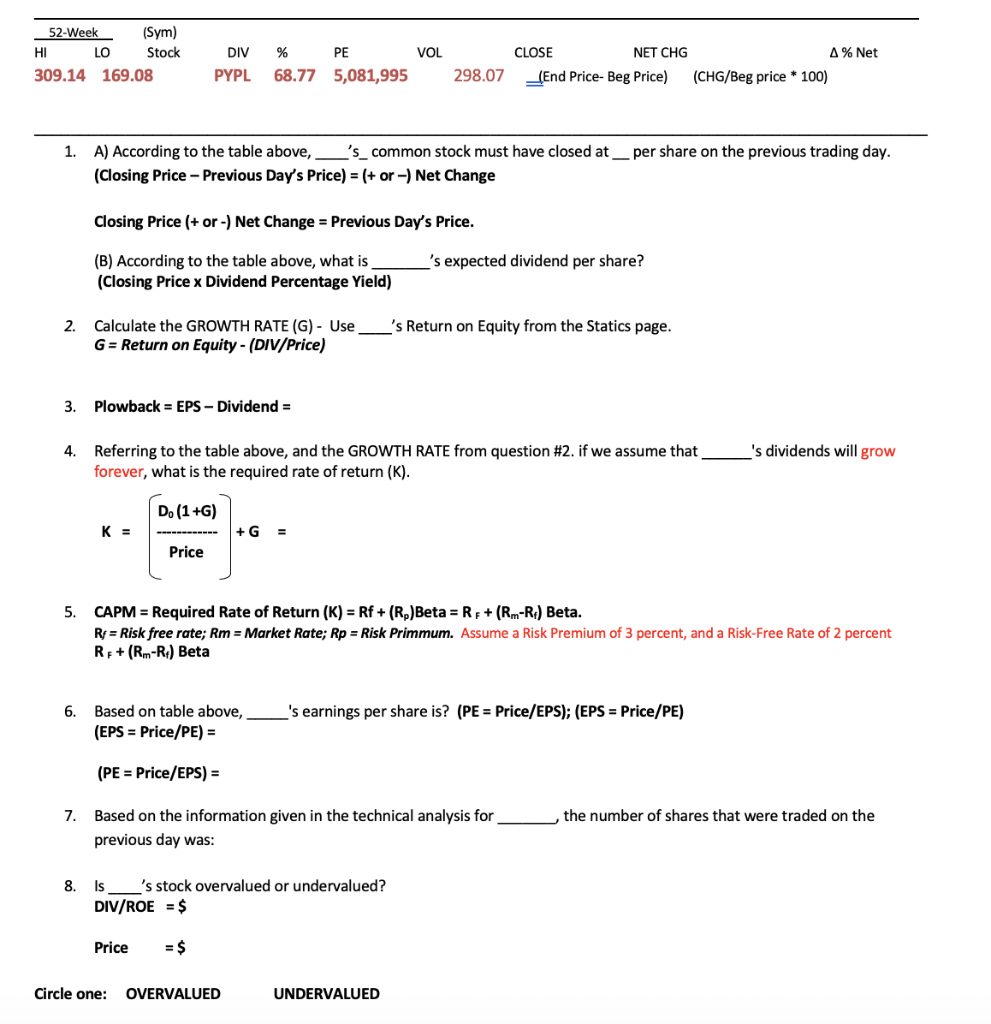

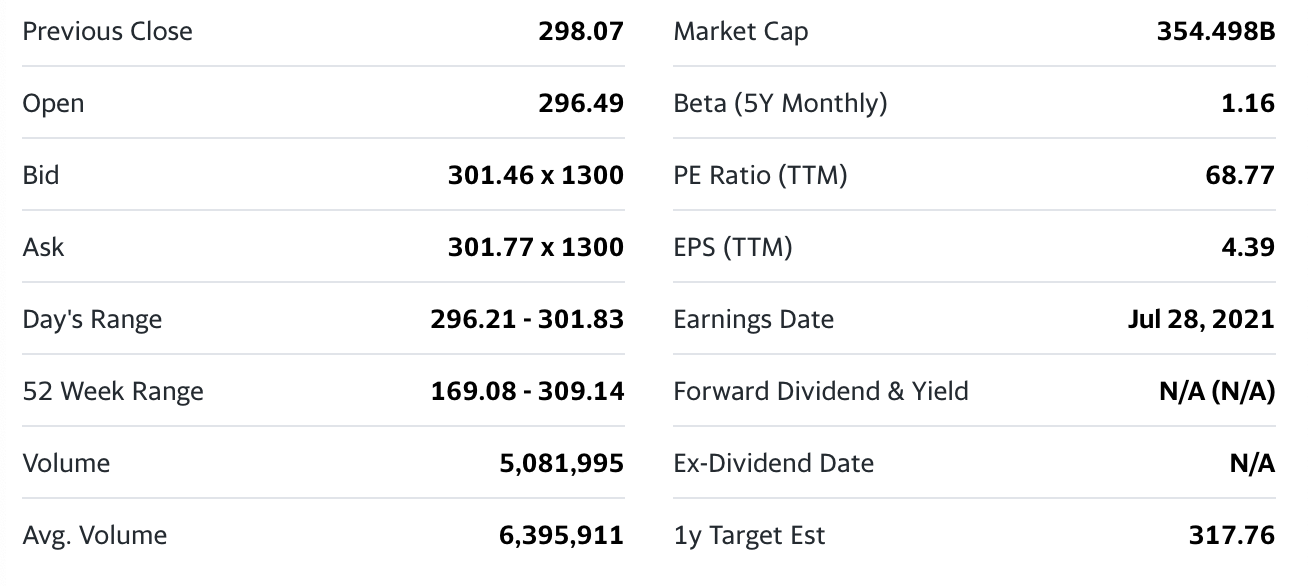

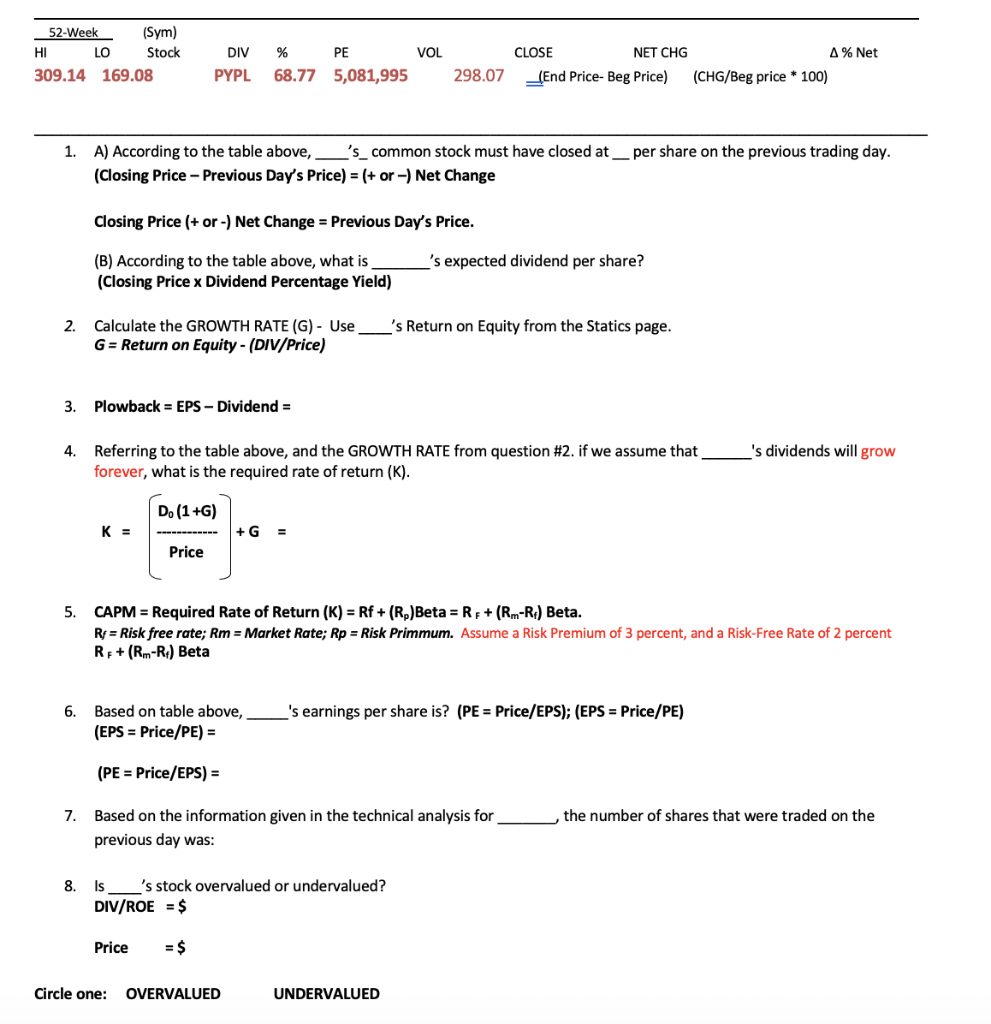

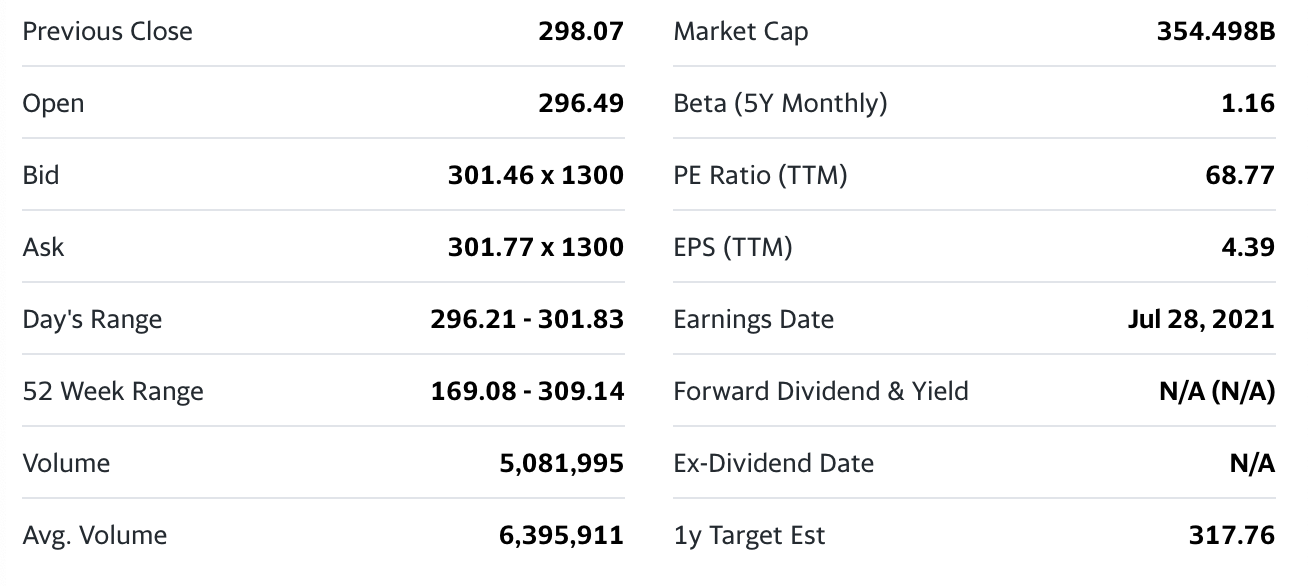

52-Week (Sym) HI LO Stock 309.14 169.08 DIV PYPL % PE VOL 68.77 5,081,995 CLOSE NET CHG A % Net _{End Price-Beg Price) (CHG/Beg price * 100) 298.07 1. A) According to the table above, L's_common stock must have closed at _per share on the previous trading day. (Closing Price - Previous Day's Price) = (+ or -) Net Change Closing Price (+ or -) Net Change = Previous Day's Price. 's expected dividend per share? (B) According to the table above, what is (Closing Price x Dividend Percentage Yield) 2. 's Return on Equity from the Statics page. Calculate the GROWTH RATE (G) - Use G = Return on Equity - (DIV/Price) 3. Plowback = EPS - Dividend = 's dividends will grow 4. Referring to the table above, and the GROWTH RATE from question #2. if we assume