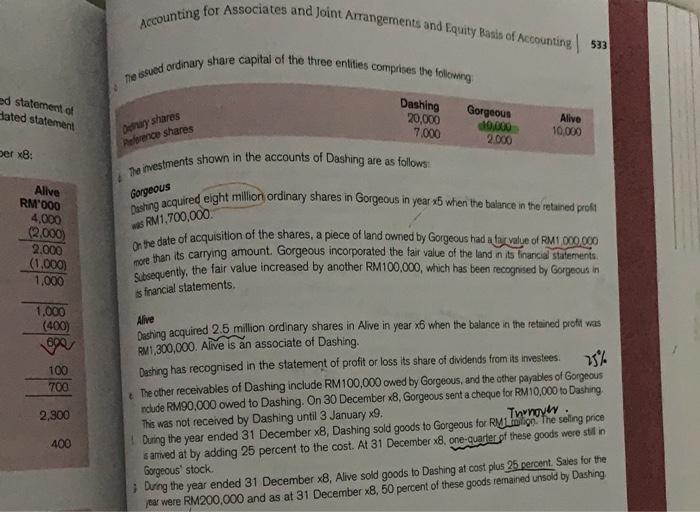

512 Chapter 14 10 The more to the companies. You are required to prepare the consented met poor and other comprehensive income for the year ended 31 December and the content Statements of protect and other compreencome for the year ended 31 December of the possono a date Dashing RA000 10.000 14.000 6.000 1000) 3.000 280 3.200 (1.000) 2.280 Gorgeous RM"000 3,000 (1.400 1,000 (800) 800 P06 4000 2.000 2.000 (1000 1.000 200 (300) 500 1.00 (400 ye 109 700 Fathew 100 22360 100 800 Docomom Jawa Oud 12.000 2,800 200 400 Odnar 1.000 1.000 100 1. Statement of Two poston #31 December Ae Nenen Med den Investments Dogo Dashing RM1000 40.000 (10.000 Gorgeous RM000 21,100 (5,000 Alive RW 000 20.000 2.000 13.000 3.500 600 1.000 2.000 3.000 800 52.300 900 300 400 17.700 10200 Othe 28.000 7.000 10 19.260 10.000 10300V 2.000 1,100 2.000 Eles de Llais 100 2.500 Thor 4,000 1.000 1.000 40 800 300 17 700 Accounting for Associates and Joint Arrangements and Equity Basis of Accounting 533 me scued ordinary share capital of the three entities comprises the following ed statement of Hated statement Dashing 20,000 7.000 Gorgeous d0.000 2.000 Alive 10.000 Denay shares Perence shares ber : The investments shown in the accounts of Dashing are as follows: Desting acquired eight million ordinary shares in Gorgeous in year 25 when the balance in the retained profit Gorgeous Alive RM1000 4,000 (2.000) 2.000 (1.000) 1.000 wa RM1,700,000 a more than its carrying amount. Gorgeous incorporated the fair value of the land in its financial statements Subsequently, the fair value increased by another RM100.000, which has been recognised by Gorgeous in is financial statements 1.000 (400) 100 700 2,300 Alive Dashing acquired 2.5 million ordinary shares in Alive in year 6 when the balance in the retailed profit was RM 1,300,000. Alive is an associate of Dashing. Dashing has recognised in the statement of profit or loss its share of dividends from its investees. The other receivables of Dashing include RM100,000 owed by Gorgeous, and the other payables of Gorgeous ndude RM90.000 owed to Dashing. On 30 December 8, Gorgeous sent a cheque for RM10,000 to Dashing. This was not received by Dashing until 3 January 9. During the year ended 31 December 8, Dashing sold goods to Gorgeous for RML lin. The selling price Turnover samed at by adding 25 percent to the cost. At 31 December 8, one-quarter of these goods were still in Gorgeous' stock During the year ended 31 December 28, Alive sold goods to Dashing at cost plus 25. percent. Sales for the ter were RM200,000 and as at 31 December x8, 50 percent of these goods remained unsold by Dashing 400 512 Chapter 14 10 The more to the companies. You are required to prepare the consented met poor and other comprehensive income for the year ended 31 December and the content Statements of protect and other compreencome for the year ended 31 December of the possono a date Dashing RA000 10.000 14.000 6.000 1000) 3.000 280 3.200 (1.000) 2.280 Gorgeous RM"000 3,000 (1.400 1,000 (800) 800 P06 4000 2.000 2.000 (1000 1.000 200 (300) 500 1.00 (400 ye 109 700 Fathew 100 22360 100 800 Docomom Jawa Oud 12.000 2,800 200 400 Odnar 1.000 1.000 100 1. Statement of Two poston #31 December Ae Nenen Med den Investments Dogo Dashing RM1000 40.000 (10.000 Gorgeous RM000 21,100 (5,000 Alive RW 000 20.000 2.000 13.000 3.500 600 1.000 2.000 3.000 800 52.300 900 300 400 17.700 10200 Othe 28.000 7.000 10 19.260 10.000 10300V 2.000 1,100 2.000 Eles de Llais 100 2.500 Thor 4,000 1.000 1.000 40 800 300 17 700 Accounting for Associates and Joint Arrangements and Equity Basis of Accounting 533 me scued ordinary share capital of the three entities comprises the following ed statement of Hated statement Dashing 20,000 7.000 Gorgeous d0.000 2.000 Alive 10.000 Denay shares Perence shares ber : The investments shown in the accounts of Dashing are as follows: Desting acquired eight million ordinary shares in Gorgeous in year 25 when the balance in the retained profit Gorgeous Alive RM1000 4,000 (2.000) 2.000 (1.000) 1.000 wa RM1,700,000 a more than its carrying amount. Gorgeous incorporated the fair value of the land in its financial statements Subsequently, the fair value increased by another RM100.000, which has been recognised by Gorgeous in is financial statements 1.000 (400) 100 700 2,300 Alive Dashing acquired 2.5 million ordinary shares in Alive in year 6 when the balance in the retailed profit was RM 1,300,000. Alive is an associate of Dashing. Dashing has recognised in the statement of profit or loss its share of dividends from its investees. The other receivables of Dashing include RM100,000 owed by Gorgeous, and the other payables of Gorgeous ndude RM90.000 owed to Dashing. On 30 December 8, Gorgeous sent a cheque for RM10,000 to Dashing. This was not received by Dashing until 3 January 9. During the year ended 31 December 8, Dashing sold goods to Gorgeous for RML lin. The selling price Turnover samed at by adding 25 percent to the cost. At 31 December 8, one-quarter of these goods were still in Gorgeous' stock During the year ended 31 December 28, Alive sold goods to Dashing at cost plus 25. percent. Sales for the ter were RM200,000 and as at 31 December x8, 50 percent of these goods remained unsold by Dashing 400