Question

5-26 Activity-based costing, manufacturing. Decorative Doors, Inc., produces two types of doors, interior and exterior. The companys simple costing system has two direct-cost categories (materials

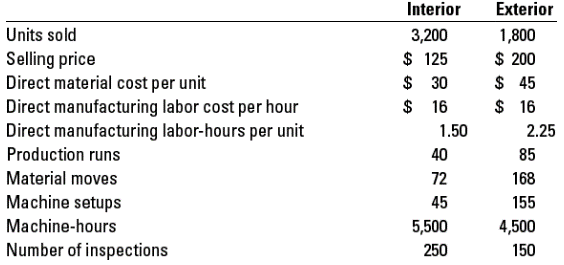

5-26 Activity-based costing, manufacturing. Decorative Doors, Inc., produces two types of doors, interior and exterior. The companys simple costing system has two direct-cost categories (materials and labor) and one indirect-cost pool. The simple costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year follows:

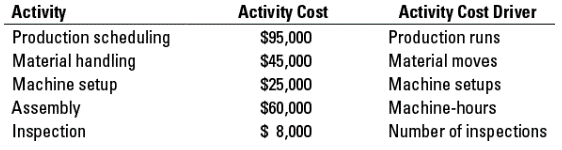

The owners have heard of other companies in the industry that are now using an activity-based costing system and are curious how an ABC system would affect their product costing decisions. After analyzing the indirect-cost pool for Decorative Doors, the owners identify six activities as generating indirect costs: production scheduling, material handling, machine setup, assembly, inspection, and marketing. Decorative Doors collected the following data related to the indirect-cost activities:

Marketing costs were determined to be 3% of the sales revenue for each type of door.

- Calculate the cost of an interior door and an exterior door under the existing simple costing system.

- Calculate the cost of an interior door and an exterior door under an activity-based costing system.

- Compare the costs of the doors in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of an interior door and an exterior door?

- How might Decorative Doors, Inc., use the new cost information from its activity-based costing system to address the declining market share for interior doors?

Units sold Selling price Direct material cost per unit Direct manufacturing labor cost per hour Direct manufacturing labor-hours per unit Production runs Material moves Machine setups Machine-hours Number of inspections Interior 3,200 $ 125 $ 30 $ 16 1.50 40 72 45 5,500 250 Exterior 1,800 $ 200 $ 45 $ 16 2.25 85 168 155 4,500 150 Activity Production scheduling Material handling Machine setup Assembly Inspection Activity Cost $95,000 $45,000 $25,000 $60,000 $ 8,000 Activity Cost Driver Production runs Material moves Machine setups Machine-hours Number of inspections

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started