that forever, what is the required rate of return (K). D. (1+G) K = + G = Price 5. CAPM = Required Rate of Return (K) = Rf + (Re)Beta = R: + (Rm-Rt) Beta. R = Risk free rate; Rm = Market Rate; Rp = Risk Primmum. Assume a Risk Premium of 3 percent, and a Risk-Free Rate of 2 percent RE+ (Rm-Rt) Beta 6. 's earnings per share is? (PE = Price/EPS); (EPS = Price/PE) Based on table above, (EPS = Price/PE) = (PE = Price/EPS) = 7. the number of shares that were traded on the Based on the information given in the technical analysis for previous day was: 8. Is 's stock overvalued or undervalued? DIV/ROE = $ Price = $ Circle one: OVERVALUED UNDERVALUED Previous Close 298.07 Market Cap 354.498B Open 296.49 Beta (5Y Monthly) 1.16 Bid 301.46 x 1300 PE Ratio (TTM) 68.77 Ask 301.77 x 1300 EPS (TTM) 4.39 Day's Range 296.21 - 301.83 Earnings Date Jul 28, 2021 52 Week Range 169.08 - 309.14 Forward Dividend & Yield N/A (N/A) Volume 5,081,995 Ex-Dividend Date N/A Avg. Volume 6,395,911 1y Target Est 317.76 52-Week (Sym) HI LO Stock 309.14 169.08 DIV PYPL % PE VOL 68.77 5,081,995 CLOSE NET CHG A % Net _{End Price-Beg Price) (CHG/Beg price * 100) 298.07 1. A) According to the table above, L's_common stock must have closed at _per share on the previous trading day. (Closing Price - Previous Day's Price) = (+ or -) Net Change Closing Price (+ or -) Net Change = Previous Day's Price. 's expected dividend per share? (B) According to the table above, what is (Closing Price x Dividend Percentage Yield) 2. 's Return on Equity from the Statics page. Calculate the GROWTH RATE (G) - Use G = Return on Equity - (DIV/Price) 3. Plowback = EPS - Dividend = 's dividends will grow 4. Referring to the table above, and the GROWTH RATE from question #2. if we assume that forever, what is the required rate of return (K). D. (1+G) K = + G = Price 5. CAPM = Required Rate of Return (K) = Rf + (Re)Beta = R: + (Rm-Rt) Beta. R = Risk free rate; Rm = Market Rate; Rp = Risk Primmum. Assume a Risk Premium of 3 percent, and a Risk-Free Rate of 2 percent RE+ (Rm-Rt) Beta 6. 's earnings per share is? (PE = Price/EPS); (EPS = Price/PE) Based on table above, (EPS = Price/PE) = (PE = Price/EPS) = 7. the number of shares that were traded on the Based on the information given in the technical analysis for previous day was: 8. Is 's stock overvalued or undervalued? DIV/ROE = $ Price = $ Circle one: OVERVALUED UNDERVALUED Previous Close 298.07 Market Cap 354.498B Open 296.49 Beta (5Y Monthly) 1.16 Bid 301.46 x 1300 PE Ratio (TTM) 68.77 Ask 301.77 x 1300 EPS (TTM) 4.39 Day's Range 296.21 - 301.83 Earnings Date Jul 28, 2021 52 Week Range 169.08 - 309.14 Forward Dividend & Yield N/A (N/A) Volume 5,081,995 Ex-Dividend Date N/A Avg. Volume 6,395,911 1y Target Est 317.76