Answered step by step

Verified Expert Solution

Question

1 Approved Answer

52 17-52 Relevant Cost Analysis: Decision Making Pack-and-Go, a new competitor to FedEx and UPS, does intra-city package deliveries in seven major metropolitan areas. The

52

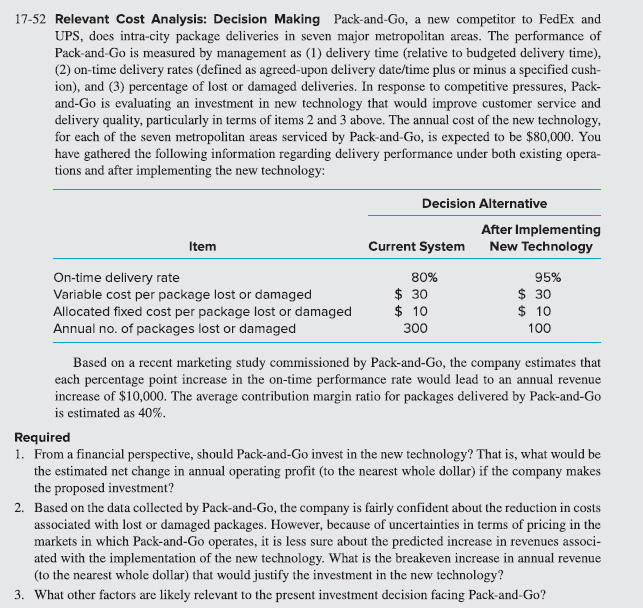

17-52 Relevant Cost Analysis: Decision Making Pack-and-Go, a new competitor to FedEx and UPS, does intra-city package deliveries in seven major metropolitan areas. The performance of Pack-and-Go is measured by management as (1) delivery time (relative to budgeted delivery time), (2) on-time delivery rates (defined as agreed-upon delivery date/time plus or minus a specified cush- ion), and (3) percentage of lost or damaged deliveries. In response to competitive pressures, Pack- and-Go is evaluating an investment in new technology that would improve customer service and delivery quality, particularly in terms of items 2 and 3 above. The annual cost of the new technology, for each of the seven metropolitan areas serviced by Pack-and-Go, is expected to be $80,000. You have gathered the following information regarding delivery performance under both existing opera- tions and after implementing the new technology: Decision Alternative After Implementing Item Current System New Technology On-time delivery rate 80% 95% Variable cost per package lost or damaged $ 30 $ 30 Allocated fixed cost per package lost or damaged $ 10 $ 10 Annual no. of packages lost or damaged 300 100 Based on a recent marketing study commissioned by Pack-and-Go, the company estimates that each percentage point increase in the on-time performance rate would lead to an annual revenue increase of $10,000. The average contribution margin ratio for packages delivered by Pack-and-Go is estimated as 40%. Required 1. From a financial perspective, should Pack-and-Go invest in the new technology? That is, what would be the estimated net change in annual operating profit (to the nearest whole dollar) if the company makes the proposed investment? 2. Based on the data collected by Pack-and-Go, the company is fairly confident about the reduction in costs associated with lost or damaged packages. However, because of uncertainties in terms of pricing in the markets in which Pack-and-Go operates, it is less sure about the predicted increase in revenues associ- ated with the implementation of the new technology. What is the breakeven increase in annual revenue (to the nearest whole dollar) that would justify the investment in the new technology? 3. What other factors are likely relevant to the present investment decision facing Pack-and-GoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started