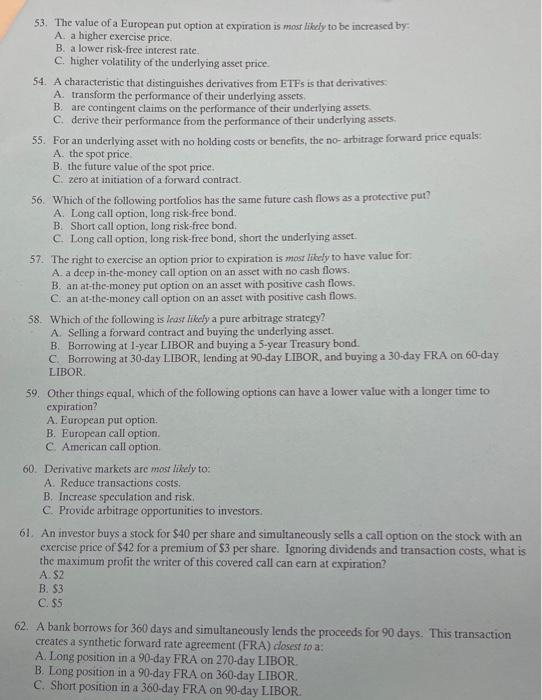

53. The value of a European put option at exparation is mos likely to be increased by: A. a higher exercise price. B. a lower risk-free interest rate. C. higher volatility of the underlying asset price. 54. A characteristic that distinguishes derivatives from EIFs is that derivatives: A. transform the performance of their underlying assets. B. are contingent claims on the performance of their underlying assets. C. derive their performance from the performance of their underlying assets. 55. For an underlying asset with no holding costs or benefits, the no-arbitrage forward price equals: A. the spot price B. the future value of the spor price. C. zero at initiation of a forward contract. 56. Which of the following portfolios has the same future cash flows as a protective put? A. Long call option, long risk-free bond. B. Short call option, long risk-free bond. C. Long call option, long risk-free bond, short the underlying asset. 57. The right to exercise an option prior to expiration is most likely to have value for: A. a deep in-the-moncy call option on an asset with no cash flows. B. an at-the-moncy put option on an asset with positive cash flows. C. an at-the-money call option on an asset with positive cash flows. 58. Which of the following is least likely a pure arbitrage stratcgy? A. Selling a forward contract and buying the underlying asset. B. Borrowing at l-year LIBOR and buying a 5-year Treasury bond. C. Borrowing at 30-day LIBOR, lending at 90 -day LIBOR, and buying a 30-day FRA on 60 -day LIBOR. 59. Other things equal, which of the following options can have a lower value with a longer time to expiration? A. European put option. B. European call option. C. American call option. 60. Derivative markets are most likely to: A. Reduce transactions costs. B. Increase speculation and risk, C. Provide arbitrage opportunities to investors: 61. An investor buys a stock for $40 per share and simultaneously sells a call option on the stock with an exercise price of $42 for a premium of $3 per share. Ignoring dividends and transaction costs, what is the maximum profit the writer of this covered call can earn at expiration? A. 52 B. 93 C. 55 62. A bank borrows for 360 days and simultaneously lends the proceeds for 90 days. This transaction creates a synthetic forward rate agreement (FRA) closest fo a: A. Long position in a 90-day FRA on 270-day LIBOR. B. Long posation in a 90-day FRA on 360-day LIBOR. C. Shomt position in a 360-day FRA on 90-day LIBOR