Question

5.16 Computing and Interpreting Risk and Bankruptcy Prediction Ratios for a Firm That Declared Bankruptcy. Delta Air Lines, Inc., is one of the largest airlines

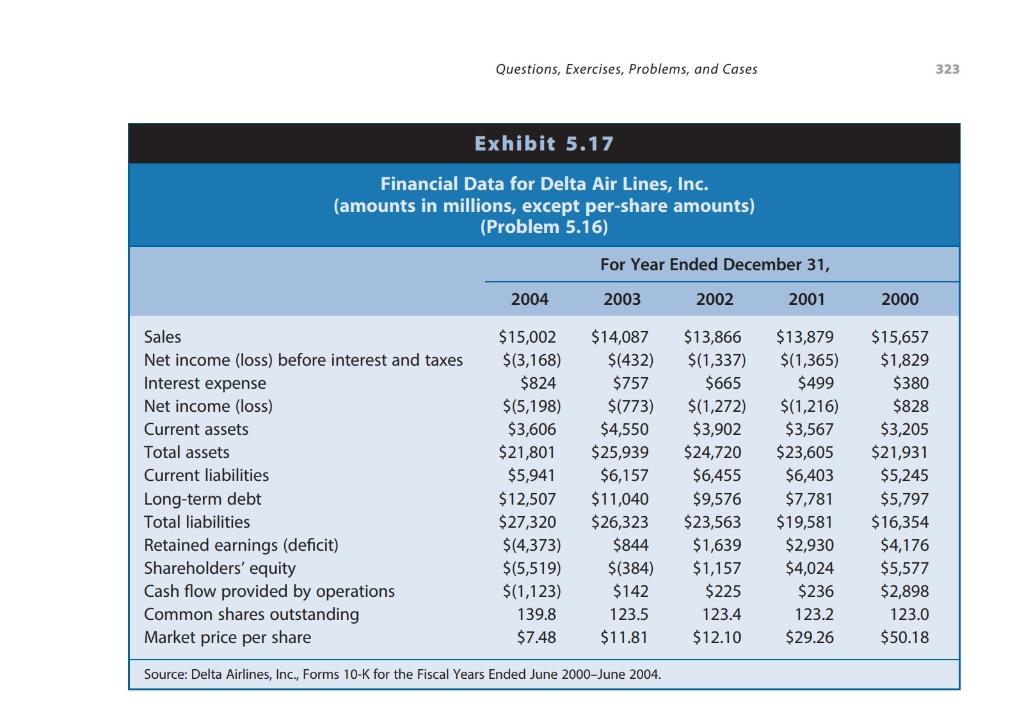

5.16 Computing and Interpreting Risk and Bankruptcy Prediction Ratios for a Firm That Declared Bankruptcy. Delta Air Lines, Inc., is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for several years. Exhibit 5.17 presents selected financial data for Delta Air Lines for each of the five years ending December 31, 2000, to December 31, 2004. Delta Air Lines filed for bankruptcy on September 14, 2005. We recommend that you create an Excel spreadsheet to compute the values of the ratios and Altmans Z-score in Requirements a and b, respectively.

REQUIRED

a. Compute the value of each the following risk ratios.

(1) Current ratio (at the end of 20002004)

(2) Operating cash flow to current liabilities ratio (for 20012004)

(3) Liabilities to assets ratio (at the end of 20002004)

(4) Long-term debt to long-term capital ratio (at the end of 20002004)

(5) Operating cash flow to total liabilities ratio (for 20012004)

(6) Interest coverage ratio (for 20002004)

b. Compute the value of Altmans Z-score for Delta Air Lines for each year from 2000 to 2004.

c. Using the analyses in Requirements a and b, discuss the most important factors that signaled the likelihood of bankruptcy of Delta Air Lines in 2005.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started