Answered step by step

Verified Expert Solution

Question

1 Approved Answer

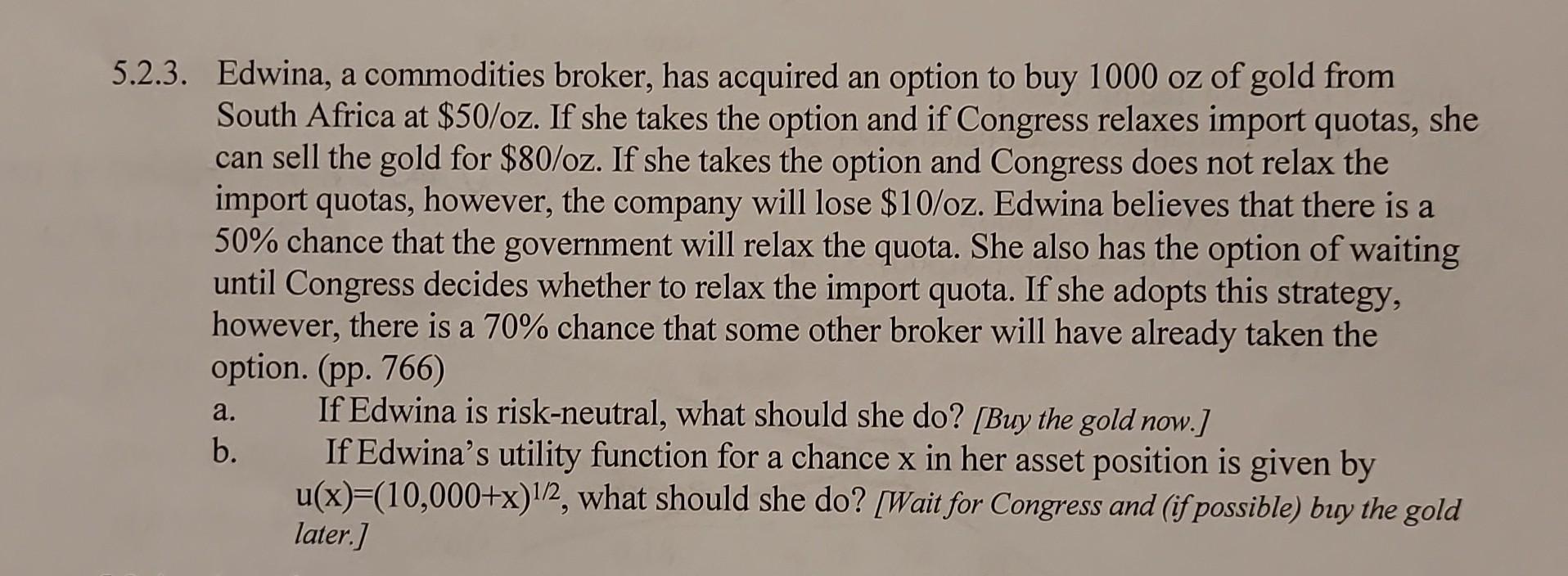

5.2.3. Edwina, a commodities broker, has acquired an option to buy 1000oz of gold from South Africa at $50/oz. If she takes the option and

5.2.3. Edwina, a commodities broker, has acquired an option to buy 1000oz of gold from South Africa at $50/oz. If she takes the option and if Congress relaxes import quotas, she can sell the gold for $80/oz. If she takes the option and Congress does not relax the import quotas, however, the company will lose $10/oz. Edwina believes that there is a 50% chance that the government will relax the quota. She also has the option of waiting until Congress decides whether to relax the import quota. If she adopts this strategy, however, there is a 70% chance that some other broker will have already taken the option. (pp. 766) a. If Edwina is risk-neutral, what should she do? [Buy the gold now.] b. If Edwina's utility function for a chance x in her asset position is given by u(x)=(10,000+x)1/2, what should she do? [Wait for Congress and (if possible) bryy the gold later.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started